Best CRM for SAAS Startups

Running a SaaS startup comes with unique challenges, including managing customer relationships, automating workflows, and optimizing sales funnels. A Customer Relationship Management (CRM) system...

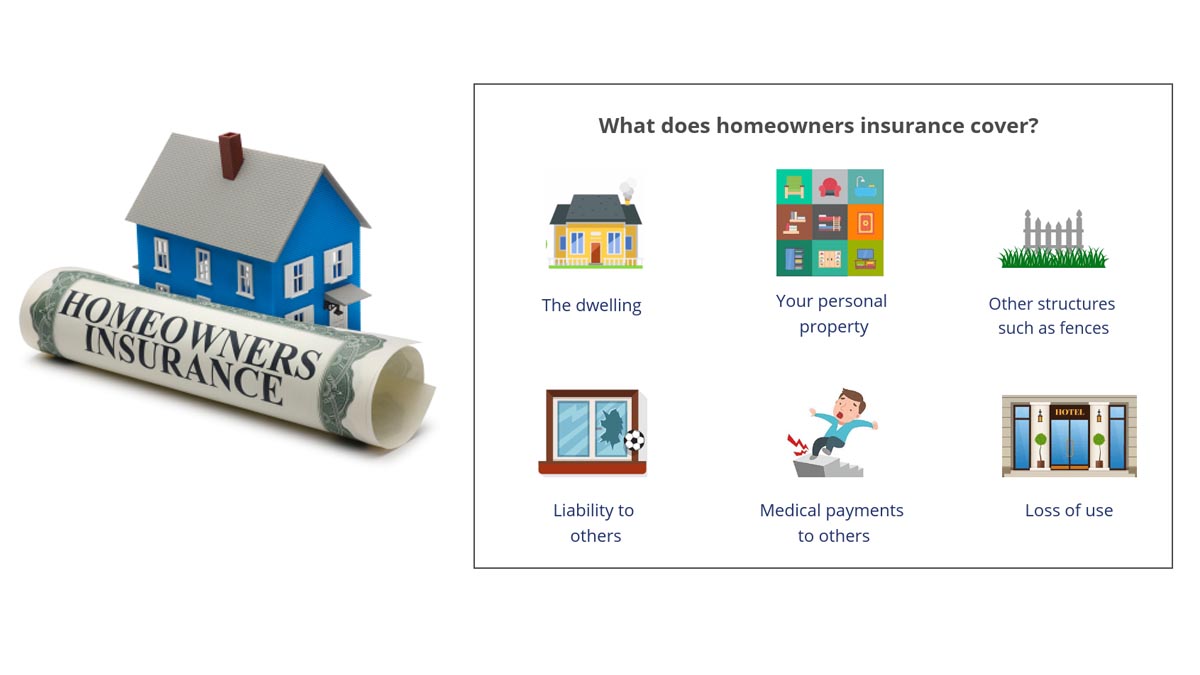

What Does Homeowners Insurance Cover? – Homeowners Insurance

When talking about “what does homeowners insurance cover?” the first thing that comes to mind is “What is homeowner insurance” and “what does it...

AA Insurance – How to Get Insurance Quote

Nevertheless, Insurance is a very wide topic and it’s broadly spread on various angles like travel insurance, car insurance, business insurance, life insurance, and...

Mortgage Questions – 20 Essential Questions You Have to Ask

Applying for a mortgage is one of the biggest financial commitments you'll make in your lifetime. To ensure you’re getting the best deal possible,...

Dovenmuehle Mortgage Login – Access Your Account

When it comes to managing your mortgage payments and account details, ease of access plays a vital role. For homeowners with loans serviced by...

Life Insurance Calculator – Get Your Quote Today

Life can be unpredictable, and having a financial safety net in place for your loved ones after you're gone is an important step you...

Why GEICO’s Home Insurance Coverage is Perfect for First-Time Homebuyers

Is GEICO home insurance good or how can I get a GEICO home insurance quote? When people are looking for a home insurance policy...

Repairing Credit – How To Fix Your Credit In 5 Easy Steps

What is the fast way to repair your credit or how can I repair my credit? In this article, you can learn more about...

High Yield Investment Strategies for Retirees

Living comfortably in retirement requires careful planning and a reliable source of income. This guide explores various high-yield investment strategies specifically tailored for retirees...

How to Get Universal Life Insurance

Discover the ins and outs of acquiring universal life insurance. Learn about its benefits, eligibility criteria, and how to make the most out of...