Is GEICO home insurance good or how can I get a GEICO home insurance quote? When people are looking for a home insurance policy that best suits their preferences. They decide to find the cheapest home insurance. However, GEICO not only offers you the cheapest home insurance but also a great insurance policy that suits your budget.

Property insurance is a particular kind of insurance policy that offers members insurance coverage on property owners and renters. Some examples include homeowners insurance, renter insurance, landlord insurance, and more.

GEICO Home Insurance which is different from GEICO Renters Insurance provides insurance coverage for unexpected events. Based on the fact that once the home is regarded as one of their significant investment. Therefore, the need to protect your home from unexcepted or unforeseen events like fire, wind, or water damage is required.

However, GEICO Insurance Agency offers the best home insurance coverage or home insurance policy to help in protecting your property. The interesting aspect about this includes the combination of home and auto insurance allows you to save time and money.

Existing members outside home insurance wanting to join the platform enjoy better offers and savings on getting a quote while switching to get a homeowner insurance quote with GEICO.

What is GEICO Home Insurance?

GEICO. It’s known to be one of the biggest and most well-known insurance companies in the United States. The advantage of some homeowners insurance includes protecting you against financial losses that might arise due to unexpected events like fire, theft, or natural disasters. Having GEICO homeowners insurance is an advantage for your home and finances knowing that your home and possessions are safe.

Why GEICO’s Home Insurance Coverage is Perfect for First-Time Homebuyers

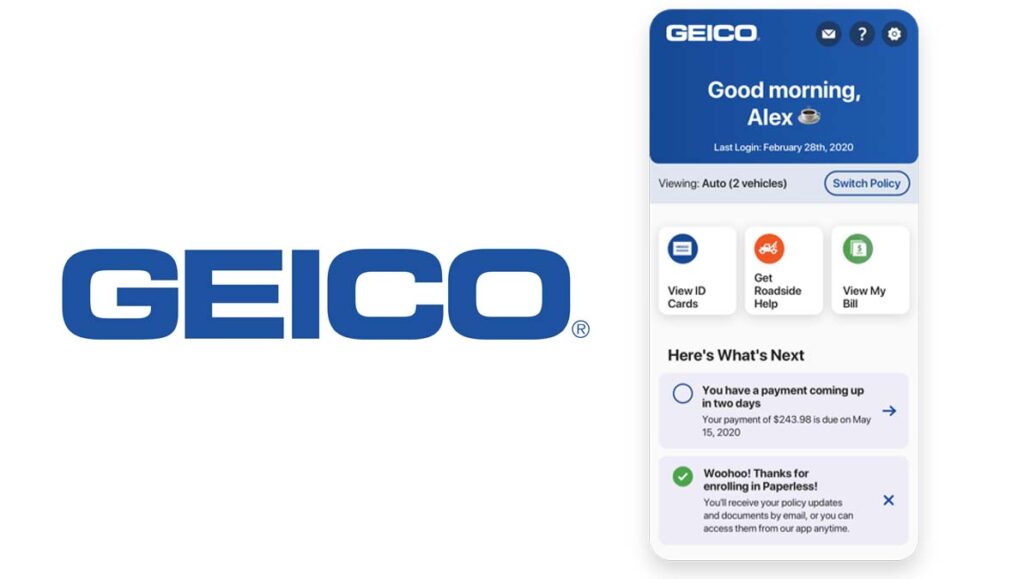

Initially, as a first-time buyer, buying a home can be a daunting experience, and one of the most advantageous decisions one can make is choosing the right home insurance coverage to protect your investment. There are a variety of options that offer the same coverage, but GEICO home insurance coverage is exceptional to other providers as the best choice for first-time homebuyers. What makes GEICO an excellent choice from other providers is its commitment to making insurance processes simple and stress-free. Plus, it provides a user-friendly website, 24/7 customer support, convenient coverage, and more.

Who do I require GEICO Home Insurance?

There are so many reasons why you need homeowners insurance. Actually, homeowner insurance helps in protecting one of your most valuable assets. Also, when applying for mortgage loans most lenders request homeowner insurance. Above all, there are so many GEICO home insurance coverages offered to members.

Coverage Options

There are lots of coverage options offered by GEICO to protect your home. Now, you can discover the comprehensive coverage option that GEICO has to offer to help protect your home and valuable investment. here are the following coverage options

Dwelling Coverage

This coverage helps to safeguard the physical structure of your home from unforeseen damage caused by covered perils. Protection includes walls, roofs, and other structures attached to your home.

Personal Property Coverage

This also provides you with coverage on property stolen or damaged which includes furniture, appliances, clothing, and also dishes. With the help of the personal property insurance calculator, you can estimate the cost of coverage that suits your situation.

Liability coverage

This coverage helps to provide you from financial loss if someone is injured on your property or if you destroy another person’s property by accident. It covers legal expenses and medical bills.

Jewelry

Limited coverage for jewelry that was stolen from your own worth $500 – $2,000 is offered to members. This includes jewelry like engagement rings, diamond bracelets, and wedding bands.

Additional living expenses coverage

If the living condition of your home becomes uninhabitable as a result of a covered loss, this coverage got you covered in covering the cost of temporary living arrangements like a hotel or rental properties, until your home is fully repaired.

In addition, the GEICO homeowners insurance also covers personal liability, medical bills, and also additional expenses.

Benefits of GEICO Home Insurance

There are lots of amazing benefits to choosing GEICO home insurance. This includes the following:

- Financial Protection: It offers policyholders financial protection from unforeseen events giving them peace of mind that they don’t have to worry about any cost of repair or other expenses in case of a covered loss.

- Quick and easy claims process: GEICO offers a quick and easy claims process which make it convenient for policyholders to report and resolve claim easily. You can use the online platform to file a claim or track its progress.

- 24/7 customer support: One of the advantages GEICO has over other homeowner providers is its 24/7 customer support. In ensuring a suitable and more convenient way policyholders can stand above is to provide 24/7 customer support where you can reach out for assistance at any time.

Bundle and save: save more money with an amazing bundle with other insurance policies such as auto insurance, and many others.

Discounts and Savings

Do you know that you save more money with the GEICO home insurance discount? Here are some of the options to save big:

- Bundle discount: save up to 24% on your home insurance premium when you purchase both a home and auto insurance policy.

- Safety device discount: save up to 15% on your home insurance premium when you have smoke detectors, burglar alarms, and also a security system installed in your home.

- Ne home discount: Quality for a discount on your home insurance premium when you recently built or renovate your home.

- Military discount: quality for a discount on your home insurance premium when you are in active duty or a retired member of the military.

Pros and Cons

Before deciding on choosing GEICO home insurance, you need to consider the following pros and cons:

Pros:

- Trusted and reputable insurance provider

- Wide range of coverage options

- Competitive Pricing

- Convenient claims process

- Excellent customer satisfaction ratings

Cons

- Limited availability in certain regions

- Some additional features may require an extra cost

How to get a quote for GEICO’s home insurance coverage

Getting GEICO home insurance coverage is easy and can be done either on the phone or online. To get a quote online, you can simply visit the website and enter your zip code and enter some of your personal information about your home and personal belongings.

Frequently Asked Questions (FAQ)

Why is home insurance important for first-time homebuyers?

Home insurance protects your investment against financial losses from unexpected events like fire, theft, or natural disasters. It also provides liability coverage if someone is injured on your property.

What factors affect GEICO’s home insurance rates?

Factors include your home’s location, age, construction materials, coverage limits, and deductible. Your credit score and claims history can also play a role.

Can I bundle my home and auto insurance with GEICO?

Yes, GEICO offers bundling discounts, which can significantly reduce your overall insurance costs.

What is dwelling coverage, and why is it important?

Dwelling coverage protects the physical structure of your home, including the walls, roof, and foundation. It’s essential for rebuilding your home if it’s damaged or destroyed.

Does GEICO offer coverage for personal property?

Yes, GEICO’s home insurance policies include personal property coverage, which protects your belongings inside your home.

How do I file a home insurance claim with GEICO?

You can file a claim online, through the GEICO mobile app, or by calling their customer service line.

How can I save money on GEICO’s home insurance?

You can save money by bundling policies, increasing your deductible, installing safety features, and maintaining a good credit score.

Does GEICO offer discounts for new homebuyers?

GEICO offers various discounts, including discounts for bundling, and for safety devices. It is always best to speak with a Geico representative to understand all available discounts.

Conclusion

For first-time homebuyers, GEICO’s home insurance offers a compelling combination of affordability, comprehensive coverage, and user-friendly resources. By simplifying the insurance process and providing clear guidance, GEICO empowers new homeowners to protect their investment with confidence.