Explore VA mortgage rates and benefits in 2024. Find the best VA loan for you with our guide and compare current rates from top lenders.

VA mortgage rates are a unique benefit offered to veterans and service members in the United States. These loans, backed by the Department of Veterans Affairs (VA), come with several advantages including lower down payments, competitive interest rates, and often less stringent credit score requirements compared to traditional mortgages. Understanding current VA mortgage rates can be a crucial step for veterans navigating homeownership. Whether you’re considering buying a new home or refinancing an existing one, knowing these rates can empower you to make informed financial decisions.

Understanding VA Loans

A VA loan is a mortgage offered by private lenders but guaranteed by the U.S. Department of Veterans Affairs (VA). This guarantee significantly reduces the risk for lenders, allowing them to offer favorable terms to veterans, including lower interest rates and no down payment requirements (depending on your eligibility).

Current VA Mortgage Rate

- National Average 30-year Fixed VA Rate: 6.97% [According to Bankrate]

- National Average 15-year Fixed VA Rate: Around 5.88% (Estimated based on recent trends)

- VA Jumbo Loan Rates: Slightly higher than conventional VA rates (Expect around 0.25% – 0.75% increase)

Remember: These are averages, and your specific rate will depend on your credit score, loan term, location, and other factors.

Key Factors Affecting VA Mortgage Rates

Several factors influence VA mortgage rates, similar to conventional mortgage rates. Here’s a breakdown of the most important ones:

- Credit Score: A higher credit score demonstrates your creditworthiness and typically translates to a lower interest rate.

- Debt-to-Income Ratio (DTI): This ratio compares your monthly debt obligations to your gross monthly income. A lower DTI indicates a stronger financial position and makes you a more attractive borrower, potentially qualifying for a lower rate.

- Loan Type: Fixed-rate loans typically offer higher interest rates compared to adjustable-rate mortgages (ARMs) with initial fixed periods.

- Loan Term: Shorter loan terms (e.g., 15 years) generally come with lower interest rates compared to longer terms (e.g., 30 years).

- Market Conditions: Overall economic conditions and interest rate trends can impact VA mortgage rates.

Types of VA Loans

Here’s an overview of the different VA loan options available:

- VA Purchase Loan: This is the most common type of VA loan, used to finance the purchase of a primary residence.

- VA Refinance Loan: This allows you to refinance your existing mortgage to potentially lower your interest rate or shorten your loan term.

- IRRRL Streamline Refinance: This is a simplified refinance option for existing VA loans with minimal paperwork.

Benefits of VA Loans

- Competitive Rates: VA loans generally offer lower interest rates compared to conventional mortgages.

- No Down Payment Required: In most cases, you won’t need a down payment to qualify for a VA loan.

- Easier Qualification: VA loans have more relaxed credit score requirements compared to conventional loans.

- Funding Fee: The VA funding fee is typically lower than traditional mortgage private mortgage insurance (PMI).

How to Shop for the Best VA Mortgage Rate

Here are some key steps to secure the most competitive VA mortgage rate:

- Compare rates from multiple lenders: Don’t settle for the first offer you receive. Get quotes from banks, credit unions, and online lenders specializing in VA loans.

- Shop around with your credit score in mind: Be mindful of credit inquiries impacting your score. Consider using a service that provides pre-qualified rates without affecting your credit.

- Understand the terms of your loan: Don’t just focus on the interest rate. Look at closing costs, origination fees, and other charges.

- Negotiate your rate: Lenders often have some wiggle room on rates, so don’t be afraid to negotiate based on your qualifications and the quotes you’ve received elsewhere.

Tips for Getting the Best VA Mortgage Rate

- Shop Around: Compare rates from multiple lenders to ensure you’re getting the best possible deal. Don’t just settle for the first offer you receive.

- Improve Your Credit Score: A higher credit score can significantly impact your interest rate. Work on improving your credit score before applying for a VA loan.

- Lower Your DTI: Pay down existing debt to reduce your DTI and qualify for a more favorable rate.

- Consider a Shorter Loan Term: While the monthly payments will be higher, choosing a shorter loan term can lead to a lower overall interest rate paid.

- Work with a VA-approved Lender: These lenders specialize in VA loans and understand the unique needs of veterans.

Additional Considerations

While the interest rate is a crucial factor, it’s not the only thing to consider when choosing a VA loan. Here are some additional points to keep in mind:

- Origination Fees: These are one-time fees charged by the lender to process your loan application.

- Closing Costs: These are fees associated with finalizing your loan, including title insurance, appraisals, and recording fees.

- Prepayment Penalties: Some VA loans may have prepayment penalties if you pay off your loan early.

FAQs on VA Mortgage Rates

What are the current VA mortgage rates?

As of March 25, 2024, the national average VA rate for a 30-year fixed loan is around 6.97%. Rates can vary depending on your creditworthiness and other factors.

How can I get the best VA mortgage rate?

To get the best rate, focus on improving your credit score, lowering your DTI ratio, and considering a down payment if possible. Shopping around and comparing rates from multiple lenders is crucial.

Are VA loans worth it?

VA loans offer significant advantages for veterans and active military personnel. The competitive rates, relaxed credit requirements, and option to avoid a down payment make them an attractive option for qualified borrowers.

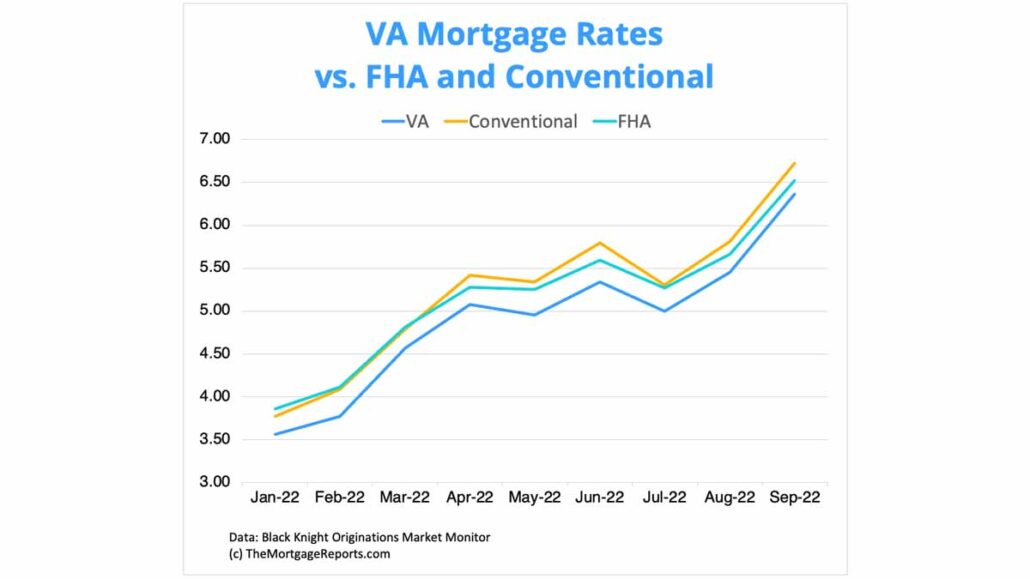

Are VA mortgage rates always lower than conventional rates?

Generally, yes. VA loans are backed by the government, which reduces risk for lenders and allows them to offer lower rates.

Do I need a perfect credit score to qualify for a VA loan?

No. While a good credit score can help you secure a better rate, VA loans are more flexible than conventional loans regarding credit requirements.

Can I still get a VA loan with no down payment?

In most cases, yes. VA loans are designed to be accessible to veterans, and a down payment isn’t mandatory. However, putting some money down can strengthen your application and potentially lower your rate.

How long does it take to close on a VA loan?

Closing times can vary depending on the lender and your specific situation. However, VA loans are generally known for a faster closing process compared to conventional loans.

Conclusion

VA loans offer a powerful tool for veterans to achieve homeownership. By understanding VA mortgage rates, eligibility requirements, and the loan application process, veterans can confidently navigate the path to securing their dream home with an affordable mortgage.

Check Out