Car Insurance Quotes in Pennsylvania – How Much is Car Insurance in Pennsylvania

What are the cheapest car insurance quotes in Pennsylvania? Auto insurance or car insurance in most states is important for you to purchase. However,...

How to Become a Pet Insurance Adjuster

Becoming a Pet Insurance Adjuster is a fulfilling career choice for those who have a passion for animals and a knack for navigating insurance...

Best Investing Books for Beginners

Learn about the best investing books for beginners, including summaries of each book, key takeaways, and links to where to purchase the books.

Investing is...

How to Obtain No Fault Insurance

What is no fault insurance?

No-fault insurance can help you pay for medical expenses and lost wages after a car accident, regardless of who was...

Financial Advisor – How to Choose a Financial Advisor

If you’re in any budget or financial situation, there is always a financial advisor to help you overcome your financial and budget situation. In...

Cashiers Check – What Is a Cashier’s Check, How to Get a Cashier’s Check

The use of cashier checks is for making large payments. You can find them in banks and credit unions. Cashier’s checks are considered as...

Where to Buy Bitcoins – Best Places to Buy Bitcoin in 2024

Where can I buy cryptocurrency? Looking for where to buy your bitcoins, there is a wide range of cryptocurrency wallets where you can buy...

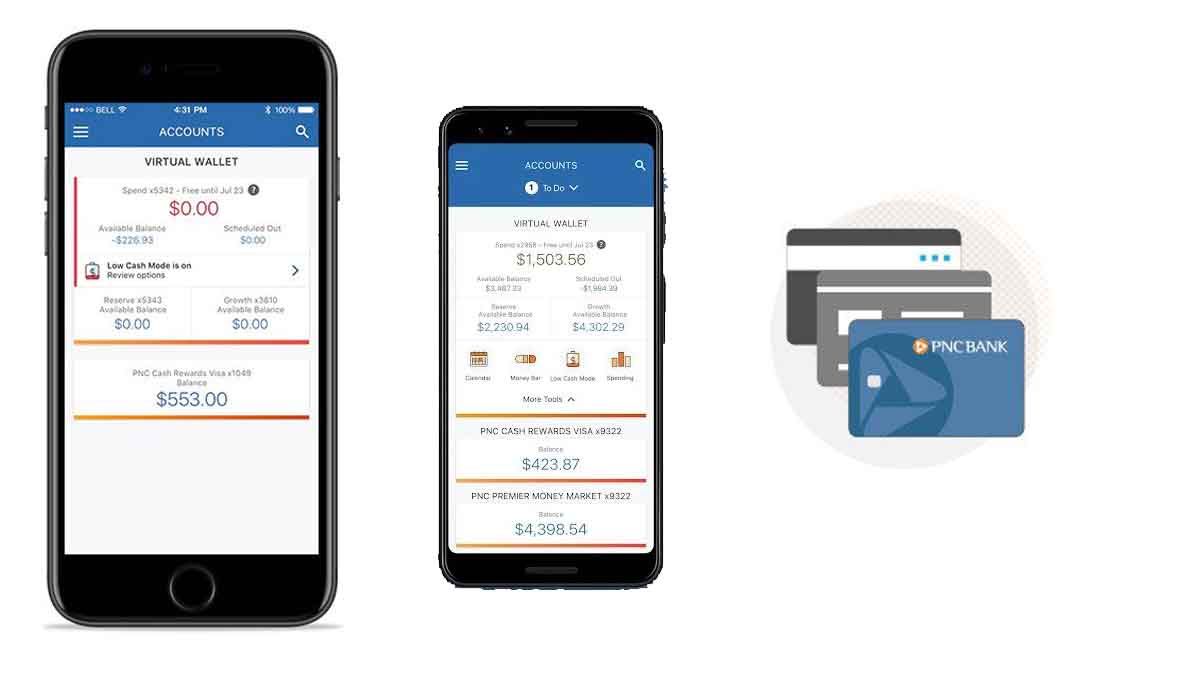

How to Check PNC Card Balance Online

How can I check the balance on my PNC credit card? In this article, we will show you the simple procedure on how to...

Lake Michigan Credit Union Near Me – Find LMCU Branches & ATMs Location

How can I find the nearest Lake Michigan ATM or branch near me? When looking for a credit union within your location, there are...

Good Credit Cards With Rewards – Top Picks in 2024

In the USA, credit cards with rewards programs are a powerful tool to earn valuable perks while managing your finances. The right card can...