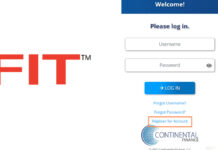

Fit Credit Card Login – My Account Access

The Fit Credit Card login process is not just about signing in; it’s about managing your financial world with one convenient tool. If you’re...

Purdue Federal Credit Union Login

As someone who prefers doing everything online from paying bills to transferring money, I found Purdue Federal Credit Union Login (often called PFCU) incredibly...

Dover Phila Credit Union Login – Access Your Credit Union Account

If you’ve ever tried logging into an Dover Phila Credit Union Login online banking portal and found it confusing, then this guide will make...

Amazon Orders My Recent Orders – My Orders Placed Recently by Me

Amazon Orders My Recent Orders, this simple phrase is more powerful than it looks, it’s like a gateway to your entire shopping journey. With...

Italian Restaurants Near Me – Location Service

When I first started searching for Italian restaurants near me, I didn’t just want a place to eat I wanted an experience. There’s something...

Easy Beef Stroganoff Recipe

When I first tried a simple beef stroganoff recipe, I was amazed by how something so rich and flavorful could be made with such...

My Facebook Page Please Open

Millions of people around the world search for help using terms like “my facebook account open please,” “open facebook now,” or “facebook log into...

Wright Patt Credit Union Login – Access Your WPCU Account

You might be wondering, “What makes Wright Patt Credit Union login online system so special?” Well, the answer lies in its combination of user-friendly...

Open My Yahoo Mail Inbox – Mail.yahoo Login

If you find yourself typing phrases like “open my Yahoo mail inbox Yahoo Mail”, “open my Yahoo inbox”, or “take me to my Yahoo...

Twice Baked Potatoes Recipe

I remember making this for the first time on a cozy Sunday afternoon. The smell of baking potatoes filled my kitchen, and by the...