If you’ve issue with the term “Radiant Credit Union login,” or you’re probably trying to access your account and manage your money the easy way, but don’t know now. Well, you’re not alone. This is not the first time one has encounter such issue. In this article, I will provide you the right step to logging in to your account.

Radiant Credit Union login account is your gateway to checking balances, making loan payments, managing cards, and much more. It’s like having a branch in your pocket. Whether you’re using a desktop or a mobile device, the login process is super user-friendly, but it still helps to know exactly what to expect and how to troubleshoot common issues.

- Mainstreet Credit Union Login – How to Access Your Account Securely

- Charter Oak Federal Credit Union Login – Secure Access

- Credit Union for Mortgage – Get Preapproved for a Home Loan

- Credit Union For Car Loan – Apply for a Credit Union Car Loan

- Eastman Credit Union Near Me – Find Eastman Credit Union Branch & ATM Locations

- Lake Michigan Credit Union Near Me – Find LMCU Branches & ATMs Location

What is Radiant Credit Union?

Radiant Credit Union is a not-for-profit financial institution based in Florida. Unlike big banks that focus on shareholders, RadiantCU focuses on members, you and me. Their goal? To offer top-notch financial services like savings, loans, and checking accounts without nickel-and-diming you with excessive fees.

They’re community-driven and member-owned, which gives them a leg up in trust and customer service. From personal checking to auto loans and online banking tools, RadiantCU is built to help regular folks manage their finances better.

So when we talk about the Radiant Credit Union login.

Why Logging Into RadiantCU Matters

You might think, “Logging in? That’s obvious.” But here’s the deal, it’s more than just checking your balance. When I login to my Radiant Credit Union account, I can do things like:

- Transfer money between my accounts

- Pay off my car loan

- Set up text alerts for low balances

- Freeze my debit card if I misplace it

- Deposit a check without stepping into a branch

The RadiantCU login makes managing money as easy as ordering pizza online. No long lines. No confusing paperwork. Just you and your finances, all in one secure spot.

Plus, it gives you control. You’re no longer waiting for statements in the mail or standing in line for a teller. Everything’s instant. Everything’s easy. And for busy people like us, that convenience is priceless.

First Steps Before Logging In

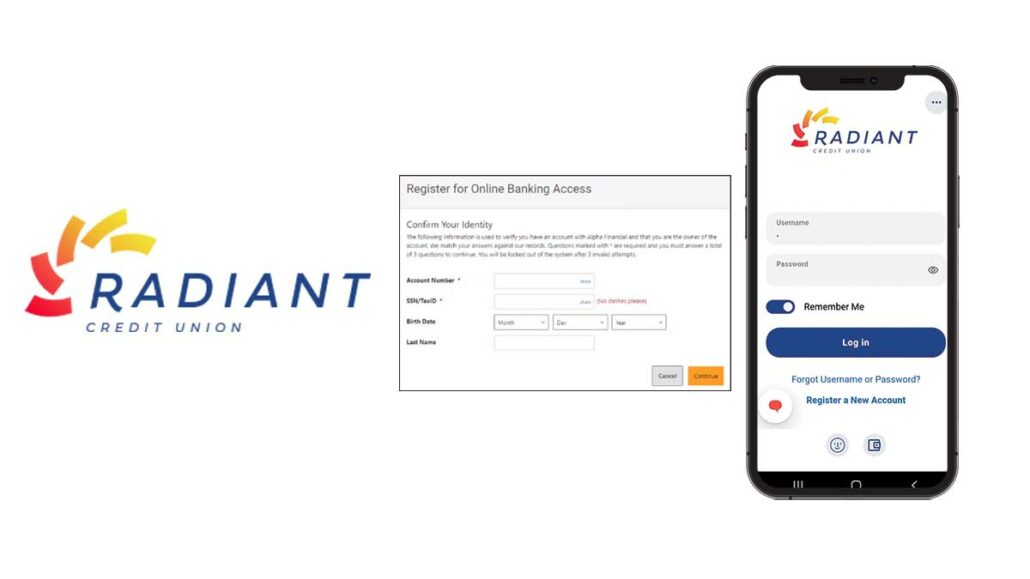

Setting Up Your Account for the First Time

Okay, before you can login, you obviously need an account. Signing up is pretty simple, but let’s not rush through it. First, you’ve got to become a member. Radiant Credit Union serves specific regions in Florida, so check if you’re eligible.

Once your membership is approved, you’ll get your member number. That’s your golden key.

Here’s what I had to do:

- Go to the RadiantCU website

- Click “Enroll Now” (under the login section)

- Fill in details like your SSN, member number, and date of birth

- Set a strong password (more on that later)

- Choose your security questions

- After that, boom! Your online account is ready.

You’ll get a temporary password and then be prompted to create your own. Don’t skip the security setup. Those questions come in handy if you ever get locked out (trust me, I’ve been there).

Things You Need Before You Start

Here’s your RadiantCU login starter pack:

- Your Member Number: This usually comes after you join the credit union.

- Social Security Number (SSN): Used for identity verification.

- Date of Birth: Another piece of the ID puzzle.

- Email or Phone Number: To receive verification codes.

- A Strong Password: Don’t use “123456” or “password.” Go for a combo of upper and lowercase letters, numbers, and symbols.

- A Secure Device: Preferably one you own. Public computers = risky business.

If you’re logging in for the first time, have your mobile phone nearby. RadiantCU often uses 2-step verification to make sure it’s really you trying to get in.

How to Login to Radiant Credit Union

Step-by-Step Login Guide

Let me break it down like we’re sitting side by side:

- Visit radiantcu.org

- Click on the “Login” button at the top right

- Enter your Username (or Member ID)

- Type in your Password

- If prompted, enter the code sent to your mobile device

- Click Login

Once you’re in, the dashboard opens up. It’s clean, user-friendly, and not cluttered with a bunch of ads like some big banks.

If you’re on a mobile device, it’s even easier. Open the Radiant Credit Union app, use biometrics (like Face ID or your fingerprint), and you’re good to go.

Radiant Credit Union Login on Mobile

Downloading the Mobile App

Let’s be real, most of us do everything from our phones these days, and RadiantCU gets that. Their mobile app is free and easy to install from:

- Apple App Store

- Google Play Store

Just search “Radiant Credit Union” and download the official app with the blue and white logo. Avoid sketchy third-party versions.

Once installed, open the app and:

- Enter your Username and Password

- Set up Face ID or fingerprint login

- Enable push notifications (they’re super helpful)

Navigating the App Login Process

Logging into the app feels like magic. One tap, and I’m in. Here’s what I see:

- My account balances right on the home screen

- Quick buttons for transfers, loan payments, and deposits

- Access to credit card management and budget tools

The mobile login process is smooth, fast, and secure. It’s a huge time-saver when you’re on the go—whether you’re waiting in line or sipping coffee at your favorite café.

Managing Your Account After Login

Dashboard Overview

Once you’re logged in, you’ll land on the dashboard and honestly, it’s designed for real people, not tech geniuses. The layout is simple but powerful. You’ll see:

- Checking and savings balances

- Recent transactions

- Upcoming loan due dates

- Quick access to bill pay and transfers

- Alerts or notifications

What I love about it? Everything is right there, no clicking through five tabs just to see what’s going on with your money. You can even customize your dashboard to highlight the features you use most. For me, I like having my checking account and credit card balance front and center.

It’s like having a financial control center at your fingertips.

Viewing Transactions and Balances

Need to check if your paycheck hit? Or if your rent payment went through? After logging in, you can view detailed transaction histories for each account. You can filter by date, amount, or transaction type.

Here’s what I usually do:

- Click on my checking account

- Scroll through the list of recent transactions

- Click on any transaction for more details

You can also download monthly statements, print receipts, and even search specific vendors. It’s a lifesaver when you’re trying to figure out where that mysterious $45 charge came from (spoiler: it was a late-night food delivery in my case).

You can also set balance alerts. If your account drops below a certain amount, you get a text or email. That’s helped me avoid overdraft fees more times than I’d like to admit.

Using eBanking Through RadiantCU Login

What You Can Do with Online Banking

If you’re like me, you want to do as much as possible without visiting a branch. And RadiantCU delivers. After logging in, you can access a full suite of eBanking tools.

Here’s just a peek at what you can do:

- Transfer funds between accounts or to other members

- Pay bills using their Bill Pay system

- View and download eStatements

- Apply for loans or credit cards

- Set up recurring transfers (like for savings goals)

- Manage your RadiantCU credit or debit card

You can even send secure messages to their support team directly from your dashboard, which makes resolving issues a breeze.

RadiantCU’s online banking platform is clean, fast, and built with the user in mind. No unnecessary features, just the stuff you actually use.

Tips to Maximize Your Digital Experience

To make the most of RadiantCU’s digital tools, here are a few tips from my own experience:

- Enable account alerts: These can notify you about deposits, withdrawals, and low balances.

- Use Bill Pay: Stop writing checks and start scheduling your payments online.

- Create savings goals: Set up automatic transfers to help reach your goals faster.

- Use tags and notes: Label transactions like “Groceries” or “Rent” for easy tracking.

- Download the app: It’s much more convenient when you’re on the go.

Once you get used to the system, you’ll wonder how you ever lived without it. It really feels like you’ve got your own personal bank in your pocket.

Making Loan Payments After Login

Paying Loans from the Portal

Paying loans has never been easier since I started using the Radiant Credit Union login. Whether it’s an auto loan or a personal loan, the process is seamless.

After logging in:

- Navigate to your Loan Account

- Click “Make a Payment”

- Choose the account to pay from

- Enter the amount

- Confirm and submit

That’s it. No checks, no mailing payments, and no trips to a branch.

You can even set up scheduled payments so that your loan is paid automatically on your due date each month. It’s the ultimate set-it-and-forget-it tool.

Auto-Pay Options and Manual Payments

I personally use Auto-Pay because, well, life gets busy. You can enable it right from the login dashboard. Just go to the Loan Details page and turn on Auto-Pay. Choose your funding account, payment date, and amount (minimum, full, or custom).

Prefer to handle it yourself? No problem. Manual payments are just as easy. You can even pay more than the due amount if you’re trying to knock that balance down faster.

Making an extra payment here and there, especially early in the loan, can save you a lot in interest over time.

FAQs

How does radiant credit union eBanking work?

RadiantCU’s eBanking works through their secure online and mobile platforms. Once logged in, you can manage accounts, pay bills, transfer money, and even deposit checks all from your computer or smartphone. It’s fast, safe, and designed to be user-friendly.

How do I make my Radiant credit union loan payment?

You can make your loan payment after logging in to your RadiantCU account. Go to your loan account, choose “Make a Payment,” select the funding source, enter the amount, and hit submit. You can also set up auto-payments so you never miss a due date.

Does Radiant Credit Union offer digital banking?

Yes! Radiant Credit Union offers a full suite of digital banking tools, including online banking, a mobile app, mobile check deposits, account alerts, bill pay, and more. Everything is accessible through your login credentials and is secured with two-factor authentication.

How do I log in to radiantCU?

Go to radiantcu.org, click the “Login” button, enter your username and password, and complete the 2FA if prompted. If you’re using the app, you can also log in with your fingerprint or Face ID.

How do I create a RadiantCU account?

Start by visiting RadiantCU’s website and clicking on “Join.” Fill out your personal information, verify your eligibility, fund your initial deposit, and submit your application. Once you receive your member number, you can enroll in online banking to create your login.

How can I use my Radiant credit union card?

You can use your RadiantCU debit or credit card just like any other bank card for purchases, ATM withdrawals, and online shopping. After login, you can manage the card through the app, set alerts, freeze/unfreeze the card, and even request a new PIN.

Conclusion

Using the Radiant Credit Union login has completely changed the way I manage my money. From quick check-ins on my phone to making loan payments without stepping foot in a branch, it’s made my financial life simpler, safer, and so much more convenient.

Whether you’re just getting started or you’ve been a member for years, the login process gives you full access to a wide range of tools that make banking feel effortless. From my personal experience, I can honestly say that RadiantCU has built a digital experience that actually works for real people like us, not just tech wizards or financial pros.