If you’ve ever found yourself scratching your head over how to use the True Link card holder login, trust me, you’re not alone. A lot of people have been trying to figure out what makes this card different, how to log in, and why everyone keeps saying it’s such a lifesaver, especially for families managing money for older parents or loved ones.

The True Link card is a smart prepaid Visa card that lets you or someone you care for spend money safely and with limits you set. The login is your personal key to monitor, load, and control the card. Without it, it’s like having a car but no keys.

In this guide, I’m going to break everything down for you from signing up and logging in to managing the card and making sure your money stays secure. By the end, you’ll feel like a pro.

- Cincinnati Insurance Agent Login – Access to Insurance Agent Portal

- Kitsap Credit Union Login – How to Secure Online Banking Access

- Andrews Federal Credit Union Login – Online Step-by-Step

- People Driven Credit Union Login – Access Your Account

What is the True Link Card?

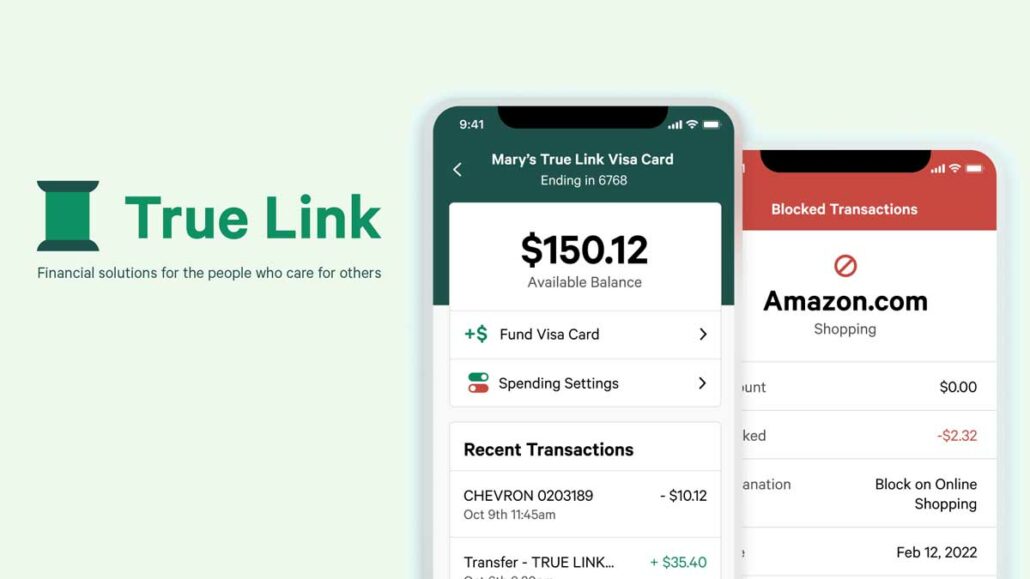

Let me explain it in my own plain words. The True Link card is basically a reloadable Visa prepaid card, but it’s built for people who might need a little more help managing money like seniors, people with disabilities, or folks in recovery programs. It gives family members or trustees a way to keep spending under control, while still giving independence to the cardholder.

You can load money onto it, set where it can be used, block risky purchases, and even get instant alerts. It’s a huge relief if you’ve ever worried about your mom falling for a phone scam or your nephew spending trust funds too fast.

Why is the True Link Card Holder Login Important?

Think of the True Link card holder login as your command center. Once you log in, you can see everything happening on the card. Want to check the balance before going to the store? Done. Want to make sure no weird charges popped up? You’re covered. Need to reload funds? Easy.

Without logging in, you’d be in the dark. Plus, if you’re a caregiver or trustee, it’s how you keep track of spending and make sure the money’s being used right. So yeah, it’s pretty important and actually, it’s pretty simple once you get the hang of it.

How to Set Up Your True Link Card Account

Signing Up for the True Link Card

Alright, let’s start at the very beginning signing up. Go to the True Link website. There’s a big, friendly button that says “Get Started.” Click it.

- Fill out some basic info. You’ll need your name, email, phone number, and, of course, details about the person who will use the card (if it’s not you).

- Choose how to fund it. You can link a bank account or arrange for direct deposits.

- Verify your identity. Because it’s a financial product, they’ll ask for things like your SSN and maybe even a photo of your ID.

After that, they’ll mail you the card. It usually comes within 7–10 days.

Activating Your Card

Once the True Link Visa card shows up in your mailbox, you’re halfway there. Now you need to activate it.

- Log in to your new True Link account.

- Enter the activation code from the paperwork.

- Create a PIN. Make sure it’s something easy to remember but not super obvious (no birthdays!).

Boom. Your card is now live and ready for spending.

Step-by-Step Guide to True Link Card Holder Login

Accessing the True Link Dashboard

Now to the star of the show, the True Link card holder login process.

- Go to www.truelinkfinancial.com and click “Login.”

- Enter your email and password.

- Complete any two-factor authentication if they prompt you.

Once inside, you’ll see a neat dashboard. It shows your balance right up top. You can also see recent transactions, adjust spending settings, load money, and more.

It’s all super user-friendly. I like how they designed it because even my uncle, who barely touches technology, figured it out without me holding his hand.

Tips for Secure Login

Let’s be real, online scams are everywhere. Here’s how to keep your True Link login safe:

- Never save passwords in your browser. Use a password manager instead.

- Turn on two-factor authentication. That extra code sent to your phone? It’s worth the tiny hassle.

- Always log out on shared devices. Especially if you’re at a library or using someone else’s laptop.

Managing Your True Link Prepaid Card Online

Checking Your Balance

You can check your balance at least twice a week. With the True Link card holder login, it takes me less than 30 seconds.

- Log in, and the balance is right on the home screen.

- If you want, you can even set it up so it texts or emails you every time the balance dips below a certain amount. Super helpful!

Viewing Transactions and Statements

Want to see where the money’s going? The online account shows every swipe, including the date, store name, and amount. You can also download monthly statements if you’re old-school like me and want to keep a paper file.

Setting Up Alerts and Controls

This is one of the biggest reasons people go for True Link. In your online dashboard, you can:

- Block certain stores or types of spending.

- Set daily, weekly, or monthly spending limits.

- Get instant text alerts for purchases.

It’s like having guardrails on a highway, which keeps everything moving safely.

How Does the True Link Visa Card Work?

Spending and Usage Explained

How does the True Link Visa card actually work day-to-day? It’s pretty much like any regular debit card except with smarter safety features. You or your loved one can use it to:

- Shop in-store or online anywhere Visa is accepted.

- Withdraw cash at ATMs (if you allow it in the settings).

- Pay bills or recurring subscriptions.

But the magic is that it’s not tied to a checking account, so there’s no way to overdraft. You can only spend what’s loaded on the card. That gives me tons of peace of mind. It means if my mom accidentally tries to pay for something over the card’s balance, the transaction just declines instead of racking up overdraft fees.

You can also set up detailed controls from your True Link dashboard. Want to block online purchases to stop impulse shopping? Easy. Want to prevent spending at liquor stores or casinos? Just toggle them off. It’s like having a personal spending bodyguard on the card.

Funding Your True Link Visa Card

You might be wondering, “Okay, but how does the money get on there in the first place?” Good question. Here are the usual ways:

- Direct deposit: If the cardholder gets Social Security or disability benefits, you can have them sent straight to the card.

- Bank transfer: Link a bank account and move money over as needed.

- Recurring load: Schedule automatic reloads so you don’t have to think about it.

This flexibility is especially helpful for trust managers, guardians, or family caregivers who want to keep a loved one supported without handing over full access to bank accounts.

Can the True Link Visa Card Be Funded by a Trust Account?

Yes! That’s actually one of the big reasons many trustees and attorneys recommend True Link. You can set it up so the True Link card is funded directly by a trust account, which is a game changer for special needs trusts or family trusts.

It means money stays protected in the trust, but the cardholder still has a way to spend it on day-to-day things without risking misuse or hurting benefit eligibility. From my own experience helping a friend with a trust, this setup really simplifies everyone’s life.

Common Issues with True Link Card Holder Login

Forgotten Passwords and Recovery

Let’s face it, we all forget passwords. If you ever try to log in to your True Link account and your brain goes blank, don’t panic.

- Click “Forgot Password?” on the login page.

- Enter your email, and they’ll send you a secure link to reset it.

- Make a new password that’s strong but memorable (maybe use a passphrase like “GrandmaBakes$BestCookies!”).

You’ll be back on your dashboard in no time.

Locked Account Solutions

If True Link notices suspicious activity, like someone trying to log in from a foreign country they might temporarily lock the account to protect you.

In that case:

- Check your email. They often send a note explaining what happened.

- Call their customer support. They’ll walk you through unlocking it.

Pro tip: Always keep your account contact info (like phone and email) updated, so you can quickly verify your identity.

Staying Safe Online with Your True Link Account

Avoiding Scams and Phishing

These days, scammers will try anything. They might send fake emails saying your True Link account needs “urgent verification,” hoping you’ll click a bad link.

Here’s the rule:

- If you didn’t expect it, don’t click it.

- Always go directly to the official site by typing www.truelinkfinancial.com into your browser.

And if something seems weird? Call them directly. Better safe than sorry.

Tips to Keep Your Account Secure

A few other smart habits:

- Change your password every few months.

- Never share login details with anyone, even if they say they’re from “customer support.” (A real rep will never ask for your password.)

- Use two-factor authentication for that extra layer.

Following these basics means you’ll stay one step ahead of any hackers or shady characters.

Benefits of Using a True Link Prepaid Card

Flexibility and Control

The most amazing thing about the True Link prepaid card is how much control it gives you as a caregiver and how much dignity it still gives to your family.

The flexibility is huge. you can:

- Load more money instantly if he needs it for a doctor visit.

- Block sketchy merchants with one click.

- Get text alerts for every purchase so I always know what’s up.

It’s also handy for different situations. Whether you’re helping a senior, managing funds for a family member with a disability, or even giving a teen a safe first spending card, True Link fits the bill.

Great for Seniors and Caregivers

This is where True Link really shines. Older adults can still shop and pay for things themselves without the risks that come from handling large amounts of cash or having open access to a checking account.

As a caregiver, it gives me the freedom to set it and mostly forget it, since the controls keep things on track. If there’s ever an unusual purchase or if the balance gets low, you get a ping on my phone. That means fewer awkward money conversations and more trust.

A lot of my friends who also care for ageing parents say True Link has been a total game changer. It cuts down on money fights, prevents expensive mistakes, and gives everyone more peace of mind.

Customer Support and Help Resources

Contact Options

If you ever hit a snag, the True Link customer support team is genuinely helpful. You can reach out by:

- Phone: They have a toll-free number you can call during business hours.

- Email: Usually gets a reply within a day.

- Secure message: Through your dashboard after logging in.

They’re used to working with seniors and caregivers, so they’re patient and explain things in plain English. That’s a big plus.

Using the True Link Help Center

If you’re like me and prefer to figure things out yourself first, the True Link website has a super handy help center. It covers pretty much everything:

- How to set up spending limits.

- What to do if your card is lost or stolen.

- How to add money.

- FAQs on all the nitty-gritty details.

FAQs

What is a True Link prepaid card?

It’s a reloadable Visa card designed for seniors, people with disabilities, or anyone who needs help managing money. You can control where it’s used, set spending limits, and monitor transactions all from an online dashboard.

How do I access my account as a True Link card holder?

Simply go to www.truelinkfinancial.com, click on “Login,” and enter your email and password. From there, you can see balances, transactions, and adjust settings.

How does a True Link Visa card work?

It works like a regular debit card, except it’s loaded with prepaid funds. You can only spend what’s on the card; there’s no overdraft or interest. Plus, you can block or allow certain purchases to keep spending safe.

What is the maximum account balance for a True Link card?

The typical maximum balance is around $20,000. If you’re using it with a trust, funds generally stay in the trust, and only what’s needed is moved onto the card.

Can the True Link Visa card be funded by a trust account?

Yes! This is one of its biggest features. Trustees can transfer funds directly from a trust into the True Link card, keeping things compliant and protected.

What is a True Link Next Step Visa card?

It’s a special version of the True Link card built for people in recovery programs. It comes with even stricter spending controls to help avoid triggers or relapse spending.

What do I do if I can’t log in to my True Link account?

First, click “Forgot Password?” on the login page to reset it. If your account’s locked, check your email for instructions or call customer support for help.

Is the True Link card FDIC insured?

Yes. Funds loaded onto the card are FDIC insured through the issuing bank, so your money is protected up to standard limits.

Can I use my True Link card internationally?

Generally yes, anywhere Visa is accepted. But you’ll want to double-check the card settings in your dashboard and watch for possible foreign transaction fees.

Conclusion

If you’ve made it this far, congrats you now know all the essentials about the True Link card holder login, how it works, and why it’s such a solid choice for managing someone else’s spending safely.

Whether you’re managing trust distributions, helping a parent, or even recovering from financial missteps yourself, it’s a tool that can make life a lot easier.

If you’re considering getting a True Link card, I say go for it. It might just be the best money move you’ll make this year.