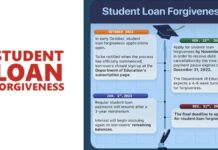

When Will Student Loan Forgiveness Be Applied

Student loan forgiveness is a hot topic, with borrowers eager to know when they can finally get some relief from their debt. The Biden...

Teaching Jobs in USA with Visa Sponsorship

Are you looking for Teaching Jobs in USA with Visa Sponsorship? Do you know that working in a teaching job, you can earn about...

Religious Worker Jobs in USA with Visa Sponsorship

Are you looking for religious worker jobs in USA with visa sponsorship? Earn about $34,054 USD to $40,957 USD per year working as a...

Farm worker Jobs in the USA with Visa Sponsorship

Are you looking for farm worker jobs in USA with visa sponsorship? Earn about $35,958 USD to $56,985 USD per year working as a...

Dispatch Rider Jobs in USA with Visa Sponsorship

Looking for available dispatch rider jobs in USA with visa sponsorship? Interested applicants can start now by applying for dispatch rider jobs in USA...

Delivery Jobs in USA with Visa Sponsorship

Are you looking for delivery jobs in USA with visa sponsorship? You know you can earn about $35,560 USD per year or $36,840 USD...

Phone Technician Jobs in USA with Visa Sponsorship

Are you looking for companies willing to offer visa sponsorship for phone technician jobs or are you interested in applying for phone technician jobs...

Taxi Drivers Job in USA with Visa Sponsorship

Are looking to apply for taxi drivers job in USA with visa sponsorship? Start earning about $30,857 USD or $64,083 USD per year in...

Construction Job in USA with Visa Sponsorship

Are you looking for a construction job in USA with visa sponsorship? Do you that you can earn a whooping salary from $46,350 USD...

Car Wash Jobs in USA with Visa Sponsorship

Do you know you can earn $32,730 USD to $45,590 USD in the United States as a car washer? Are you looking for car...