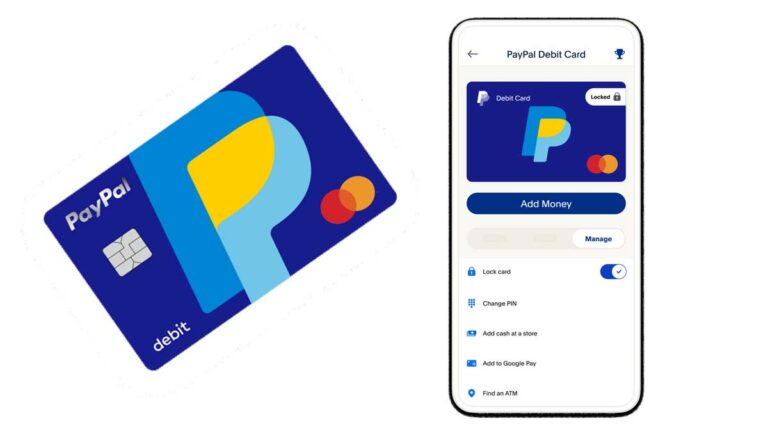

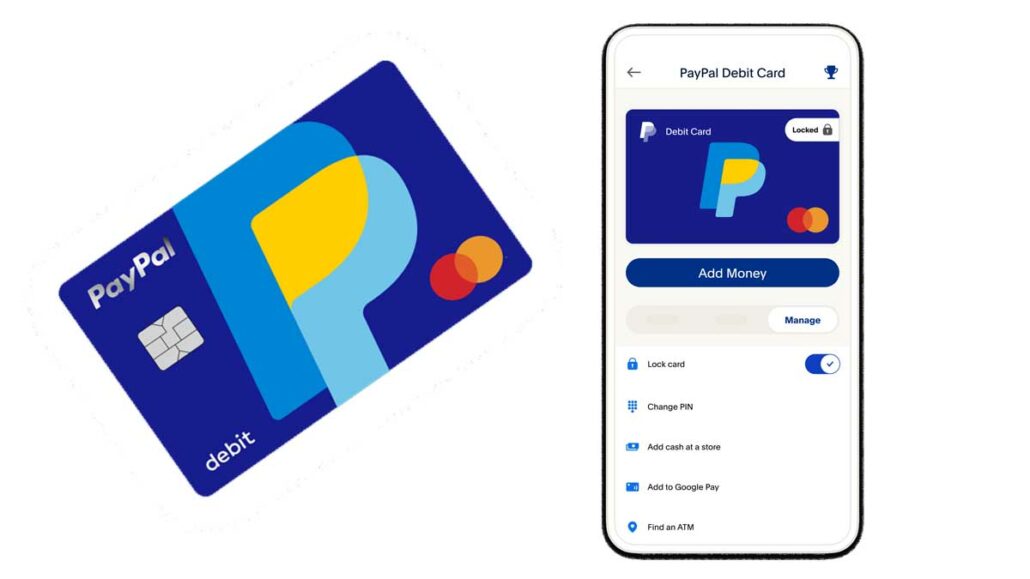

A PayPal debit card is a reloadable prepaid debit card that is linked to your PayPal balance. You can use it to pay for goods and services anywhere Mastercard is accepted, both in-store and online. You can also use it to withdraw cash from ATMs worldwide. Learn how to activate your PayPal debit card.

Why do you need to activate your PayPal debit card?

- To prevent fraud: Activating your card helps to protect it from unauthorized use.

- To set up your PIN: When you activate your card, you will need to create a PIN that you will use to make purchases and withdraw cash.

- To start using your card: Once your card is activated, you can start using it to make purchases and withdraw cash immediately.

Once your card is activated, you can start using it immediately. When you use your card to make a purchase, the funds will be deducted from your PayPal balance. If you don’t have enough money in your PayPal balance to cover the purchase, your card will be declined.

How to activate PayPal debit card online

To activate your PayPal debit card online, you can follow these steps:

- Go to the PayPal website or app and log in to your account.

- Click Wallet.

- Click your PayPal debit card.

- Click Activate Card.

- Enter the card’s expiration date and the last 4 digits of the card number.

- Click Activate Card.

Once you have activated your card, you can start using it to make purchases online and in stores. You can also use it to withdraw cash from ATMs.

How to activate PayPal debit card over the phone

To activate your PayPal debit card over the phone, you can follow these steps:

- Call the PayPal customer support number at 1-800-314-8298.

- Be prepared to provide your PayPal account information, as well as the information on your debit card.

- Follow the instructions provided by the customer support representative.

Also, one of the tips for activating your PayPal debit card over the phone, be prepared to provide your Social Security number, date of birth, and other personal information. This is a security measure to help protect your account.

How to activate PayPal debit card abroad

To activate your PayPal debit card abroad, you can follow the same steps as you would to activate it in your home country. You can either activate it online or over the phone.

To activate your PayPal debit card online abroad:

- Go to the PayPal website or app and log in to your account.

- Click Wallet.

- Click your PayPal debit card.

- Click Activate Card.

- Enter the card’s expiration date and the last 4 digits of the card number.

- Click Activate Card.

To activate your PayPal debit card over the phone abroad:

- Call the PayPal customer support number for the country you are in. You can find a list of PayPal customer support numbers on the PayPal website.

- Follow the prompts to speak to a customer service representative.

- Tell the representative that you want to activate your PayPal debit card.

- Provide the representative with your card number, expiration date, and CVC code.

- The representative will then verify your identity and activate your card.

How to activate PayPal debit card if it’s expired

You cannot activate an expired PayPal debit card. Once your card expires, it is permanently deactivated and you will need to request a new card.

To request a new PayPal debit card:

- Go to the PayPal website or app and log in to your account.

- Click Wallet.

- Click your expired PayPal debit card.

- Click Report card lost, stolen, or damaged.

- Follow the instructions to request a new card.

Your new card will be mailed to your confirmed address and should arrive within 7-10 business days. Once you receive your new card, you will need to activate it before you can start using it.

To activate your new PayPal debit card:

- Go to the PayPal website or app and log in to your account.

- Click Wallet.

- Click your new PayPal debit card.

- Click Activate Card.

- Enter the card’s expiration date and the last 4 digits of the card number.

- Click Activate Card.

Benefits of using a PayPal debit card

Convenience

You can use your PayPal debit card to make purchases online and in stores anywhere Mastercard is accepted. You can also use it to withdraw cash from ATMs worldwide.

Security

PayPal uses a variety of security measures to protect your financial information, including fraud protection and encryption.

Rewards

You can earn rewards on your purchases when you use your PayPal debit card. For example, you can earn cash back on eligible everyday purchases, and redeem your rewards for cash back and other options.

No fees

There is no monthly fee or annual fee for using a PayPal debit card. There is also no fee for using your card to make purchases in stores or online. However, you may be charged a fee for withdrawing cash from ATMs outside of the PayPal network.

How to use your PayPal debit card to make payments

To use your PayPal debit card to make payments, you can follow these steps:

In stores:

- Swipe or insert your card at the checkout terminal.

- Select “credit” or “debit”.

- Enter your PIN.

- Sign your receipt.

Online:

- Enter your card number, expiration date, and CVC code at the checkout page.

- Click “pay”.

At ATMs:

- Insert your card into the ATM.

- Enter your PIN.

- Select “withdraw cash”.

- Enter the amount of money you want to withdraw.

- Click “withdraw”.

To send money to someone:

- Go to your PayPal account and log in.

- Click “Send & Request”.

- Enter the recipient’s email address or phone number.

- Enter the amount of money you want to send.

- Click “Send”.

Pay a bill:

- Go to your PayPal account and log in.

- Click “Manage Bills”.

- Click “Add a New Bill”.

- Enter the biller’s name and contact information.

- Enter the amount of money you want to pay.

- Click “Add Bill”.

To transfer money between your PayPal account and your bank account:

- Go to your PayPal account and log in.

- Click “Wallet”.

- Click “Transfer Money”.

- Select “To your bank account”.

- Enter the amount of money you want to transfer.

- Click “Transfer”.

Please note that there may be fees associated with using your PayPal debit card for certain transactions, such as withdrawing cash from ATMs outside of the PayPal network or sending money to someone in another country.

How to withdraw cash from your PayPal debit card

To withdraw cash from your PayPal debit card, you can use an ATM. Here are the steps:

- Insert your PayPal debit card into the ATM.

- Enter your PIN.

- Select “withdraw cash”.

- Enter the amount of money you want to withdraw.

- Click “withdraw”.

You can also withdraw cash from your PayPal debit card at certain stores, such as Walmart and Walgreens. To do this, you will need to swipe your card and enter your PIN at the checkout counter.

Please note that there may be fees associated with withdrawing cash from your PayPal debit card. For example, you may be charged a fee for using an ATM outside of the PayPal network.