How to Insure a Car Before You Buy It

Learn how to insure a car before you buy it. Buying a car is a significant financial decision, and securing the right insurance coverage...

What Other Jobs Can a Medical Assistant Apply For

What Other Jobs Can a Medical Assistant Apply For? Do you thrive in the fast-paced world of healthcare, assisting patients and doctors alike? As...

Cash Out Refinance – Get the Cash You Need Today

Feeling strapped for cash but hesitant to sell your home? You might be surprised to learn that your home holds a hidden asset: equity....

Equity Release – Explore Equity Release Options

Considering equity release? Learn how to access tax-free cash from your home's value. Explore reputable providers and compare plans.

Equity release can be a tempting...

Facebook Dating Sign Up – Your Guide to Finding Love on Facebook

The realm of online dating has continually evolved, seeking to provide users with more integrated and accessible platforms to foster connections. Among these advancements,...

Facebook Dating Login – Access Your Dating Profile

Looking for Facebook Dating Login? Easily access your Facebook Dating profile and connect with potential matches. Find the official Facebook Dating login page here....

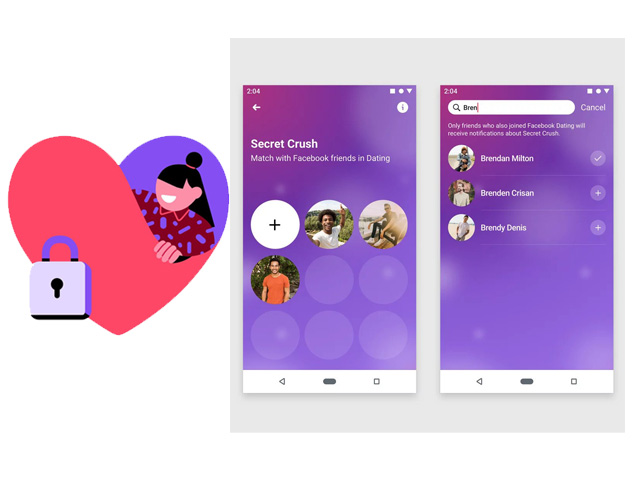

Facebook Dating App – Online Dating for Singles

Facebook, a platform already deeply ingrained in social interaction, has extended its reach into the realm of romance with Facebook Dating app. This feature,...

Facebook Dating – Find Love on Facebook

The digital age has fundamentally reshaped how individuals connect, and within this landscape, online dating platforms have become a dominant force. Seeking to capitalize...

2025 Facebook Dating Review – New Features Available

What is the best dating app for 2025 or how can I download free Facebook dating? The Facebook dating application is one of the...

First Time Home Buyer Programs

As a first-timer on First Time Home Buyer Programs, you can enjoy benefits that include special loans that come with low-interest rates, down payment,...