Safe Auto Insurance – SafeAuto Car & Home Insurance Review

Across all the states in the United States, vehicle owners need to possess car insurance coverage. But sometimes, to some drivers, it’s very difficult...

Small Business Grants – Free Grant Programs for Small Business

Organizations like federal, state, and also private companies offer small businesses grants commonly referred to as Small Business Grants. In the article, you can...

Lienholder – What is a Lienholder on Car Insurance

When you finance a vehicle, you tend to have a lienholder. However, for those that do not know what a lienholder is. You need...

Credit Score Range – What Is a Good Credit Score?

Credit scores range from the scale of 300 to 850, and a good credit score is 690 to 710 on a credit scoring system...

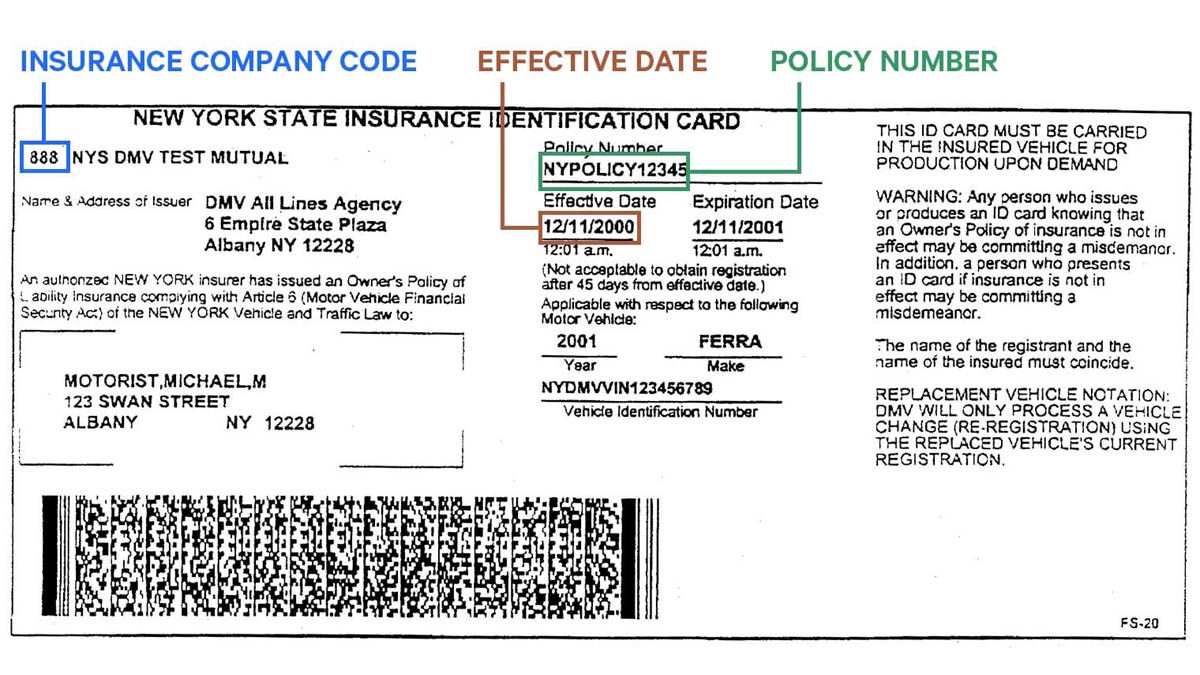

How to Obtain Proof of Insurance

How to Obtain Proof of Insurance - Proof of insurance is a way of showing that you have insurance for any property insured, such...

Homeowners Insurance Dispute Attorney Oklahoma City

When it comes to navigating the complex landscape of homeowners insurance disputes in Oklahoma City, having a seasoned professional by your side can make...

Attorney For Car Accidents – Get Help

Have you been injured in a car accident in the USA? If so, you're likely facing a complex situation involving medical bills, lost wages,...

Hard Money Lenders – Fast Funding for Fix & Flips

When traditional financing avenues seem shut, the doors of hard money lenders might swing open. These alternative lenders offer short-term, asset-backed loans secured by...

Best Corporate Bankruptcy Lawyer in Los Angeles

Facing financial difficulties can be stressful for any business owner. When considering corporate bankruptcy as a potential solution, navigating the legal landscape becomes critical. Finding...

Attorneys Specializing in Auto Insurance Claims

Learn why hiring attorneys specializing in auto insurance claims is crucial for getting the compensation you deserve. Navigate the complex legal process with ease...