How do I get approved for Apple Credit Card? Are you interested in the Apple Card but unsure if you’ll qualify? This card offers potential benefits like cashback rewards and a sleek titanium design. In the following guide, we’ll walk you through the steps to take to increase your chances of getting approved for the Apple Card. We’ll cover the application requirements and what factors Goldman Sachs considers when reviewing applications. By understanding these aspects, you can position yourself for success and potentially be using your new Apple Card in no time.

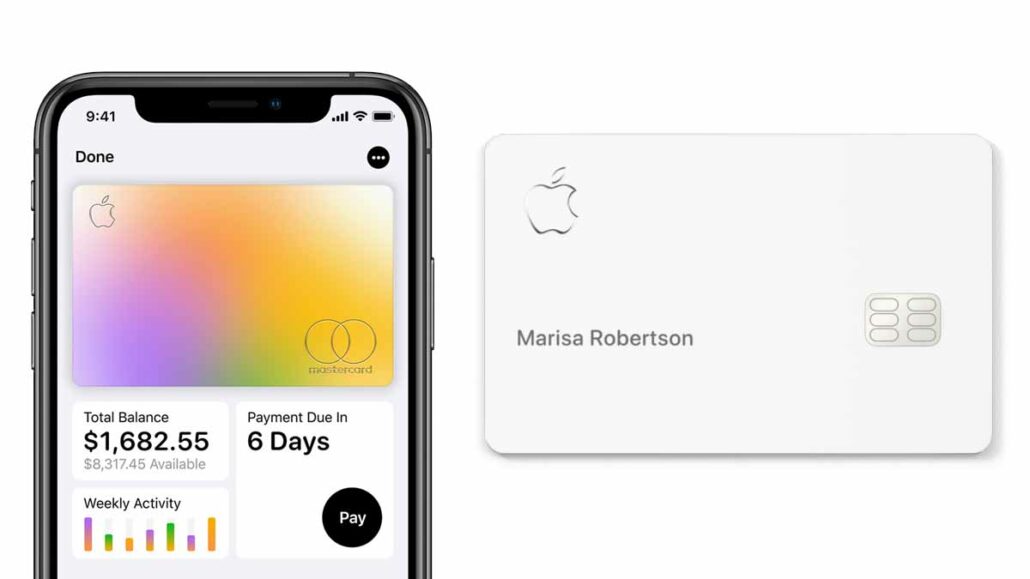

The Apple Card, issued by Goldman Sachs, has become a popular choice for Apple enthusiasts and those seeking a sleek credit card with potential rewards and benefits. However, securing an Apple Card requires meeting specific criteria and understanding the application process.

Apple Card Eligibility and Requirements

Before diving into the specifics of getting approved, let’s first establish if you’re eligible for the Apple Card. Here are the basic requirements:

- Age: You must be 18 or older (age requirement may vary depending on your location).

- Residence: Be a U.S. citizen or lawful permanent resident with a valid U.S. physical address (no P.O. boxes). Military addresses are also accepted.

- Technical Requirements: Your iPhone or other Apple device needs to be compatible with Apple Pay and have the latest software update.

- Apple ID: You’ll need to sign in to your Apple ID with two-factor authentication enabled.

- Credit Report: A temporary lift on any credit freezes may be required for application processing.

Secrets of Apple Card Approval

Unlike traditional credit card applications, Apple Card decisions are made by Goldman Sachs, Apple’s financial partner. Here’s what Goldman Sachs considers when reviewing your application:

Credit Score

This plays a significant role, with higher scores generally leading to better approval odds and credit limits. While the exact minimum score isn’t publicly disclosed, some users have been approved with scores in the good (670-739) range. Aiming for a very good (740-799) or excellent (800+) score will significantly improve your chances.

Credit Report

Beyond the score, Goldman Sachs will analyze your credit report for factors like payment history, credit utilization ratio (amount of credit used compared to total limit), and the types of credit accounts you hold. A history of on-time payments, a low credit utilization ratio, and a healthy mix of credit cards and loans will strengthen your application.

Income

Goldman Sachs will consider your income to assess your ability to repay the potential credit line offered.

Tips to Improve Your Chances of Getting Approved

- Check Your Credit Report and Score: Obtain a free copy of your credit report from AnnualCreditReport.com. Dispute any errors and focus on improving your score if needed.

- Reduce Your Credit Utilization Ratio: Aim for a utilization rate below 30%. Pay down existing credit card balances to demonstrate responsible credit management.

- Maintain a Healthy Payment History: On-time payments across all credit accounts significantly improve your creditworthiness.

- Limit Credit Inquiries: Applying for multiple credit cards in a short period can negatively impact your score.

Applying for the Apple Card

The application process is quick and convenient directly through your iPhone’s Wallet app. Here’s what to expect:

- Open the Wallet app and tap the “+” sign.

- Select “Apple Card” and tap “Continue.”

- Review the terms and conditions.

- Enter your personal information and income details.

Goldman Sachs will perform a soft credit check (doesn’t affect your score). You’ll receive an instant decision with your credit limit and APR offer.

Didn’t Get Approved? Don’t Despair!

If your application is rejected, Apple might offer you the opportunity to enroll in the “Path to Apple Card” program. This program provides personalized steps to improve your creditworthiness and reapply within 14 days.

Additional Considerations:

- Pre-Qualification: Apple Card doesn’t offer pre-qualification, but the soft credit check during application has minimal impact on your score.

- Building Credit with Apple Card: Responsible Apple Card use can positively impact your credit score due to on-time payments and a healthy credit utilization ratio.

By following these steps and optimizing your credit health, you’ll be well on your way to securing the Apple Card and unlocking its benefits.

Maintaining Your Apple Card

Once approved, responsible credit card use is key. Make your payments on time and in full to maintain a good standing with Apple Card and continue building your credit score. Take advantage of Apple Card’s features like spending tracking and interest-free financing to maximize the benefits of your card.

Frequently Asked Questions (FAQs):

Does applying for an Apple Card affect my credit score?

A soft inquiry is performed initially, which has no impact on your score. However, if you’re approved and accept the offer, a hard inquiry will be made, which may slightly lower your score temporarily.

What are the benefits of the Apple Card?

The Apple Card offers potential daily cash-back rewards, a user-friendly interface for managing your finances, and a unique titanium card option.

What if I don’t get approved for the Apple Card?

You can review Goldman Sachs’ decision and potentially reapply after improving your creditworthiness.

Are there any alternatives to the Apple Card?

Several other credit cards offer similar rewards programs and benefits. Consider exploring options based on your spending habits and financial goals.

Conclusion

Getting approved for the Apple Card requires a combination of a good credit score, responsible financial management, and meeting eligibility criteria. By following the steps outlined in this guide, you can increase your chances of securing this coveted card and unlocking its benefits. Remember, building good credit takes time and consistent effort. Start today and pave the way for Apple Card approval in the future.