Whether you want to sign in CRA, sign into my CRA account, access revenue canada login my account. Or simply understand how the whole CRA portal works, this guide will make the entire process feel easy and natural.

I’ll walk you through registration, login options, GCKey, sign-in partners, CRA business accounts, CRA rep services, benefits, refunds, security, troubleshooting. And everything else you can do with your my account CRA sign in profile. My goal is to help you feel confident using your CRA tools so that you can manage your taxes, benefits, and financial life without stress.

Understanding What CRA My Account Really Is

If you’ve ever heard someone say “Just check it on your CRA My Account,” and you had no clue what they were talking about, trust me, you’re not alone. CRA My Account is really just your personal online dashboard for everything related to your taxes and benefits in Canada.

The system lets you manage almost every detail of your financial information with the government, from checking your refund status to updating your address, linking direct deposit, downloading tax slips, tracking credits, and a lot more. And you can do all of this through the cra.gc.ca my account section, which is the official website, not some random page pretending to be the CRA.

CRA My Account is like the digital version of having a personal file drawer at Revenue Canada, except you can open it anytime you want. Whether you need your Notice of Assessment, want to track your GST credit, or simply want to check if your tax return was received, the myaccount CRA portal brings everything to one place.

Also, it’s important to know the difference between the three main CRA platforms:

- CRA My Account — for individuals like you and me

- CRA My Business Account — for business owners (GST, payroll, corporate tax)

- CRA Represent a Client — for accountants, authorized reps, or family members

This article focuses mainly on the individual side, but I’ll also cover the business and rep components because many people get confused when they see all three options on the cra login services page.

Step-by-Step: How to Use CRA Login My Account Canada

Always check that the URL starts with https://www.canada.ca or https://www.cra.gc.ca before entering anything.

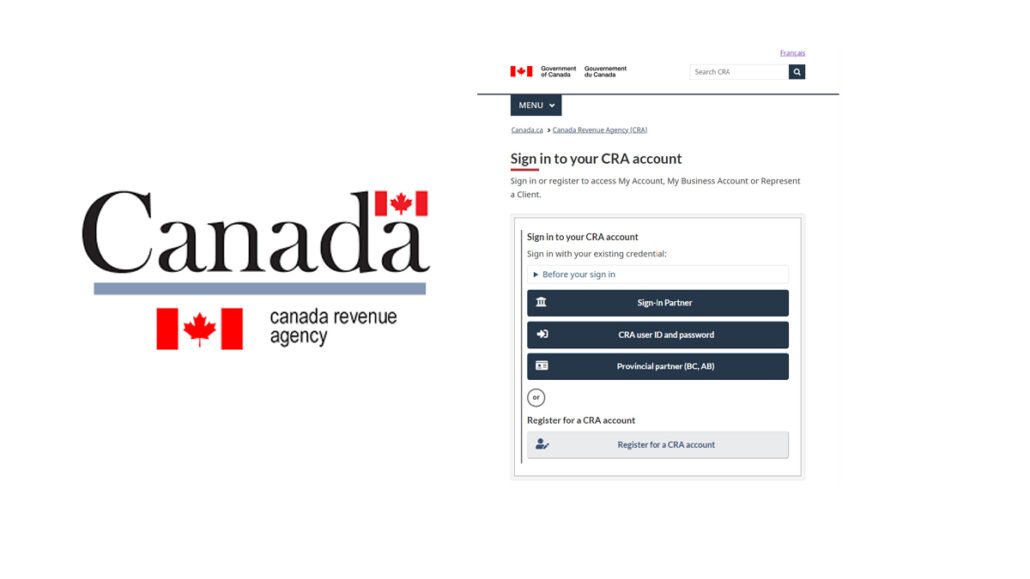

Here’s exactly how to sign in:

- Go to www.cra.gc.ca login or the official Canada.ca link.

- Click “CRA My Account” under personal taxes.

- Choose whether you want to sign in with GCKey or with your bank (Sign-In Partner).

- Enter your login credentials.

- Enter your second verification when prompted.

- Once inside, you’ll land on the main dashboard where all youry tax and benefit information is neatly displayed.

It honestly takes less than 10 seconds once you get the hang of it.

CRA Registration: How to Create Your Account

The key thing you need to remember is this: the CRA takes your security seriously, very seriously, so the registration flow might feel a bit stricter compared to creating a random app login. But once you’re past that first setup, using your cra my login becomes incredibly easy.

Here’s how I personally walk through the registration when helping family or friends set up their own cra my account for the first time. First, I go to the official canada.ca/my-cra-account page. I never search “CRA login” in Google because there are too many scam ads. I always type the URL myself or go through the official Canada.ca website. Once on the page, I click “CRA My Account” and then choose “CRA Register”.

The system gives you two options: registering with GCKey or registering with a Sign-In Partner (your bank login). If you go with GCKey, you simply create a username and password. If you choose your bank, you log in with your existing online banking credentials. Either way is fine, it just depends on what you prefer. Some people like GCKey because they want a login that’s completely separate from their bank. Others prefer Sign-In Partner because it’s fast and familiar.

After choosing your login method, CRA will ask for personal details like your SIN, birthday, postal code, and some info from your last tax return. This step is just to make sure that it’s really you signing up. Then they’ll mail you a security code. And yes, they literally mail it, like an old-fashioned envelope in your mailbox. It usually arrives within 3–10 business days depending on where you live.

Once you receive that code, you log back into myaccount CRA, enter it, and boom, you’re fully registered. From that point on, you can use login to CRA, access your tax records, track refunds, view benefits, update personal info, and much more. That little letter unlocks everything.

Sign In CRA Using a Sign-In Partner (Bank Login)

Now let me talk about the Sign-In Partner option, because honestly, this is the login method most people I know prefer. It’s fast, familiar, and you don’t need to remember another password. Signing in CRA with a bank login means you use your existing online banking username and password to access your CRA account. You’re not giving your bank access to your CRA info, and you’re not giving CRA access to your bank account. They simply share a secure login system.

When you go to the official cra login services page, you’ll see banks like TD, RBC, Scotiabank, CIBC, BMO, Desjardins, and others available as login providers. Once you click on your bank logo, you simply sign in with your regular banking details. After that, CRA will still verify you through its own security steps, but you don’t have to create or remember a CRA-specific password.

A lot of people ask me whether this is safe. And I totally understand the concern because anything involving your bank can feel risky. But yes, it’s safe. CRA and Canadian banks use a system called SecureKey, which is basically a locked bridge between the two systems. Neither side sees your private data from the other. All that’s shared is authentication, that you are who you say you are.

This login method is also incredibly reliable during peak tax season when everyone is trying to sign in CRA account and some login paths slow down. Bank logins usually stay strong under heavy traffic, making them a comfortable backup if GCKey ever gives you trouble.

If you want convenience, speed, and simplicity, using your bank login might be the perfect way to access your cra my account log in.

CRA My Account Login for Individuals – What I Can Do Inside

Once you finally sign into my CRA account, a whole world of tools opens up, tools that honestly make managing your taxes and benefits a hundred times easier.

Inside your CRA individual login, the dashboard is designed to be user-friendly, even if you’re not tech-savvy. The very first thing I always notice is the clean layout. There are tabs and sections for everything, tax returns, benefits, mail, RRSP room, TFSA room, payments, account balances, and more. If you’re like me and want to know where your refund is, you can click the “Tax Returns” section and instantly check your return status. No more guessing. No more calling Revenue Canada and waiting on hold.

One of my favorite features is the “View Mail” section. Instead of receiving thick envelopes in the mailbox, I get everything digitally, reassessments, notices, reminders, T1 adjustments, and more. You never lose anything because it stays in your CRA portal. If you’ve ever misplaced an important letter from the CRA (like I used to), this feature alone feels like a lifesaver.

And if you receive government benefits, like the GST/HST credit, Climate Action Incentive, or Canada Child Benefit, the CRA portal lets you track payment dates and amounts effortlessly. Everything is transparent. You don’t have to wonder whether a payment is coming or if something went wrong.

CRA Business Account: If You Run a Business

If you’ve ever tried managing a business tax account, you know how overwhelming it can feel. Between payroll, GST/HST, corporate taxes, and remittances, it’s easy to lose track. That’s where the CRA business account, also known as My Business Account, comes into play. And believe me, if you run a business, even a small home-based one, you’ll want to set this up right away.

Inside your my business account CRA portal, you can manage everything from:

- GST/HST filings

- Payroll deductions

- Corporate income tax

- Refunds and balances

- Installments

- T2 returns

- ROE Web login connections

- Business mail and correspondence

The dashboard feels a little more complex than the personal CRA account because businesses deal with more moving parts, but it’s still user-friendly. You can file returns, view balances, pay amounts owing, check payroll summaries, or authorize a representative using the CRA rep a client system.

If you run a business, I strongly recommend setting up both your personal my account CRA login and your business account. CRA makes it easy to link the two so you can switch between them without logging out. It feels seamless, and it saves so much time.

Plus, business owners often get audited more frequently, so being organized in your CRA portal gives you peace of mind. Everything is documented, timestamped, and accessible anytime.

CRA Rep a Client / Represent a Client

If you’ve ever needed someone, like your accountant, bookkeeper, spouse, or even adult child, to handle your CRA information, then you’ve probably heard of the CRA Represent a Client service. This tool is one of the most helpful features CRA has ever created because it allows authorized people to access your account securely without breaking any rules.

This service is perfect for:

- Accountants handling multiple clients

- Business owners delegating payroll or GST tasks

- Elderly relatives needing help

- Spouses assisting each other

- Bookkeepers managing business filings

The process is simple:

You request authorization through the CRA portal, and the client approves it through their my CRA account login. Once approved, you can switch between your own CRA portal and your client list using the same login. It’s incredibly convenient and eliminates the need to juggle different accounts or passwords.

This system also keeps things transparent. CRA logs every action, and the account holder can see which representative accessed their data and when. For privacy and accountability, this is amazing.

Whether you’re an accountant filing dozens of T1s or a family member lending a hand, the Rep a Client system is one of the strongest features in the entire CRA ecosystem.

CRA Epass, CRA Portal & Older Systems

If you’ve been in Canada long enough, you probably remember something called CRA ePass. Logging in required extra steps, long passwords, and a system that felt a bit outdated even at the time. Eventually, CRA retired ePass because technology changed and people needed a more modern, user-friendly login experience.

Today, everything has transitioned into the more secure and polished CRA portal, which includes options like GCKey, Sign-In Partner, and multi-factor authentication. These upgrades weren’t just cosmetic, they were essential. With cyber threats increasing worldwide, CRA had to build a login system strong enough to protect millions of Canadians’ personal information, tax returns, direct deposit details, and benefits. The move from ePass to today’s login system was a massive improvement in both security and usability.

Another big improvement over the old ePass era is the layout of the CRA portal itself. Years ago, navigating your CRA account felt like clicking through a maze. Now, everything is cleanly organized into sections: tax returns, benefits, mail, balances, slips, and more. You don’t have to hunt for information anymore, it’s placed clearly on your dashboard.

Even though ePass is gone, the CRA continues to update the portal and security tools. They add features regularly, like email notifications, account alerts, and mandatory two-step verification. These changes show that the CRA is committed to giving Canadians safe, digital access to their tax and benefit information without the headaches of older systems.

Troubleshooting: CRA Login Not Working

If you’ve ever tried to sign in CRA account and ran into issues, don’t worry, you’re not alone. I can’t tell you how many times I’ve been locked out, forgotten a password, or had the system unexpectedly kick me out during tax season. The CRA login can be tricky sometimes, especially when millions of people across Canada try to log in at the same time to file taxes or check refunds.

One of the most common problems I see is account lockouts. This usually happens when you enter the wrong password too many times or answer your security questions incorrectly. If you’re using GCKey, you can reset your password pretty easily, but if you’re using a Sign-In Partner, you may need to fix your bank login first. Whenever this happens to me, I take a deep breath, reset what I need to, and try again carefully. It’s annoying, sure, but it’s also part of keeping your account safe.

Another issue is the missing CRA security code. This is especially common for new users. If you forget to enter the code within the designated timeframe or misplace the letter, you can request a new one through the my CRA sign in page. It takes a few more days, but it’s worth it to get your account working properly.

Sometimes the problem isn’t the CRA at all, it’s your browser. I once spent 20 minutes thinking the CRA was down, only to realize my browser had outdated cookies blocking the login. Clearing the cache, switching browsers, or using incognito mode fixes this almost every time. CRA even recommends using modern browsers like Chrome, Firefox, Edge, or Safari for the best experience.

Lastly, always double-check that you’re on the real CRA website. Fake pages look shockingly similar and can lead to phishing scams. The safest trick I use is typing the URL manually or bookmarking the official canada.ca login page.

Whenever something goes wrong, remember this: CRA login issues are normal and usually easy to fix with patience and a few simple steps.

CRA My Account Login Canada for Benefits & Credits

If you receive any type of government benefit in Canada, then your cra my account login Canada is one of the best tools you can use to keep track of everything. I rely on it all the time to check payment dates, confirm amounts, view past deposits, and make sure nothing looks off. The CRA handles a lot more benefits than people realize, and having one place to see it all makes life much easier.

For example, your GST/HST credit payments show up clearly in your CRA portal. You can see the exact date the next one will be deposited into your account, how much you’re getting, and whether any adjustments were made.

If you receive the Canada Child Benefit (CCB), CRA My Account becomes even more valuable. You can track how much you’ll get each month, see your past payment history, update your marital status, and even recalculate your expected payments.

Another important thing you can track is the Climate Action Incentive. Whether you file individually or as a family, the CRA posts your payment details, eligibility, and history. Before CRA digital systems improved, tracking these payments meant digging through paperwork. Now, it’s all inside your dashboard under “Benefits.”

Having your benefits and credits visible in one place helps you stay informed, plan ahead, and avoid worrying about whether something got delayed or lost.

CRA My Account Login for Tax Filing & Refund Tracking

This is honestly my favorite part of the whole cra login my account for individuals system, being able to track my refund and manage my tax returns without stress. Before I had access to my CRA portal, I never knew what was happening after I filed my taxes. I would just wait, guessing when my refund would arrive. Now, with just a few clicks inside my my account CRA, I can see every step of the process.

The first thing I always check during tax season is the “Tax Returns” section. It shows whether CRA has received my return, whether they’re processing it, and how long they expect it to take. If they need more information from me, it shows up right there. And once they finish assessing it, I can read my entire Notice of Assessment online, no waiting for mail.

One feature I absolutely love is the Auto-Fill My Return service. When I file online using tax software, CRA automatically sends all my T4s, RRSP receipts, tax slips, and other information directly into the software. I don’t have to type in everything manually. It saves so much time and reduces the risk of mistakes.

Tracking refunds is also super easy. Inside my account, I can see the exact date my refund was deposited or mailed. If there’s a delay, the system explains why. And if CRA adjusted something, like correcting an RRSP deduction or updating a slip, they show it clearly in the reassessment section.

Direct deposit can also be set up right inside the portal. I love this because once you link your bank account securely in your CRA login, you don’t have to think about it again. Refunds, GST credits, CCB payments, all of it comes automatically.

If you file taxes late, or if you’re self-employed and need to track installment payments, everything is visible in your account. You can even print your tax slips if you lost them.

For anyone who wants to stay on top of their taxes, CRA My Account is hands-down one of the most powerful tools available.

CRA My Account Sign In on Mobile

If you’re anything like me, you probably use your phone for almost everything, banking, paying bills, email, shopping, and so on. So it makes sense that you’d also want to use your phone to sign in CRA account and check your tax or benefit information. The good news is that CRA has made the mobile experience surprisingly smooth, even without a dedicated CRA mobile app.

The CRA website is fully mobile-responsive, meaning it adjusts automatically to fit your screen. Whether you’re using an iPhone or Android, the cra my account log in works almost the same as it does on a computer. The buttons resize, the text is readable, and the menus are easy to tap.

Overall, the mobile CRA experience is incredibly convenient, and honestly, I use it more than the desktop version now. It’s perfect for quick checks, updates, and staying on top of your taxes anywhere you go.

Keeping Track of Notices & Mail in CRA Portal

One of the features that made me fall in love with the cra myaccount portal is the digital mail section.

Whenever CRA sends you something, whether it’s a Notice of Assessment, a Reassessment, a benefit update, a verification request, or a tax slip, it appears instantly in your online mailbox. The very moment I sign in CRA, I can tell right away if there’s new mail waiting for me because there’s a notification at the top of the dashboard.

Plus, CRA keeps all your digital mail for years. Even if you delete an email or lose a physical letter, the portal stores everything safely.

The digital mail system is also a huge help in catching important updates. Sometimes CRA sends out requests for more information or alerts about changes to your tax return. If you don’t see these messages, you can miss deadlines or delay your refund. But when you use the cra login my account Canada portal regularly, you’re always up to date.

If you receive benefits like GST or CCB, the CRA mail centre also gives you notices explaining changes, recalculations, future payments, and eligibility. This transparency makes a huge difference in understanding exactly what’s happening with your benefits.

Honestly, digital mail alone is a reason I recommend everyone activate their my CRA account. It keeps you informed, organized, and in control of all your tax-related communication, without drowning in paper.

FAQs

How do I log in to my CRA account?

To log in, visit the official Canada.ca CRA page, select “CRA My Account,” and choose either GCKey or Sign-In Partner. Then enter your credentials, complete the verification step, and access your dashboard.

How do I sign in using a CRA sign-in partner?

From the CRA login page, select “Sign-In Partner,” choose your bank, and log in with your usual banking credentials. CRA will confirm your identity using its own security steps afterward.

What can I do with a CRA My Account?

Inside your portal, you can track refunds, view tax slips, update personal details, check benefits, set up direct deposit, download notices, manage installments, and view all your tax-related information.

What is the CRA My Account portal?

It’s a secure online dashboard where individuals can access and manage their personal tax and benefit information directly with the Canada Revenue Agency.

Why is my CRA login not working sometimes?

Common issues include wrong passwords, expired security codes, high website traffic, browser problems, or using old bookmarks. Resetting your password, clearing your cache, or visiting the correct Canada.ca link usually fixes it.

Conclusion

Whether you’re trying to access your refunds, check GST payments, update personal information, or manage a business account, CRA My Account gives you the tools to stay informed and confident.

This guide walked through everything, from GCKey and Sign-In Partners to benefits, troubleshooting, mobile access, business accounts, security tips, and the difference between CRA and Canada.ca logins. My hope is that now you not only understand how to use your CRA account but also feel empowered to take control of your financial information.

If you haven’t registered yet, or if you’ve been hesitant to explore the portal, now is the time. Once you begin using it regularly, you’ll wonder how you ever managed without it.