Are you ready to unlock the door to your dream home? Carrington Mortgage can be your trusted partner throughout the mortgage process. This in-depth guide will equip you with everything you need to know about Carrington Mortgage, from their competitive rates and loan options to insightful reviews and valuable resources.

Carrington Mortgage is a leading mortgage lender and servicer in the United States, offering a wide range of loan options for home purchases, refinances, and equity access. Whether you’re a first-time homebuyer, looking to refinance your existing mortgage, or seeking to tap into your home’s equity, it can help you achieve your financial goals.

Who is Carrington Mortgage?

Established in 2006, Carrington Mortgage has become a prominent player in the mortgage industry. They offer a wide range of loan products catering to various borrower needs, including:

- Purchase Loans: Fulfill your dream of homeownership with Carrington’s purchase loan options, including conventional, FHA, VA, and USDA loans.

- Refinance Loans: Lower your monthly payment, access home equity, or consolidate debt with Carrington’s diverse refinance programs.

- Down Payment Assistance: it offers various down payment assistance programs to help first-time homebuyers bridge the gap toward their dream home.

Why Choose Carrington Mortgage?

Several factors set carrington apart from the competition:

- Extensive Loan Portfolio: Carrington boasts a comprehensive loan portfolio catering to diverse borrower profiles, credit situations, and down payment capabilities.

- Competitive Rates: Carrington is committed to offering competitive mortgage rates, ensuring you get the best possible deal on your loan.

- Streamlined Process: Carrington’s online platform and experienced loan officers facilitate a smooth and efficient mortgage application process.

- Exceptional Customer Service: Carrington prioritizes customer satisfaction, providing dedicated support throughout the loan journey.

Services Offered by Carrington Mortgage

- Home Purchase Loans: Carrington provides various loan options for homebuyers, including government-backed and conventional loans, catering to first-time buyers and seasoned homeowners alike.

- Mortgage Refinancing: The company offers refinancing options to help homeowners lower their interest rates, reduce monthly payments, or access home equity.

- Real Estate Agent Services: Through its network, Carrington connects clients with experienced real estate agents to facilitate smooth property transactions.

- Insurance Services: Carrington also provides insurance services, ensuring clients have access to comprehensive coverage options for their homes.

Loan Programs Available

It offers a variety of loan options to fit your specific needs. Here’s a closer look at some popular choices:

- Conventional Loans: These loans are not insured by the government and typically require a minimum credit score and down payment.

- FHA Loans: Backed by the Federal Housing Administration, FHA loans offer lower credit score requirements and flexible down payment options.

- VA Loans: Veterans and eligible service members can access VA loans with favorable terms, including no down payment in many cases.

- USDA Loans: USDA loans are designed for rural homeownership, offering low or no down payment options for eligible borrowers in designated areas.

Understanding Non-QM Loans

- Definition and Purpose: Non-QM loans are designed for borrowers who don’t fit the conventional lending criteria, providing alternative pathways to homeownership.

- Eligibility Criteria: Eligibility for Non-QM loans varies but often includes considerations of alternative income documentation, higher debt-to-income ratios, or recent credit events.

- Benefits and Risks: Benefits of Non-QM loans include flexible qualification requirements and personalized loan terms. However, they may come with higher interest rates and stricter repayment terms, reflecting the increased risk to lenders.

Carrington Mortgage Rates

However, Carrington Mortgage offers competitive rates, but the specific rate you qualify for will depend on various factors, including:

- Loan Type: Interest rates differ between loan types (purchase vs. refinance) and government-backed programs (FHA, VA, USDA) vs. conventional loans.

- Credit Score: A higher credit score typically translates to a lower interest rate.

- Loan-to-Value Ratio (LTV): The ratio of your loan amount to the property value can influence your interest rate.

- Down Payment: A larger down payment often leads to a more favorable interest rate.

Reviews

Customer reviews offer valuable insights into Carrington Mortgage’s services. While experiences may vary, Carrington generally receives positive feedback for:

- Knowledgeable and helpful loan officers

- Streamlined online application process

- Competitive mortgage rates

- Commitment to customer satisfaction

Is Carrington Mortgage Right for You?

Carrington Mortgage is a strong contender for borrowers seeking a reliable lender with a diverse loan portfolio, competitive rates, and a focus on customer service. To determine if Carrington Mortgage is the right fit for you, consider these factors:

- Your Loan Needs: Do they offer the specific loan type you require?

- Your Credit Score: Do their credit score requirements align with your profile?

- Your Down Payment: Do they offer down payment assistance programs if needed?

Taking the Next Step

Ready to explore your mortgage options with Carrington Mortgage? Here’s how to get started:

- Visit their website: Carrington Mortgage’s website provides a wealth of information, including loan options, eligibility requirements, and online application tools.

- Contact a Loan Officer: Carrington’s experienced loan officers can answer your questions and

By leveraging this comprehensive guide, you’re well-equipped to make informed decisions about your Carrington Mortgage journey. Take charge of your finances.

Conquering the Mortgage Process with Carrington

Here are some valuable tips to ensure a smooth experience with Carrington Mortgage:

- Gather necessary documents: Prepare proof of income, employment verification, tax returns, and bank statements for a streamlined application process.

- Understand your credit score: Knowing your credit score empowers you to negotiate better rates. Aim to improve your credit score before applying if possible.

- Shop around and compare rates: Don’t settle for the first offer. Compare rates from multiple lenders to secure the best deal.

- Communicate effectively: Maintain clear communication with your loan officer throughout the process. Don’t hesitate to ask questions or seek clarification.

Comparing Carrington Mortgage to Competitors

Carrington Mortgage Services (CMS) competes with several well-known mortgage lenders in the industry. When evaluating CMS against competitors like Rocket Mortgage, Wells Fargo, and Freedom Mortgage, it’s essential to compare factors such as interest rates, loan options, customer service, and overall borrower experience.

- Interest Rates & Fees:Carrington Mortgage offers competitive interest rates, but they can be higher than some mainstream lenders due to its focus on borrowers with lower credit scores and Non-QM loans.

- Loan Options: Carrington Mortgage specializes in government-backed and Non-QM loans, whereas some competitors focus primarily on conventional loans.

- Credit Score Requirements: Carrington Mortgage caters to borrowers with lower credit scores, making it a viable option for those who might not qualify with other lenders.

- Customer Service & Reviews: Customer experience varies significantly among mortgage lenders. Carrington Mortgage receives mixed reviews, with some praising its flexible loan options while others cite issues with loan servicing.

- Loan Servicing & Payment Options: Many borrowers continue to work with their lender after closing for loan servicing. Carrington Mortgage has received some complaints regarding its loan servicing.

FAQs

What are the benefits of using Carrington Mortgage?

Carrington Mortgage offers a variety of benefits, including a wide range of loan options, a streamlined process, and exceptional customer service.

What loan programs does Carrington Mortgage offer?

Carrington Mortgage offers a variety of government-backed and conventional loan programs, including FHA loans, VA loans, USDA loans, and conventional fixed-rate and adjustable-rate mortgages (ARMs). They also offer home equity loans and lines of credit.

How do I get started with Carrington?

You can visit Carrington Mortgage’s website (https://www.carringtonmortgage.com/) to learn more about their loan options and get pre-qualified for a mortgage. You can also contact them directly by phone.

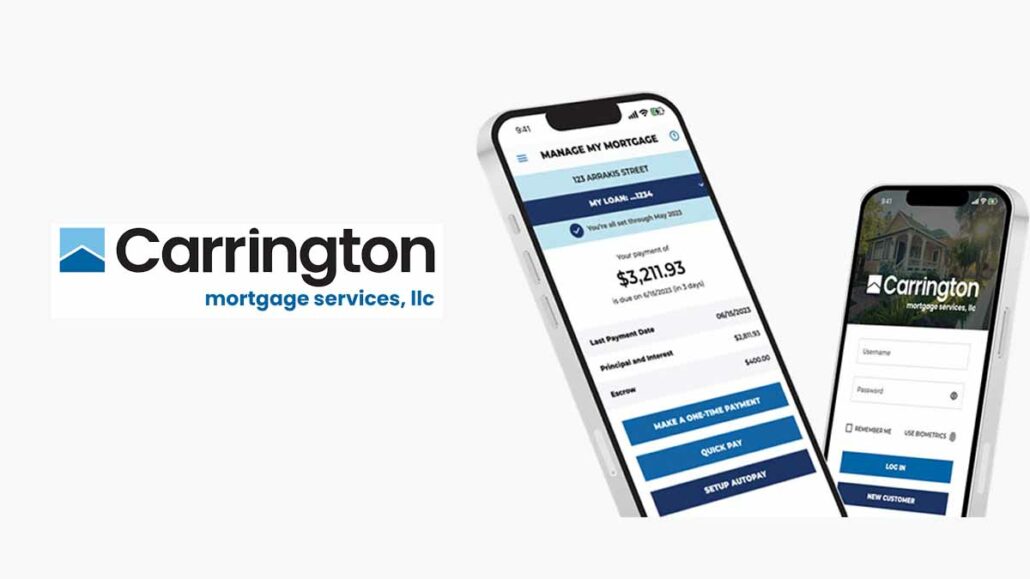

Does Carrington Mortgage offer a mobile app?

Yes, Carrington Mortgage offers a mobile app called Carrington Mobile. With the app, you can manage your mortgage account, make payments, view statements, and more. The app is available for download on the App Store and Google Play.

Carrington Mortgage is a reputable lender with a strong track record of helping borrowers achieve their homeownership goals. By considering Carrington Mortgage for your mortgage needs, you can ensure a smooth and successful home-buying or refinancing experience.