In today’s fast-paced world, nobody has the time to stand in long queues or wait endlessly for customer service calls. Having access to your Mariner Finance account online changes that completely. The Mariner Finance login portal gives you the power to track your loan, see your payment history, and even schedule payments without needing to step outside your home. Think of it like having a mini branch in your pocket, it’s available 24/7, and all you need is a smartphone, tablet, or computer.

If you’ve ever struggled with keeping your financial records straight, then this login feature could feel like a lifesaver. You can quickly check when your next payment is due, how much you owe, and whether your past payments have been properly recorded.

How Much is Homeowners Insurance on a $150000 House

How Much Would a $1000 Payday Loan Cost

Mortgage Lenders have the Lowest Rates

Get a Loan- Find a Loan Lender

Housing Assistance Payments

Mortgage 30 Year Fixed Rate – Find the Best Rates & Info

Mortgage 0 Down – Buy a Home with No Down Payment

Loan Discharge – Understand Your Options & Eligibility

Loan Xpress Pay – Fast Online Personal Loans

Loan 3000 – Get a $3000 Loan Instantly

Loan to Pay Off Credit Cards – Consolidate Debt & Save Money

Mortgage 150k House – How Much House Can I Afford

Why Use Mariner Finance Login?

Now, you might be asking yourself: why should I even bother with Mariner Finance Login when I can just call or visit a branch? Let me break it down for you.

First off, convenience. Imagine being able to check your loan details at midnight or on a Sunday afternoon when the branch is closed. That’s the beauty of online login. You’re not limited by business hours, you’re in control of when and where you access your account.

Second, with online login, you skip all that. Need to see your loan balance? Just a couple of clicks. Want to make a payment? Done in less than five minutes.

Third, security. The Mariner Finance portal is designed with modern encryption and safety features to protect your data. You don’t have to worry about someone snooping on your financial details when you’re logged in. Of course, like any online platform, you should still follow best practices, like creating a strong password and not logging in on public Wi-Fi.

Lastly, there’s the overall control it gives you. When you log in, you’re not just passively waiting for information to come to you, you’re actively managing your loan. You can monitor your progress, see if payments have been posted, and even spot potential issues early.

In short, using Mariner Finance Login is about making your life easier. It saves you time, it keeps you secure, and it helps you stay organized with your finances. If you’re someone who likes to stay on top of things (and I bet you do), this is a tool you’ll find incredibly valuable.

Step-by-Step Guide to Mariner Finance Login

Okay, let’s get into the practical side of things. Logging into Mariner Finance isn’t complicated, but if you’re new to it, having a guide can make things much smoother. Here’s exactly how you do it:

- Go to the official website: Open your browser and type in the Mariner Finance official website URL. Always make sure you’re on the right site to avoid phishing scams.

- Find the login button: Usually, it’s at the top right corner of the homepage. Click on it.

- Enter your details: Type in your username and password. Make sure you don’t mix up characters, especially if your password has special symbols.

- Hit login: Once your details are correct, click the login button, and you’ll be taken to your account dashboard.

That’s it, you’re in. From here, you can check balances, make payments, and manage your loan account.

But what if you forget your password? Don’t worry; there’s a “Forgot Password” link right on the login page. Clicking it will take you through a recovery process where you’ll verify your identity and set a new password. It usually takes just a few minutes.

How to Reset Your Mariner Finance Login Password

Forgetting a password happens to the best of us. Luckily, resetting your Mariner Finance Login password is simple.

Here’s how you can do it:

- Go to the login page.

- Click on “Forgot Password” under the password box.

- Enter your registered email address.

- Check your email for a reset link.

- Click the link and create a new password.

When creating a new password, go for something strong but memorable. For example, combine uppercase and lowercase letters, numbers, and special characters. Instead of using something obvious like “123456” or your birthday, pick a phrase you’ll remember but others won’t guess easily.

Security-wise, Mariner Finance will always send the reset link to your registered email, ensuring that only you can access it. If you don’t see the email, check your spam or junk folder, it might have landed there.

And here’s a tip from me: once you reset your password, note it down in a secure place or use a trusted password manager. That way, you won’t have to keep going through the reset process over and over.

Creating a New Mariner Finance Online Account

If you’re brand new to Mariner Finance and haven’t used their online services before, the first thing you’ll need to do is create an account. You’ll find that registering for an account isn’t complicated at all, but you do need a few things handy.

Here’s what you’ll need:

- Your loan account number (usually provided when you first get approved).

- A valid email address.

- A strong password you’ll remember.

Once you’re ready, head to the Mariner Finance website and click “Sign Up” or “Register” instead of logging in. From there, you’ll fill out a registration form. They’ll ask for your name, account number, Social Security number, and email. After verifying your details, you’ll create a username and password.

Don’t use the same password you use for social media or other websites. Keeping it unique adds an extra layer of safety.

After you finish registration, you’ll receive a confirmation email. Click the verification link inside to activate your account. That’s it, you’re ready to log in!

Creating an account doesn’t just give you online access; it gives you a powerful tool to manage your loan.

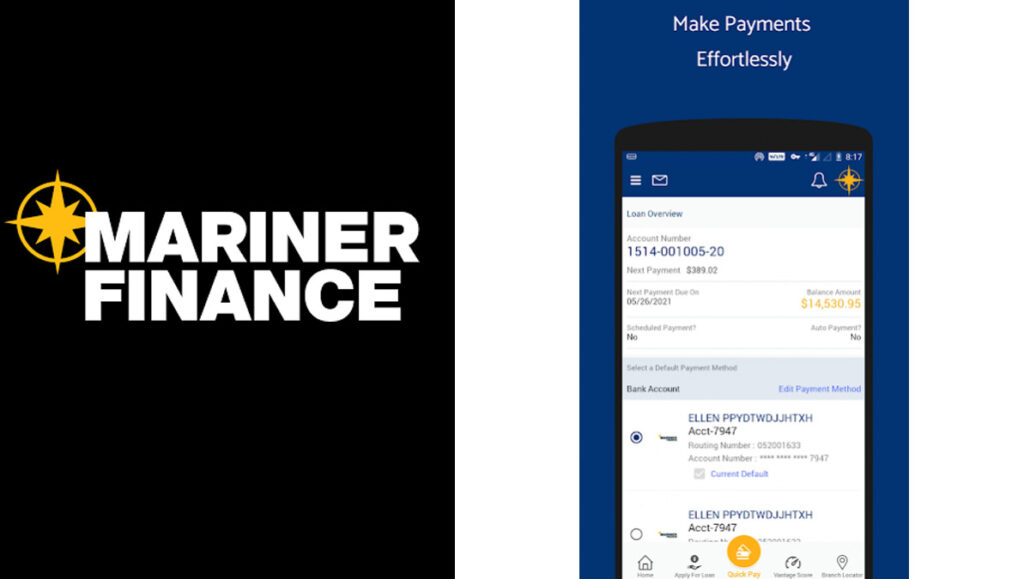

Features of Mariner Finance Online Portal

Once you’ve logged into your account, you’ll notice the portal is designed to be user-friendly. Even if you don’t consider yourself a “tech person,” you’ll find the layout straightforward. Here are some of the key features you’ll have access to:

- Loan Balance Check: See exactly how much you owe in real time. No more guessing or waiting for monthly statements.

- Payment History: You can go back and look at every payment you’ve made, which is helpful when you’re budgeting or double-checking if something was posted correctly.

- Online Payments: Probably my favorite feature. Instead of mailing a check or visiting a branch, you can make your payments instantly online.

- Profile Updates: Need to change your phone number or address? You can update it directly in the portal without calling in.

- Secure Messaging: Some portals even let you send secure messages to customer service. That way, your communication stays within your account and is protected.

Think of the portal as your financial control center. Everything you need is there, and you don’t have to shuffle through papers or keep calling to get updates. F

Making Payments via Mariner Finance Login

Most of us log in mainly to make payments. The payment process is pretty smooth and only takes a couple of minutes once you’re logged in.

Here’s how it works:

- Log into your account.

- Go to the Payments section.

- Choose whether you want to make a one-time payment or set up a recurring one.

- Enter your bank account or debit card details.

- Confirm and submit the payment.

The payment posts quickly, often within the same day. One of the biggest advantages here is avoiding late fees. Instead of worrying about mailing a check that might get delayed, you can make sure the payment is received instantly.

Does Mariner Finance Offer Automatic Payment Services?

Yes, and honestly, I think this is one of the best features offered through the Mariner Finance login portal. Automatic payments, or “auto-pay,” mean your monthly payment gets deducted from your bank account on the due date without you having to lift a finger.

Here’s why I recommend it:

- No late fees: Your payment is made on time every single month.

- Peace of mind: You don’t have to remember due dates.

- Build credit history: Consistent, on-time payments look great on your credit report.

Setting it up is simple. In the portal, go to the payment settings, choose “automatic payments,” and enter your bank details. From then on, the system takes care of the rest.

If you sometimes forget things, auto-pay can be a lifesaver. You just need to make sure you always have enough funds in your bank account to cover the payment, otherwise, you could face overdraft fees.

Common Issues with Mariner Finance Login and Their Fixes

Here are some common issues and solutions:

- Forgot Password/Username: Use the “Forgot Password” or “Forgot Username” link on the login page. Reset your credentials through email.

- Browser Issues: Sometimes the portal won’t load properly. Try clearing your browser cache, updating your browser, or switching to another one (Chrome, Firefox, Safari, etc.).

- Server Downtime: Occasionally, the website might be under maintenance. If that happens, just wait a bit and try again later.

- Incorrect Credentials: Double-check that caps lock isn’t on, and make sure you’re typing the exact username and password.

- Mobile App Issues: If you’re using the Mariner Finance app, ensure it’s updated. Outdated apps often cause login failures.

Is Mariner Finance Login Safe to Use?

“Is this actually safe?” It’s a fair concern, especially with so many online scams these days. The good news is, yes, the login system is secure, and I’ll explain why.

Mariner Finance uses encryption to protect your personal and financial details. Think of encryption like a secret code, it scrambles your information so that even if someone tried to intercept it, they wouldn’t be able to read it. On top of that, the company uses secure servers, which means your data is stored in a protected environment.

But safety isn’t just about what Mariner Finance does, it’s also about what you do. For example, you can always make sure to:

- Use a strong, unique password.

- Log out after using my account, especially if I’m on a shared device.

- Avoid logging in over public Wi-Fi, like at coffee shops.

- Check my account activity regularly for anything unusual.

They add an extra layer of protection. If someone tries to hack into your account, they’d need more than just your password.

So, is it safe? Absolutely, as long as you also practice good online habits. The Mariner Finance login is designed with strong locks, it’s up to you to make sure they stay secure.

Customer Support for Mariner Finance Login Issues

No matter how smooth technology is, sometimes you’ll need help. That’s where customer support comes in, and I have to say, Mariner Finance has been pretty responsive in my experience.

If you run into login problems or need account assistance, here are your options:

- Phone Support: You can call their customer service line for immediate help. This is the fastest way if your login isn’t working.

- Email Support: If it’s not urgent, you can email them. I like this option because it gives you a written record of your conversation.

- Branch Support: Walk into a local branch, and they’ll help reset your login or answer any questions.

- FAQ Section: On their website, you’ll find a detailed FAQ page. Honestly, half the time, I fix my issues just by reading that.

Pro tip: If you do call, have your loan account number ready. It saves you time and helps the representative find your account quickly.

Does Mariner Finance Send Loan by Mail Checks?

This is something a lot of people ask, and the answer is yes, Mariner Finance can send loan funds via mail checks. When you get approved for a loan, you usually have a few options for how you want to receive your money. One of those options is a check delivered to your mailing address.

Here’s how it works: once your loan is approved and finalized, Mariner Finance issues a check for the loan amount. Depending on your location and mailing speed, it could take a few days to reach you. I know some people prefer this method because it feels more tangible, you’re literally holding your loan funds in your hand.

Of course, it’s not the fastest method. If you’re in a hurry, you might prefer direct deposit or picking up your check at a branch. Mailing can sometimes be delayed, especially around weekends or holidays. Personally, I prefer direct deposit because it gets into my account quickly, but I’ve had friends who chose the mail option and had no problems.

So yes, if you’d rather have a physical check mailed to you, Mariner Finance can make that happen. Just remember to plan around delivery time so you’re not left waiting too long for the funds.

How Do I Send a Payment to Mariner Finance?

Making a payment to Mariner Finance is simple, and you’ve got several options.

- Online via Mariner Finance Login: This is the fastest and most convenient way. You log in, go to the payment section, and submit a payment directly from your bank account or debit card.

- Automatic Payments: As we covered earlier, you can set up auto-pay so your payments come out on their own each month. No effort needed on your part.

- In-Person at a Branch: If you like handling payments directly, you can visit a local Mariner Finance branch and pay by check, debit card, or cash.

- By Phone: You can call customer service and make a payment over the phone. It’s helpful if you don’t have internet access at the moment.

- By Mail: You can send a check or money order to the address listed on your loan statement. Just be sure to mail it early enough so it arrives before your due date.

FAQs

Who is Mariner Finance?

Mariner Finance is a lending company that offers personal loans, debt consolidation loans, and other financial services. They have both physical branches and online services, making them accessible to a wide range of borrowers.

Should you apply for a Mariner loan online?

Yes, applying online is convenient and quick. However, if you prefer face-to-face interaction, you can always apply at a branch. Both options are secure and reliable.

How do I send a payment to Mariner Finance?

You can send a payment online through the Mariner Finance login, set up auto-pay, pay in person at a branch, mail a check, or call customer service for phone payments.

Does Mariner Finance offer automatic payment services?

Yes, they do. Auto-pay deducts your monthly payment automatically from your bank account, helping you avoid late fees and maintain consistent payments.

Does Mariner Finance send loan by mail checks?

Yes, if you choose this option, they can mail a loan check directly to your address. It’s slower than direct deposit but still available.

Who can access Mariner Finance?

Only approved borrowers with active accounts can access the Mariner Finance login portal. New customers gain access once their loan is approved.

Conclusion

To wrap it all up, Mariner Finance Login is more than just a simple online portal, it’s a tool that puts you in control of your loan. From checking balances and payment history to making payments and setting up auto-pay, the login system gives you everything you need right at your fingertips.

Whether you’re creating a new account, resetting your password, or just making your monthly payment, the portal is designed to be user-friendly and secure. Combine that with customer support and alternative options like branches, phone payments, and even mailed checks, and you’ve got a flexible system that works for different lifestyles.