How to Obtain Proof of Insurance – Proof of insurance is a way of showing that you have insurance for any property insured, such as a car, home, motorcycle, and others. Proof of insurance appears in various forms, but most importantly, especially for every driver to have. When stopped, you might be asked to provide proof of insurance, as well as when you get in a car accident, to register a car.

For most insurance companies, there are several ways in which you can obtain proof of insurance, such as a card mailed to you or printed out. Mostly, you can obtain proof of car insurance online by logging in to your account or on your mobile phone through the mobile app. This includes relevant information such as your policy number, details about you and your vehicle, and others. Some car insurance companies have their way of obtaining proof by electronic proof of insurance.

In the United States, it is required that every state have car insurance, and those without an auto insurance card or proof of coverage come with a high hassle, and sometimes cost you money. Learn more on how to obtain proof of insurance.

What is Proof of Insurance

Proof of insurance is a card, printout, or digital document offered by the insurance company to show that your insurance policy is valid/activated and is also mainly required by authorities when checking your car papers or checking if you have coverage. Most cases where proof of car insurance or a car insurance card is required include:

- Pulled over by law enforcement

- Get in an accident and need to exchange insurance information.

- Registering for a new car or renewing your license plate.

- It’s also required by a lender for financing a vehicle.

The most valid form of showing proof of car insurance is an auto insurance ID card which you can get through the mail. Also, you can get it through email where you can print them out. For others, log in to your insurance account online or by a mobile app to show proof of insurance.

What are the different types of proof of insurance?

Proof of insurance plays a crucial role in various situations, from proving financial stability for a loan to demonstrating compliance with legal requirements. However, the term “proof of insurance” can be ambiguous, encompassing various document types. So, let’s delve into the world of insurance verification and explore the different types of proof available:

Insurance ID Card

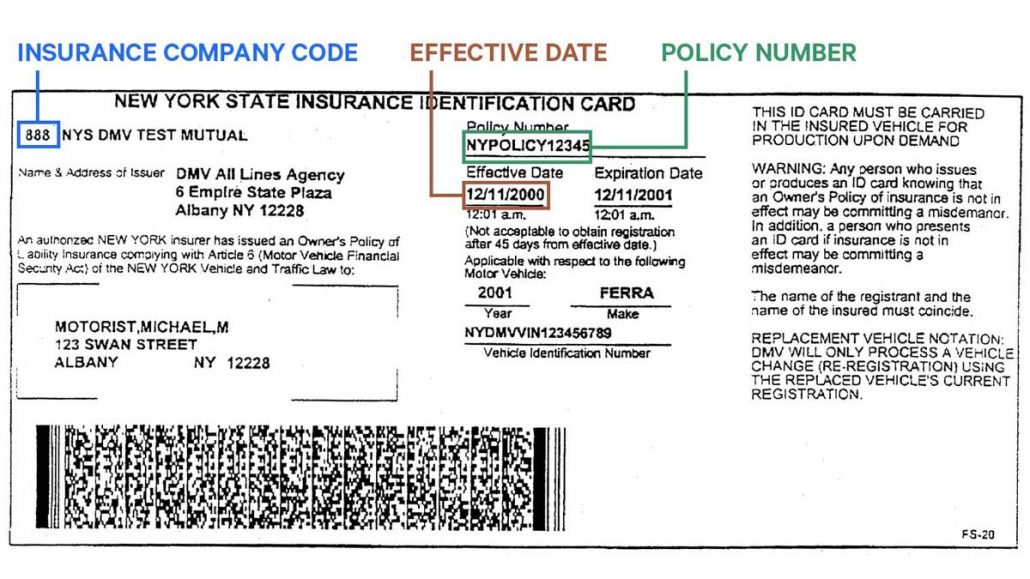

This is the most common form of proof, issued by most insurance companies. It typically includes essential information like the policy number, insured individual or vehicle, coverage dates, and insurance company contact details.

Certificate of Insurance

This document provides a more detailed overview of the insurance policy, including coverage limits, deductibles, exclusions, and additional insured parties. It’s often requested for specific purposes, like renting a car or participating in certain activities.

Insurance Binder

This temporary document serves as immediate proof of coverage while the formal policy is being processed. It typically outlines the basic coverage details and is valid for a short period.

Letter of Verification

This letter, issued by the insurance company, confirms your active insurance coverage and may include specific details requested by the recipient.

Explanation of Benefits (EOB)

While not technically proof of insurance, an EOB issued by your health insurance company can demonstrate your coverage for certain medical services.

Electronic Proof of Insurance

With technology advancements, many insurance companies offer digital versions of proof documents. These can be downloaded or accessed through an online portal, providing a convenient alternative to physical copies.

Self-Insurance Certificate

If you’re self-insured for certain risks, you may need to provide a certificate of self-insurance. This document verifies your financial capacity to cover potential liabilities without relying on conventional insurance.

Foreign Insurance Verification

When traveling abroad, you may need to present proof of insurance recognized in the destination country. This typically involves obtaining an international insurance card or translated document confirming your coverage.

Broker-Issued Proof

If you utilize an insurance broker, they may provide their document verifying your coverage. This document should include all essential information and be issued in conjunction with your insurance company.

Temporary Insurance Policy

In certain situations, like temporary car rentals or short-term projects, you may need to acquire temporary insurance. This type of policy usually comes with a limited duration and specific coverage details.

The type of proof required will depend on the specific situation and the requesting party. Understanding the different types of available documents ensures you have the appropriate documentation for any scenario. Remember, it’s crucial to keep your insurance information readily accessible, as proof of coverage may be requested unexpectedly.

When Do You Need Proof of Insurance?

Proof of insurance serves as a vital document that verifies your financial responsibility for potential damages caused while operating a vehicle. Understanding when you need to present this document can help ensure legal compliance and avoid unnecessary penalties. Here are some key situations where proof of insurance is required:

1. Driving:

- Legally mandatory: In almost every state in the US, having proof of insurance while driving is mandatory.

- Traffic stops: Law enforcement officers can request proof of insurance during traffic stops. Failure to present it can result in fines, vehicle impoundment, and even license suspension.

2. Vehicle registration and renewal:

- Initial registration: Most states require proof of insurance before registering a newly purchased vehicle.

- Renewal: When renewing your vehicle registration, proof of insurance might be necessary depending on state regulations.

3. Renting a vehicle:

- Rental requirement: When renting a car, proof of your own insurance or the rental company’s insurance coverage is typically required.

4. Selling or transferring a vehicle:

- Proof of valid insurance: In some states, proof of valid insurance might be needed when selling or transferring ownership of a vehicle.

5. Getting a loan for a vehicle:

- Loan requirement: Lenders often require proof of insurance before approving a loan for a vehicle purchase.

6. After an accident:

- Exchanging information: When involved in an accident, exchanging insurance information with other parties is crucial.

- Claiming damages: Your insurance company will require proof of insurance to process your claim for damages.

7. Court appearances:

- Traffic violations: If you appear in court for traffic violations related to insurance coverage, proof of insurance might be requested.

Details Shown on a Proof of Insurance

Your auto insurance card includes relevant information that displays valid proof of car insurance. Here is the following information that appears on your insurance card.

- Insurance policy number

- Name and address of insurance company

- Policyholder first and last name.

- Effective dates of the policy and the expiration dates.

- Year, make model, and VIN of the insured vehicle.

- Coverage details

Your insurance ID card shows that you possess the minimum amount of coverage required by your state law. For some cards, you will not see coverage selections and limits.

How to Obtain Proof of Insurance

By various insurance companies, generally, there are several ways in which you can obtain your proof of insurance or auto insurance card. Here is the following way to get proof of insurance:

- Online: yes, you access the proof of insurance online by logging in to your account. When you log in to your insurance account online, you can download or print the card anywhere.

- By Mobile App: since you can’t carry your computer everywhere, you can also get your insurance card directly from your mobile through the mobile app. Download and log in to your mobile insurance app to print or download your auto insurance ID card.

- By Mail: if you don’t want to receive your insurance card online or by mobile app, you can simply access the request for it by mail. Request for your insurance card to be mailed to you. Keep in mind, that for some insurance companies, you might lose your paperless discount if you choose to obtain your insurance ID card by mail.

- Fax: also, you can obtain proof of insurance through fax by calling your insurance customer service and your insurance card will be faxed to your home, office, car dealership, and other places you choose to receive it.

In addition, if you don’t have car insurance or show no proof of insurance, you might be faced with a penalty. As it’s illegal in every state in the United States, if you don’t have an auto insurance card and you drive a car or vehicle.

FAQ’s

What is the difference between proof of insurance and an insurance policy?

Proof of insurance is a document that summarises your active coverage, while an insurance policy is the comprehensive contract outlining the terms and conditions of your insurance.

How quickly can I get proof of insurance?

Online access is usually instant. Contacting your agent or company may take a few hours to a few business days, depending on the delivery method.

Can I use a digital copy of my proof of insurance?

Yes, in most cases, digital copies are accepted. However, it’s always best to check with the specific entity requesting the proof.

What information is included in a Certificate of Insurance (COI)?

A COI typically includes your name, insurance company’s name, policy number, coverage dates, types of coverage, and limits of liability.

How often should I update my proof of insurance?

You should update your proof of insurance whenever there are changes to your policy, such as renewals, changes in coverage, or address updates.

What should I do if I cannot find my proof of insurance?

Contact your insurance agent or company immediately. They can provide you with a new copy or guide you through the process of obtaining one.

Is an insurance card the same as proof of insurance?

Yes, an insurance card is a form of proof of insurance, especially for vehicles. However, sometimes a more detailed certificate is needed.

Can I get proof of insurance for a vehicle I just bought?

Yes. Once you purchase insurance for your newly acquired vehicle, your insurer can provide you with proof of insurance immediately, often digitally.