How Much is FedEx insurance per $100

How Much is FedEx insurance per $100? Ever need to ship something valuable? FedEx offers insurance for your packages to provide financial protection in...

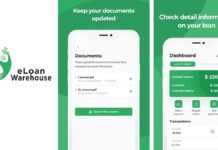

eLoanWarehouse – Online Lender

eLoanWarehouse is a lender offering installment loans as an alternative to payday loans. They advertise loans up to $3,000 which can be deposited into...

Colonial Penn Life Insurance – Get Quotes and Coverage Today

Are you looking for affordable life insurance in the USA? Consider Colonial Penn, a leading provider specializing in simplified whole life insurance for seniors...

Florida Bright Futures Scholarship – Eligibility and Application

Earning a college degree is a valuable investment in your future, but the cost can be daunting. Thankfully, Florida offers the prestigious Bright Futures...

How to Find Student Loan Account Number

Struggling to find your student loan account number? Don't worry, we've got you covered. This guide will walk you through the steps to locate...

What is Hazard Insurance on Mortgage?

What is Hazard Insurance on Mortgage? Learn about hazard insurance, a required part of most mortgages, that protects your home's structure from fire, storms,...

EWS Scholarship – Benefits. Eligibility and Application

Find EWS Scholarship for students facing financial hardship. Learn about eligibility requirements and application processes. The acronym EWS stands for Economically Weaker Section. In...

Best Scooter Insurance in USA – Get Quotes & Save Today

Find the best scooter insurance in the USA! Compare quotes, get covered fast, and save money on your scooter policy. Learn about scooter insurance...

NSHSS Scholarships – Benefits, Eligibility, and Application

Are you a high-achieving high school student striving for academic excellence and leadership? Discover NSHSS scholarships exclusively for NSHSS members. Find financial aid for...

How Much Unemployment Will I Get If I Make $1000 a Week

How Much Unemployment Will I Get If I Make $1000 a Week? Unsure about your unemployment benefits? Learn how much you might qualify for...