In the rapidly evolving world of cryptocurrency trading, investors are always on the lookout for opportunities to maximize their gains. One such opportunity is through margin trading, a popular practice that allows traders to borrow funds to amplify their positions.

Binance, one of the leading cryptocurrency exchanges in the market, offers a robust margin trading platform that allows users to engage in leveraged trading of various digital assets. In this article, we will explore how to effectively use Binance’s margin trading features, including the potential advantages of the platforms, to potentially increase profits while managing risks. So, if you are looking for a reliable trading platform, you may click this link >>.

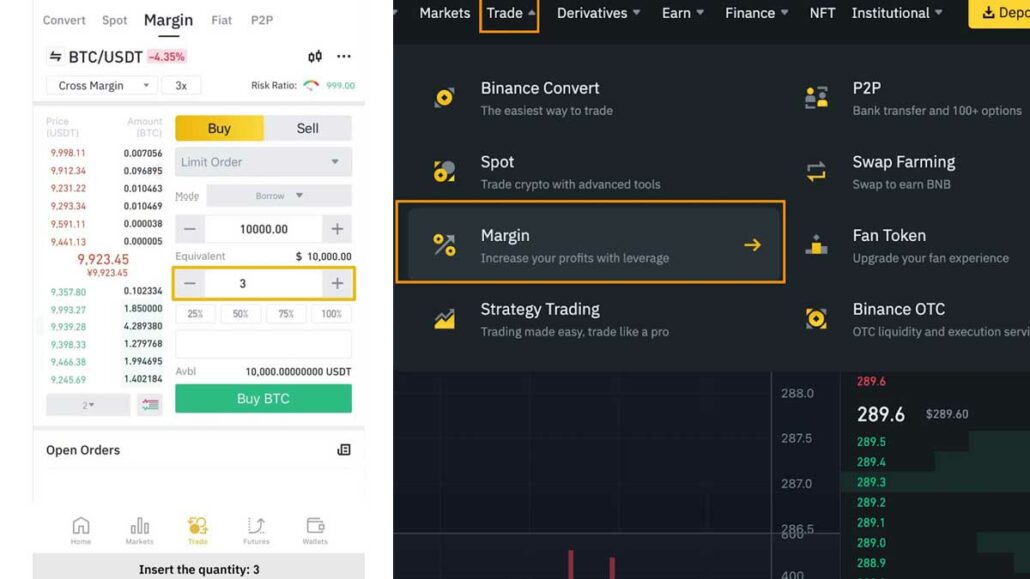

Getting Started with Binance’s Margin Trading

To embark on the margin trading journey, users need to have an active Binance account. If you haven’t signed up yet, head over to Binance’s official website and create an account. After completing the registration process, don’t forget to secure your account with strong passwords and enable two-factor authentication to protect your assets.

Funding Your Margin Account

To begin margin trading on Binance, you’ll need to transfer funds from your spot wallet to your margin wallet. This can be easily done within the Binance platform. Remember to deposit only the amount you are comfortable trading with and avoid over-leveraging, as margin trading inherently involves higher risks.

Understanding Leverage Ratios

Leverage ratios play a crucial role in margin trading. Binance offers a range of leverage options, such as 5x, 10x, 20x, and more, depending on the traded asset. These ratios determine the amount of borrowed funds you can use to open a position. While higher leverage can lead to substantial gains, it also magnifies potential losses, so it’s essential to exercise caution and choose an appropriate leverage ratio based on your risk appetite and market analysis.

Conducting In-depth Market Research

Before diving into margin trading, it’s crucial to conduct thorough research on the cryptocurrencies you intend to trade. Analyze their price trends, historical data, and potential catalysts that may impact their value.

Developing a Solid Trading Strategy

Margin trading requires a well-defined strategy to navigate the market’s volatility successfully. Determine your entry and exit points, set stop-loss orders to limit potential losses, and establish profit targets to secure gains. A disciplined approach to trading can help you stay focused and minimize emotional decisions that could lead to poor outcomes.

Practicing with a Demo Account

If you’re new to margin trading or want to test out different strategies without risking real funds, Binance offers a demo trading feature. Using a demo account allows you to gain hands-on experience in a risk-free environment, enabling you to refine your skills and build confidence before engaging in actual margin trading.

Monitoring Your Positions Closely

Once you have active positions, closely monitor their performance and the market conditions. Cryptocurrency markets can experience rapid price fluctuations, and it’s vital to stay vigilant to prevent significant losses. Be prepared to adjust your strategy if necessary, and consider setting up alerts to stay informed about critical market movements.

Managing Risk Effectively

Margin trading involves increased risk due to the borrowed funds involved. It’s essential to manage this risk prudently. Avoid allocating a significant portion of your trading capital to a single trade and diversify your positions across different assets. Additionally, regular risk assessment and portfolio rebalancing can help mitigate potential losses.

Knowing When to Exit a Trade

Knowing when to exit a trade is as crucial as knowing when to enter one. Stick to your pre-defined exit strategy based on profit targets and stop-loss orders. Avoid succumbing to the temptation of staying in a losing position for too long, as it may lead to further losses. Rational decision-making is key to long-term success in margin trading.

Continuous Learning and Adaptation

The cryptocurrency market is ever-changing, and new opportunities and challenges arise regularly. To stay ahead in the margin trading game, commit to continuous learning. Stay updated with market news, industry developments, and trading strategies. Flexibility and the ability to adapt to changing market conditions are essential traits for successful margin traders.

Conclusion

In conclusion, Binance’s margin trading features offer a powerful tool for traders seeking to capitalize on market movements and potentially amplify their gains. However, it’s essential to approach margin trading with a cautious and disciplined mindset. Proper risk management, extensive research, and a well-defined trading strategy are essential components for successful margin trading. By staying informed and continuously improving your trading skills, you can unlock the full potential of Binance’s margin trading platform and navigate the exciting world of cryptocurrencies with confidence.