Are Personal Injury Lawsuit Settlements Taxable

Are Personal Injury Lawsuit Settlements Taxable? Receiving a personal injury settlement can be a significant financial event. However, one common question that arises is...

Reverse Mortgage Plan – The Application Process

Reverse mortgages are a unique financial instrument designed to provide homeowners aged 62 or older with access to the equity in their homes. Unlike...

Private Health Insurance For Travel Nurses – Finding the Right Plan

Travel nursing, a dynamic career choice that offers both professional growth and personal adventure, presents unique challenges when it comes to healthcare coverage. As...

Private Health Insurance For Over 65 – Find the Best Plan

As individuals age, their healthcare needs often become more complex and demanding. Private Health Insurance For Over 65 offers a valuable option for seniors...

Colonial Penn Life Insurance For Seniors

Colonial Penn Life Insurance has emerged as a leading provider of affordable life insurance solutions tailored specifically to the needs of seniors. Recognizing the...

Private Health Insurance For Small Business Owners

In today's competitive business landscape, the health and well-being of employees have become a crucial factor in organizational success. Small business owners, often juggling...

What Are Private Health Insurance

Private health insurance is a financial arrangement between individuals and private insurance companies. It offers a layer of protection against unexpected medical expenses. By...

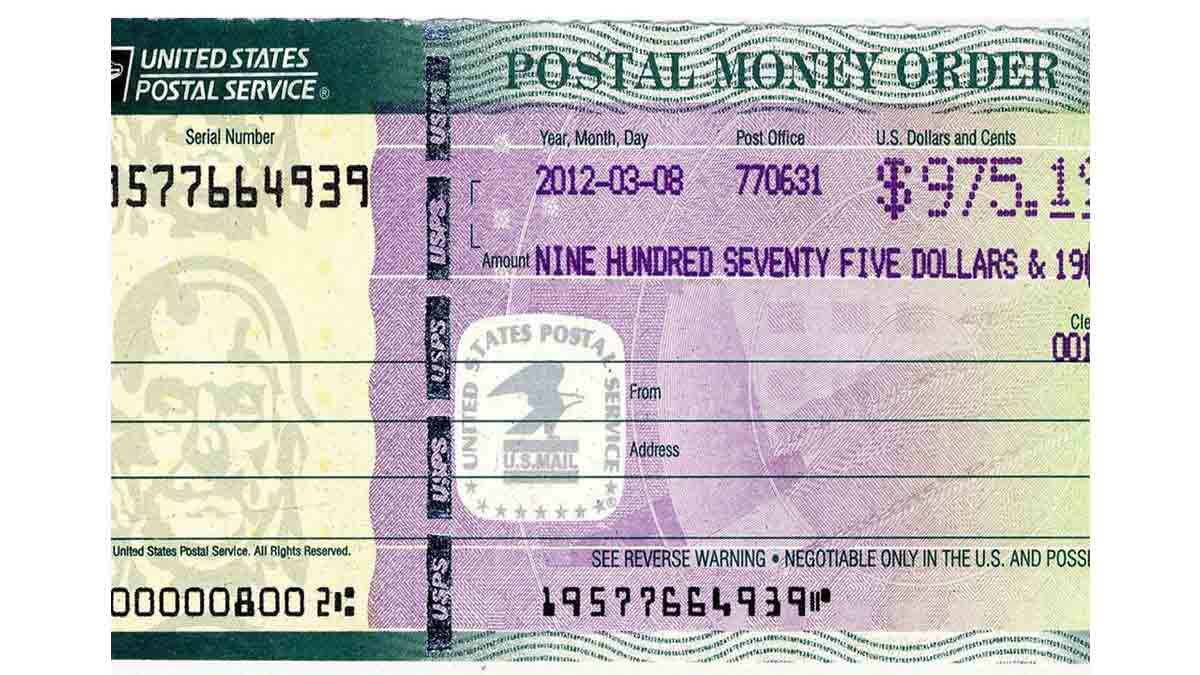

Where to Get a Money Order Near Me – Places to Get a Money...

Where can I get a money order or where can I buy a money order near me? In this article, you can find the...

Direct Auto Insurance – Reviews on Direct Auto Insurance 2024

Direct auto insurance is one of the most affordable car insurance rates you can find. Majorly, it’s suitable for the high-risk driver who has...

Coverage B Homeowners – What it Covers & Why You Need it

When it comes to homeowners insurance, understanding the different coverages is essential. One crucial component often overlooked is Coverage B homeowners, which specifically protects...