If you’ve ever tried to log in to your Clark County Credit Union account, you might know that the process is fairly simple once you know where to go and what to do. In this guide, I’ll walk you through everything from setting up your Clark County Credit Union login for the first time to accessing your account on the mobile app. Whether you’re new to CCCU or just need a refresher, I’ve got your back.

- Mainstreet Credit Union Login – How to Access Your Account Securely

- Charter Oak Federal Credit Union Login – Secure Access

- Credit Union for Mortgage – Get Preapproved for a Home Loan

- Credit Union For Car Loan – Apply for a Credit Union Car Loan

- Eastman Credit Union Near Me – Find Eastman Credit Union Branch & ATM Locations

- Lake Michigan Credit Union Near Me – Find LMCU Branches & ATMs Location

What Is Clark County Credit Union (CCCU)?

Clark County Credit Union, or CCCU as most of us call it, has been around since 1951. It was created to serve employees of Clark County, Nevada but over the years, it has grown and opened up its membership to other groups as well. What makes it stand out from typical banks is that CCCU is a member-owned, not-for-profit financial institution. That means any profits they make go right back into the credit union and its members yep, that includes you and me.

With a strong local presence in Las Vegas and the surrounding areas, CCCU has built a reputation for providing personalized service, lower loan rates, and fewer fees compared to traditional banks. You’re not just a customer, you’re a part-owner of the place. That’s why they’re so invested in providing us with easy, secure, and modern banking options.

Who They Serve – Geography and Membership

Originally, CCCU was only for Clark County employees. But now? Their arms are open to a much broader audience. If you live, work, worship, or go to school in certain parts of Nevada especially in and around Las Vegas you likely qualify to join. CCCU also serves employees from many government agencies and partner organizations.

So if you’re wondering whether you can join, chances are you can. And once you do? You’ll get access to their full range of digital banking services, including the super handy Clark County Credit Union login portal.

Why You’d Want to Use CCCU Online Banking

Let’s be real, we all live on our phones and computers now. Running into a branch every time you want to check your balance or transfer funds? Nobody has time for that. That’s where CCCU’s online banking comes into play.

Convenience – Anytime, Anywhere

One of the best things about having a Clark County Credit Union login is that it gives you 24/7 access to your money. Whether you’re at home in your PJs or halfway across the country, as long as you’ve got an internet connection, your accounts are right there with you.

You don’t need to check business hours, stand in line, or wait on hold. Just log in, tap a few buttons, and boom, you’re good to go.

Access to Account Details – Balance, Statements

I personally love being able to pull up my account and see exactly how much money I have. CCCU’s platform lets you check your account balance in real-time, review past transactions, and even download statements for tax season or budgeting. No guesswork, no surprises.

They also show pending transactions, so if you just swiped your debit card, you’ll know immediately whether it went through. That transparency is key to staying on top of your finances.

Simplified Transactions – Transfers, Bill Pay, Deposits

Need to move money between accounts? Pay your electric bill? Maybe even deposit a check without leaving the couch? You can do all that (and more) through CCCU’s online and mobile banking.

I can’t tell you how many times I’ve been thankful for being able to transfer money from my savings to checking at 11 p.m. on a Saturday. It’s seamless, fast, and secure. Bill Pay is another lifesaver, you just set up your payees once, and then it’s just a matter of a few clicks to pay your utilities, rent, or credit card.

Mobile check deposits? Yep, they’ve got that too. Just snap a picture of your check through the app, and it’s in your account. No lines, no fuss.

Setting Up Your Clark County Credit Union Login

Ready to get your login credentials? Here’s how I did it and how you can too.

Pre-Requisites – Eligibility, Membership, Account Number

Before you can log in, you’ll need to be a member of Clark County Credit Union. That means filling out an application, being approved, and having an account set up. You’ll also need:

- Your CCCU account number

- Your personal details (name, date of birth, etc.)

- An email address that CCCU has on file

- Your Social Security Number (last four digits)

- These are used to verify your identity during the setup process.

Step-by-Step: Registering for Online Banking

Here’s a simple step-by-step guide to get your Clark County Credit Union login set up for the first time:

- Visit the CCCU website: Go to www.ccculv.org.

- Click on “Login” at the top right corner of the homepage.

- You’ll see an option that says “First time user? Register here.” Click that.

- Enter your member information, including your account number and last four digits of your SSN.

- Create your username and password.

- Set up security questions for added protection.

- Confirm your email and phone number.

- Accept the terms and conditions.

Once all that’s done, you’re ready to log in!

Tips for Strong Password and Secure Login

Your password is your first line of defense don’t make it easy to guess. I like to use a mix of letters (both upper and lower case), numbers, and symbols. Avoid obvious stuff like your name or birthday.

Also, don’t forget to enable two-factor authentication (2FA) if CCCU offers it—it’s another layer of protection in case someone tries to access your account.

How to Log In to CCCU – Desktop / Web Portal

Once you’ve got your credentials set up, logging in is a piece of cake.

Navigating to the Login Page

Just head back over to www.ccculv.org and click on the “Login” button. This will take you to a secure page where you can input your details.

What Fields You Need to Enter

Here’s what they’ll ask for:

- Username

- Password

If it’s your first time logging in, they might ask you to verify your identity using a code sent to your email or phone.

What Happens If You Enter Wrong Credentials

Let’s say you forget your password it happens to the best of us. Don’t worry; there’s a “Forgot Password?” link right there on the login page. Click it, enter your info, and follow the prompts to reset your password.

Just don’t try too many wrong attempts in a row they might lock your account temporarily for security reasons. If that happens, you’ll need to contact CCCU directly to get it unlocked.

How to Log In via the CCCU Mobile App

Logging in on your phone is just as easy if not easier than on a computer. And yes, the Clark County Credit Union mobile banking app is available for both Android and iOS devices.

Downloading the Official App

You’ll want to make sure you download the official app not a third-party one. Here’s where to find it:

- iPhone Users: Search for “Clark County Credit Union” in the App Store.

- Android Users: Head to Google Play Store and do the same.

The app is free and regularly updated, which is a good sign in terms of security and functionality.

Logging In on iOS and Android

Once the app is installed, open it up and:

- Enter your username and password

- Tap Login

- If it’s your first time, you might need to answer a security question or enter a verification code

After that, you’re in! The app layout is super user-friendly, even if you’re not tech-savvy.

Using Biometric Login (Face ID / Fingerprint)

Want to make things even quicker? You can enable Face ID or Fingerprint Login if your phone supports it. Just go to the app settings and toggle it on. This way, every time you open the app, you can log in instantly with just your face or thumb.

Troubleshooting Common Login Issues

Even with a solid setup, we all run into tech hiccups now and then. Here’s what you can do if your Clark County Credit Union login isn’t cooperating.

Incorrect Username or Password

This is hands-down the most common issue I’ve faced. If you get an error saying your credentials are wrong, don’t panic.

- Double-check for typos – especially on mobile keyboards.

- Make sure CAPS LOCK isn’t on (yes, this one gets me a lot).

- Click “Forgot Password?” to reset it if needed.

- If you can’t remember your username, there’s a “Forgot Username?” link as well.

Sometimes, just closing the browser or app and reopening it solves the issue. It sounds silly, but it works.

Locked Account

If you try the wrong credentials too many times, CCCU might lock your account for security reasons. It’s a safety feature, but it can be frustrating.

Here’s what to do:

- Call CCCU’s customer service (more on that below).

- Verify your identity.

- Ask them to unlock your account or reset your login details.

The good news? Their support staff is really helpful and friendly.

Mobile App Glitches

If the app keeps crashing or freezing:

- Try updating it from the App Store or Google Play.

- Restart your phone.

- Clear your app cache (this option is usually in your phone’s settings).

- Reinstall the app if nothing else works.

Most of the time, these small fixes solve 90% of the issues.

Features Available After Clark County Credit Union Login

Once you’re in, a whole digital banking world opens up. CCCU makes sure you have control of your finances right at your fingertips.

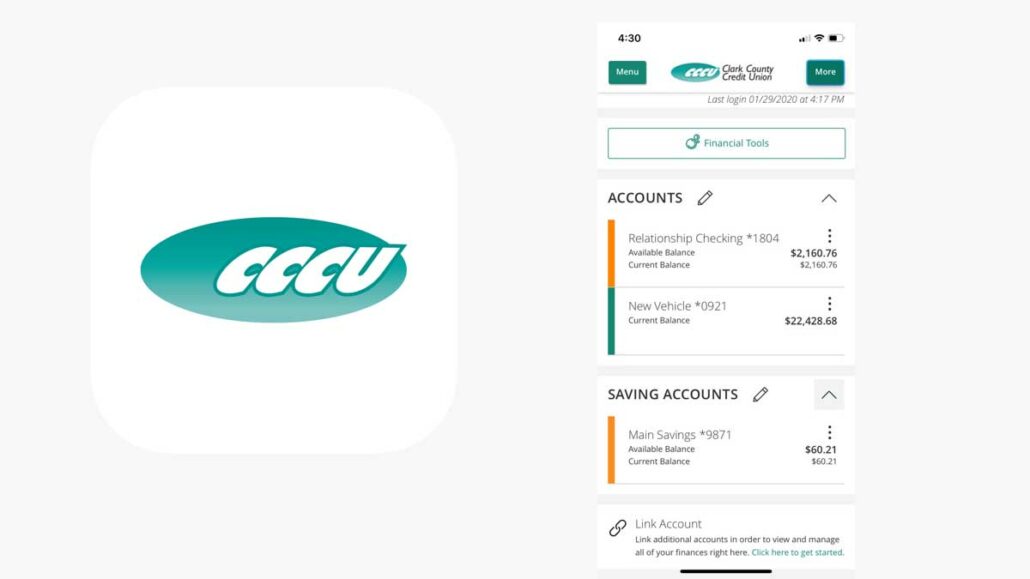

Account Overview Dashboard

The first thing you’ll see is a clean dashboard. It’s like a financial command center. I love how it shows all my accounts checking, savings, loans, credit cards on one screen.

You can:

- View balances in real-time

- See pending and posted transactions

- Customize how your dashboard looks

It’s designed to give you a bird’s-eye view of your money in one glance.

Money Transfers and Payments

You can transfer money:

- Between CCCU accounts

- To external bank accounts

- To other CCCU members

Plus, the Bill Pay feature lets you:

- Schedule one-time or recurring payments

- Set reminders

- Track payment history

No more writing checks or worrying about missing due dates.

Mobile Check Deposit

Using your phone’s camera, you can deposit checks into your account without visiting a branch. Just sign the back, snap a photo through the app, and you’re done. The funds usually show up quickly—often the next business day.

Loan and Credit Card Management

If you have a CCCU auto loan, credit card, or mortgage, you can:

- Make payments

- Check balances

- Review statements

- See your interest rate and terms

All this without calling or digging through paperwork.

Security and Privacy: How CCCU Keeps You Safe

One of the things I value most about CCCU is their emphasis on security. When you’re accessing sensitive financial info online, you want to know it’s protected.

Encrypted Login and Secure Sessions

Whenever you use your Clark County Credit Union login, your session is encrypted using SSL (Secure Sockets Layer). That’s a techy way of saying no one can snoop on your data while it travels between your device and CCCU’s servers.

It’s the same level of security used by big national banks and e-commerce giants.

Two-Factor Authentication (2FA)

When you log in from a new device or location, CCCU may prompt you to enter a code sent to your phone or email. This second layer of security makes it nearly impossible for hackers to access your account even if they have your password.

Security Questions and Notifications

You’ll also set up security questions during registration. Plus, you’ll get email or SMS alerts for important actions like:

- Large withdrawals

- Failed login attempts

- Password changes

These alerts keep you in the loop and help catch suspicious activity early.

What to Do If You Forget Your Login Info

Hey, it happens to all of us. Forgetting your login details can feel like hitting a wall, but it’s super easy to fix.

Resetting Your Password

Here’s how you can reset your CCCU password:

- Go to ccculv.org

- Click “Login”, then “Forgot Password?”

- Enter your username and the email tied to your account

- Follow the prompts to verify your identity

- Create a new password

Make sure your new password is secure but memorable avoid using your birthday or pet’s name.

Recovering a Forgotten Username

If you forgot your username:

- Click the “Forgot Username?” link on the login screen

- Enter your account number and the last 4 digits of your SSN

- CCCU will guide you through the rest

You’ll either receive an email with your username or be asked to set up a new one.

Contacting Clark County Credit Union for Help

Sometimes you just need to talk to a real person. Whether you’re having trouble logging in or you’ve got a question about your account, CCCU’s support team is easy to reach.

Customer Service Phone and Email

Here’s how to contact Clark County Credit Union directly:

- Phone: Call (locally) or (toll-free)

- Email: You can send a secure message through their website if you’re logged in, or reach out via the general contact form at www.ccculv.org

Their phone support is available during normal business hours, Monday through Friday. If you call on the weekend or after hours, you can leave a message or follow the prompts for emergency card services.

Live Chat and Branch Locations

CCCU also offers live chat on their website for quick questions super helpful if you’re in a hurry and don’t want to wait on hold.

Prefer the old-school approach? You can walk into one of their seven branch locations in the Las Vegas area. They’re open Monday through Friday, and most branches have drive-thru and ATM access too.

Support Through the Mobile App

Yes, you can get help right from the mobile app. Just tap on “More” then “Contact Us” to send a message or get directions to the nearest branch. Easy peasy.

Mobile Banking at Clark County Credit Union

Mobile banking is no longer just a nice-to-have it’s a must. Thankfully, CCCU knocks it out of the park with their easy-to-use mobile app.

What You Can Do on the App

With the CCCU app, you can:

- Check balances instantly

- Transfer money

- Deposit checks with your phone’s camera

- Pay bills

- View transaction history

- Apply for loans

- Get notifications for account activity

- Set up biometric logins for added security

It’s everything the desktop site offers, but on your phone perfect for life on the go.

Biometric and Passcode Features

You can log in using:

- Face ID (on iPhones with facial recognition)

- Fingerprint ID (on Android and older iPhones)

- Or just a secure 4-digit passcode

These features add speed and security, which is a rare combo in the digital world.

Apple Pay and Google Pay Integration

You can also link your CCCU debit or credit card to your phone’s mobile wallet. That means tap-to-pay options at stores, online payments, and even easier money management.

Online Bill Pay – A Game Changer

One of my favorite CCCU online banking features is the Bill Pay service. It’s like your personal assistant for recurring payments.

How to Set It Up

- Log into your CCCU account (web or app)

- Go to the “Bill Pay” section

- Add payees – utilities, rent, credit cards, etc.

- Choose payment frequency – one-time or recurring

- Confirm and schedule the payment

It’s fast, easy, and way safer than mailing checks.

Pay Anyone—Even Your Landlord

Yep, CCCU lets you pay almost anyone even if they don’t use CCCU. You just enter their name, address, and account info (if applicable), and CCCU takes care of the rest.

Tracking and Notifications

You’ll get alerts when payments are scheduled, sent, or completed. You can even download payment history for tax records or budgeting.

Credit Cards and Loans Through CCCU

If you thought CCCU was just for checking and savings, think again. They offer a whole suite of credit and loan products and you can manage all of it through your Clark County Credit Union login.

CCCU Credit Cards

They’ve got a few solid options:

- Low APR credit cards

- Rewards cards with points for every purchase

- No annual fee cards

You can apply right from the app or website. Once you’re approved, you can manage everything—payments, balance, statements right from your dashboard.

Auto Loans and Refinancing

CCCU is known for competitive auto loan rates, especially if you’re buying a car in Nevada. You can also refinance an existing loan to get a lower rate.

Use your login to:

- Apply for a loan

- Track your loan status

- Set up auto payments

Personal Loans and Mortgages

Need to consolidate debt or make a big purchase? CCCU has personal loans with flexible terms and fast approval. They also offer home loans and refinancing options if you’re buying property in the Vegas area.

FAQs

Does Clark County Credit Union have mobile banking?

Yes, CCCU offers a mobile banking app for iOS and Android, where you can manage your account, deposit checks, pay bills, and more.

Can I pay bills online at Clark County Credit Union Las Vegas NV?

Absolutely. You can use the CCCU Bill Pay feature to schedule payments for utilities, credit cards, rent, and other services.

How do I contact Clark County Credit Union?

You can call the phone number or use the live chat on their website. They also offer secure messaging through the mobile app and contact forms online.

Does Clark County CU offer credit cards?

Yes, they offer several credit card options with low APR, rewards, and no annual fees. You can apply online through their website or app.

Does CCCU offer online banking?

Yes. CCCU’s online banking platform allows you to check balances, transfer funds, pay bills, manage loans, and much more, 24/7.

How do I set up online banking with CCCU?

Visit ccculv.org, click “Login,” then “First Time User.” Enter your account number and SSN, then follow the prompts to create your credentials.

Is Clark County Credit Union federally insured?

Yes. CCCU is federally insured by the NCUA, protecting your deposits up to $250,000 per account holder.

Conclusion

The Clark County Credit Union login portal and mobile app offer everything you need to manage your money easily and securely. Whether you’re checking your balance, paying bills, applying for a loan, or transferring funds, CCCU gives you the digital tools to do it all without the stress.

From rock-solid security to user-friendly design, CCCU’s online banking system is designed to make life easier. And if you ever run into issues, their customer service is just a phone call or live chat away.