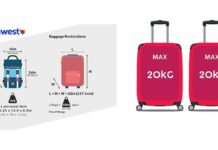

Southwest Baggage Policy – Fees, Size Limits & More

Traveling with Southwest Airlines? Understanding their baggage policy can save you time, money, and stress at the airport. Southwest Airlines stands out for its...

Can Insurance Cover Braces

Can Insurance Cover Braces? Ever wondered if that dazzling smile you crave can be achieved with a little help from your insurance plan? Braces...

Loan Places Near Me – Get Approved Today at Local Lenders

Life throws curveballs, and sometimes, a little extra financial help can smooth things over. Whether it's an unexpected car repair, a medical bill, or...

VA Home Loan – Get Your Dream Home with 0% Down

As a veteran or active-duty service member, you've dedicated yourself to serving our country. Now, it's time to secure your piece of the American...

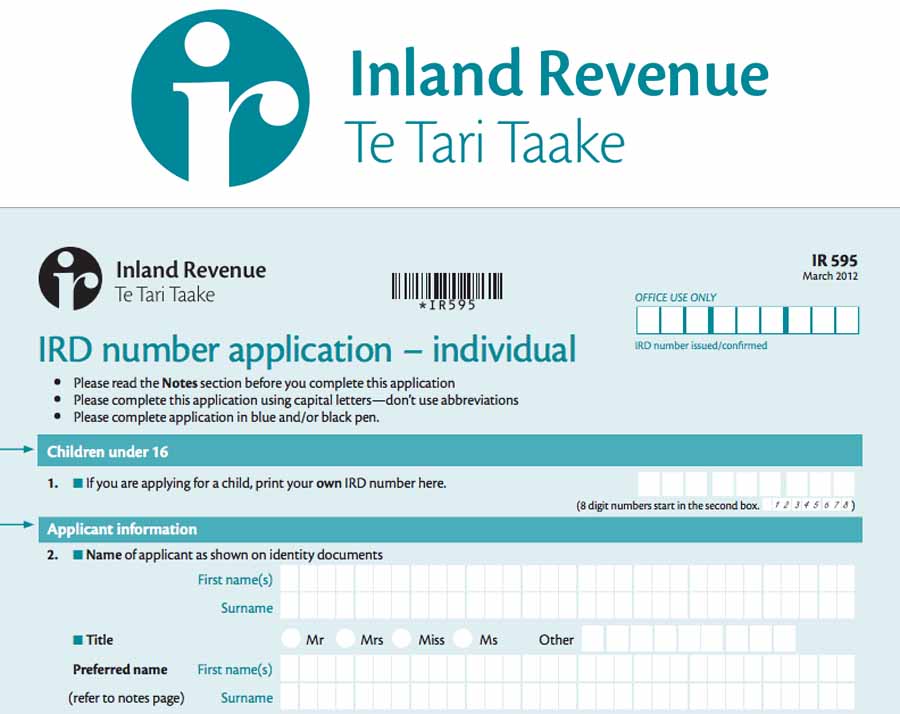

IRD Number – Applying for IRD Number Online

How can I get an IRD number or how can I find my IRD number? The following are actually related questions that pop-up on...

Chase Online Mortgage: Is Chase Mortage Good

Is a Chase mortgage good or how can I apply for a Chase bank mortgage? Find out more about Chase online mortgage in this...

Westpac Business Banking – How to Enroll in Westpac Online Banking for Business

How can I enroll in Westpac online banking for business? Westpac offers two types of accounts that includes personal banking and business banking. Personal...

How to Get the Lowest Car Insurance

How to Get the Lowest Car Insurance! Congratulations on taking charge of your car insurance! This comprehensive guide will equip you with the knowledge...

National Honor Society Scholarship – Apply for College Scholarships

Earning the National Honor Society (NHS) membership is a prestigious accomplishment. It signifies academic excellence, leadership potential, dedication to service, and a strong moral...

Debt Consolidation Americor – Conquer Debt and Save Money

Drowning in debt? You're not alone. Many Americor members, dedicated to public service, face student loans, credit card balances, and other financial burdens. But...