Home Blog

Direct Me to My Next Adventure

“Explore a new spot today near me adventure” that’s usually the first thing I think about whenever I feel that tug in my chest...

CRA Login My Account – How to Access Your Account

Whether you want to sign in CRA, sign into my CRA account, access revenue canada login my account. Or simply understand how the whole...

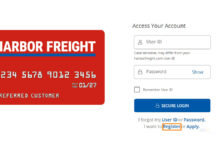

Harbor Freight Credit Card Login – Log In To Your Account

The Harbor Freight Tools credit card login process is managed through Synchrony Bank, a trusted financial partner that handles credit accounts for many major...

TJMaxx Payment Online – Manage Your TJX Credit Card Account

If you’re someone who loves shopping at TJMaxx, Marshalls, HomeGoods, or Sierra, managing your tjx synchrony bank credit card account online can make your...

Cyprus Credit Union Login – Manage Your Bank Account

If you’ve ever searched for Cyprus Credit Union login or visited cypruscu.com, you’ve probably noticed how easy and convenient online banking can be when...

www.samsclubcredit.com Pay Bill – How to Pay My Credit Card Bill

If you’ve ever searched for www.samsclubcredit.com pay bill, then you’re probably a Sam’s Club credit cardholder trying to figure out how to make your...

My Service Canada Account – How to Log Into My Service Canada Account

If you’ve ever needed to apply for Employment Insurance (EI), check your Canada Pension Plan (CPP) payments, or view your Record of Employment (ROE),...

Nevada Unemployment Claim Sign In – Unemployment Nevada Log in nui-nv com

When I first learned about the Nevada unemployment claim sign in, I didn’t realize how essential it was for anyone applying for benefits through...

Care Credit Payment – Make a Payment Online

CareCredit is more than just a financial tool, it’s a health and wellness partner that helps you cover medical, dental, vision, pet, and even...

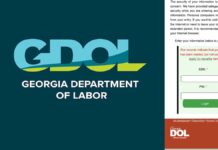

Georgia Unemployment Login – MyUI Claimant Portal

Whether you’ve lost your job or are transitioning between work opportunities, understanding how to navigate the GA DOL login system can save you a...