eLoanWarehouse is a lender offering installment loans as an alternative to payday loans. They advertise loans up to $3,000 which can be deposited into your account as soon as the next business day. They also cater to borrowers with bad credit, stating that they have few qualifications for approval on their website.

However, it’s important to be aware of some key details before considering a loan with eLoanWarehouse. They are a tribally owned business, which means they operate under tribal law and may not be subject to the same regulations as other lenders. It’s crucial to carefully review the loan terms before agreeing to anything to ensure you understand the full cost of the loan.

What is eLoanWarehouse?

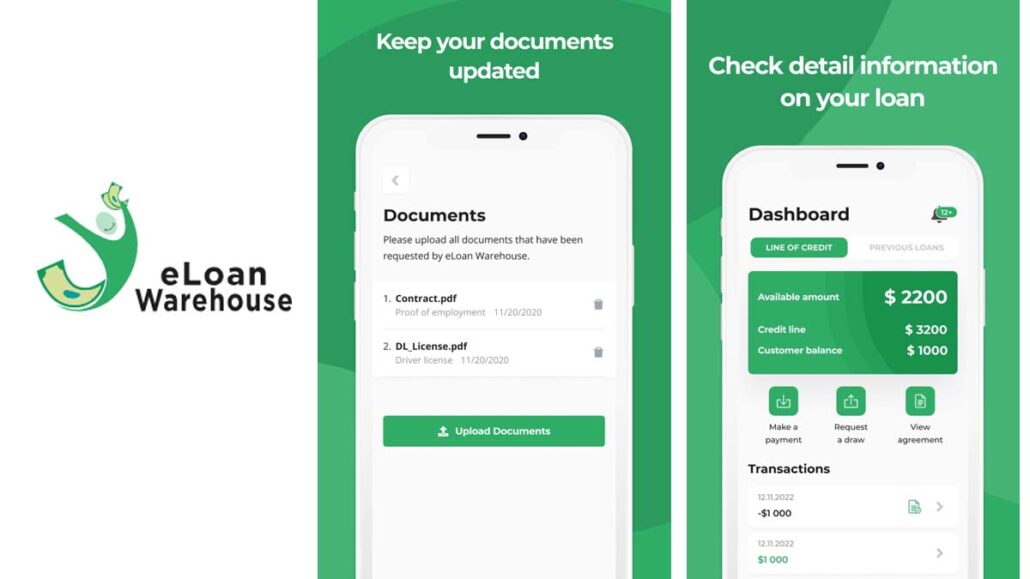

eLoanWarehouse is a cloud-based loan origination system (LOS) that empowers lenders and brokers with a centralized platform to manage the mortgage lending process. From loan application to closing, it offers a suite of tools and functionalities to automate tasks, improve communication, and ensure a faster turnaround time.

Understanding Your Mortgage Options

First-Time Homebuyer Loans

eLoanWarehouse understands the unique challenges faced by first-time buyers. They offer programs with lower down payment requirements and flexible options to help you achieve your dream of homeownership.

Refinancing

Considering lowering your interest rate or accessing home equity? It can guide you through the refinance process and help you find the best possible terms for your situation.

Conventional Loans

These are some of the most common mortgage options, and eLoan Warehouse offers competitive rates and flexible terms for conventional loan products.

FHA Loans

The Federal Housing Administration (FHA) offers government-backed loans with lower down payment requirements. eLoanWarehouse can help you determine if an FHA loan is the right choice for you.

VA Loans

Veterans and active-duty service members may qualify for special benefits, including zero down payment mortgages, through the Department of Veterans Affairs (VA). It can assist veterans in navigating the VA loan process.

USDA Loans

The United States Department of Agriculture (USDA) offers rural development loans for qualified borrowers in eligible areas. It can help you determine if a USDA loan is a good fit for your needs.

Jumbo Loans

For borrowers requiring financing above conventional loan limits, it offers jumbo loan options with competitive rates and personalized service.

Benefits of eLoanWarehouse

- Enhanced Efficiency: Automate manual tasks, streamline workflows, and eliminate data silos with eLoanWarehouse’s robust automation features.

- Improved Transparency: Provide borrowers with a real-time view of their loan status and facilitate clear communication throughout the process.

- Reduced Costs: Minimize errors and rework with automated processes, leading to significant cost savings.

- Faster Turnarounds: Process loans faster with efficient workflows and quick access to critical documents.

- Increased Compliance: Ensure adherence to ever-changing regulations with eLoanWarehouse’s built-in compliance tools.

- Improved Borrower Experience: Provide borrowers with a user-friendly online portal to track their loan progress and submit documents electronically.

Who Should Use eLoanWarehouse?

eLoanWarehouse is a valuable tool for any lender that originates mortgages. However, it is particularly well-suited for lenders who are looking to:

- Increase their loan volume: it can help lenders close more loans by streamlining the lending process.

- Improve their profitability: Reducing costs and increasing efficiency, can help lenders improve their bottom line.

- Enhance their compliance: it can help lenders stay compliant with all applicable lending regulations.

Who can benefit from eLoan Warehouse?

- Mortgage Lenders: Enhance operational efficiency, reduce costs, and improve borrower satisfaction.

- Mortgage Brokers: Streamline loan processing, close deals faster, and provide a superior borrower experience.

- Loan Officers: Increase productivity, improve loan quality, and focus on building relationships with borrowers.

How eLoan Warehouse Simplifies Your Mortgage Journey

- Pre-Qualification: Get a free pre-qualification to understand your borrowing power and explore loan options.

- Loan Application: Complete the secure online application form, upload the necessary documents electronically.

- Underwriting: Experienced loan officers assess your financial profile and navigate the underwriting process efficiently.

- Closing: it guides you through the closing process, ensuring a smooth and successful transaction.

FAQs

What are the features of eLoanWarehouse?

eLoanWarehouse offers many features, including loan application processing, document management, underwriting tools, automated workflows, borrower portals, and compliance functionalities.

Is eLoanWarehouse easy to use?

Yes, eLoanWarehouse is designed with a user-friendly interface that is intuitive for lenders, brokers, and borrowers alike.

How secure is eLoanWarehouse?

eLoanWarehouse takes data security very seriously and employs industry-standard security measures to protect sensitive borrower information.

How much does eLoanWarehouse cost?

The cost of eLoanWarehouse may vary depending on the specific features and functionalities required. Contact eLoanWarehouse for a personalized quote.

Does eLoanWarehouse offer any training or support?

Yes, eLoanWarehouse offers a variety of training and support resources to help lenders get the most out of their platform.

How can I learn more about eLoanWarehouse?

You can learn more about eLoanWarehouse by visiting their website or contacting them directly.

Conclusion

eLoanWarehouse is a powerful tool that can revolutionize the way you approach mortgage lending. With its comprehensive features and commitment to efficiency, eLoanWarehouse can help you streamline your operations, improve borrower satisfaction, and gain a competitive edge in the mortgage industry.

Check Out