Looking for how to manage your credit card bills, one phrase kept popping up everywhere: Capital One Make a Payment. It sounds pretty straightforward, right? But if you’re like me, you know that when it comes to money, banking apps, and deadlines, nothing ever feels as simple as it should. Making payments isn’t just about clicking a button, it’s about knowing your options, avoiding late fees, and making sure your hard-earned money goes exactly where it’s supposed to.

Capital One offers several ways for you to make a payment, whether it’s for a credit card, auto loan, or even a personal loan. And while that sounds convenient, it can also feel overwhelming if you don’t know which option is best for you. Should you pay online? Use autopay? Send a check in the mail? Or maybe you’re curious about how long it takes for payments to actually process.

How Much is Homeowners Insurance on a $150000 House

How Much Would a $1000 Payday Loan Cost

Mortgage Lenders have the Lowest Rates

Get a Loan- Find a Loan Lender

Housing Assistance Payments

Mortgage 30 Year Fixed Rate – Find the Best Rates & Info

Mortgage 0 Down – Buy a Home with No Down Payment

Loan Discharge – Understand Your Options & Eligibility

Loan Xpress Pay – Fast Online Personal Loans

Loan 3000 – Get a $3000 Loan Instantly

Loan to Pay Off Credit Cards – Consolidate Debt & Save Money

Mortgage 150k House – How Much House Can I Afford

Understanding Capital One Make a Payment

When we talk about Capital One Make a Payment, what we’re really talking about is flexibility. Capital One gives you multiple ways to handle your bills, and that’s a good thing. But before we get into the “how,” let’s break down the “what.”

Capital One lets you make payments on three main types of accounts:

- Credit cards: These are the most common. If you have a Capital One credit card, you’ll need to make at least a minimum payment every month.

- Auto loans: If you’ve financed your car through Capital One, you can also make your loan payments online or through other methods.

- Personal loans: Fewer people know this, but Capital One also allows payments on certain personal loans.

Now, why does this matter? Because the type of account you have can affect your payment method, your due date, and even how long it takes for your payment to process. For example, credit card payments might clear faster than loan payments.

How to Pay Your Capital One Credit Card Bill

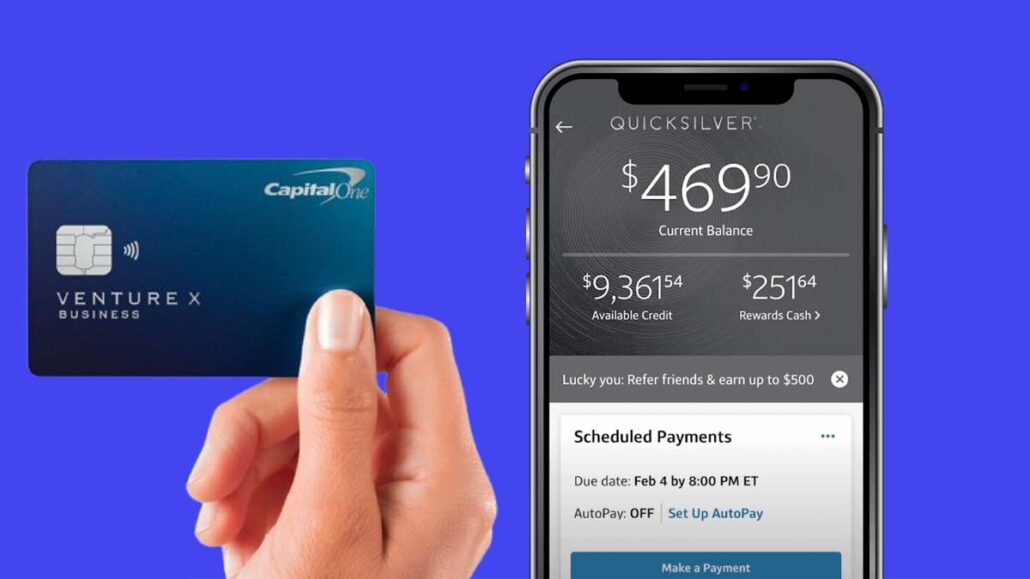

Okay, let’s get practical. If you’re holding a Capital One credit card in your wallet, you’ll eventually need to pay off that balance. Thankfully, Capital One makes it relatively easy.

Here’s a step-by-step guide to paying your Capital One credit card bill:

- Log in to your account: You can do this on the Capital One website or through their mobile app.

- Navigate to the payment section: Once you’re in, find the option labeled “Make a Payment.”

- Choose your payment method: You can link a checking or savings account, use a debit card, or even mail in a check.

- Enter the amount: Decide whether you’re paying the minimum due, the full balance, or a custom amount.

- Schedule your payment: Pick a date. You can pay today or set a future date.

- Confirm the payment: Always double-check before hitting submit.

Try not to wait until the very last minute. Payments sometimes take a day or two to process, and you don’t want to risk a late fee just because you scheduled it too close to your due date.

How Does Capital One Bill Pay Work?

If you’ve ever wondered how Capital One Bill Pay works, let me break it down for you in simple terms. Think of it as a service that lets you pay your bills directly from your Capital One account without needing to log in separately to each company you owe money to.

Here’s how it works:

- You log in to your Capital One account.

- You add the companies or service providers you want to pay.

- You schedule your payments, and Capital One takes care of the rest.

Pretty convenient, right? Instead of juggling multiple websites, passwords, and payment deadlines, everything is in one place.

The best part is the security. Every payment is tracked, and you’ll get confirmation once it’s processed. Plus, Capital One uses encryption to keep your data safe.

Choosing the Right Payment Method for Your Capital One Credit Card

Now, here’s the million-dollar question: which payment method should you use for your Capital One credit card? Well, it depends on your situation.

Here are your main options:

- Bank account transfer: Link your checking or savings account and transfer funds directly. This is fast and reliable.

- Debit card payment: Good if you don’t want to link your bank account.

- Autopay: Set it and forget it. Your bill is paid automatically every month.

- Mailed check: Slower, but still works if you like paper records.

Each option has pros and cons. For example, autopay is great for peace of mind, but it might cause problems if your account doesn’t have enough funds on the scheduled date. Mailing a check feels secure to some people, but it takes longer to process and could arrive late.

How Long Does It Take Capital One Bill Pay to Deliver Payments?

One of the questions I had early on was, “If I make a payment today, when will Capital One actually receive it?” The truth is, payment timing can vary depending on the method you use. Understanding this can save you from the frustration of unexpected late fees.

For online payments made through the Capital One website or mobile app, most of them process the same day or by the next business day. If you submit before the cut-off time (usually around 5 p.m. ET), your payment often posts that evening. Payments made after the cut-off are usually processed the next day.

If you choose Bill Pay from another bank, it might take a bit longer, sometimes two to three business days, because the payment has to travel through the banking system before Capital One credits it. And if you’re old-school and send a check by mail, you’ll need to allow at least 5–7 business days for it to arrive and process.

Don’t wait until the last minute. Schedule your payment at least a day or two in advance. It gives you peace of mind, and you won’t have to worry about cut-off times or mailing delays.

When Do I Have to Pay My Capital One Bill?

Paying your bill on time is more than just a good habit, it’s essential if you want to avoid fees and keep your credit score healthy. But when exactly do you have to pay your Capital One bill?

Every Capital One credit card comes with a monthly due date. You can find this date on your statement, in the app, or by logging into your online account. Usually, the due date falls on the same day each month, but you may have the option to request a different date if that works better for your schedule.

Now, here’s the important part: you don’t always have to pay your full balance, but you do need to make at least the minimum payment. If you only pay the minimum, though, you’ll get hit with interest on the remaining balance. That’s why I always recommend paying as much as you can, even if it’s not the full amount.

Capital One also gives you a grace period, usually about 25 days after your statement closes. If you pay your balance in full during this period, you won’t be charged interest. That’s like getting a short-term loan without fees, as long as you pay on time.

Using Capital One AutoPay for Convenience

If you’re like me and don’t want to worry about due dates every month, AutoPay can be a lifesaver. With AutoPay, Capital One automatically deducts your payment from your chosen account on your due date. It’s the ultimate “set it and forget it” option.

Here’s how it works:

- You log into your Capital One account.

- You go to the AutoPay setup section.

- You choose how much you want to pay each month (minimum payment, full balance, or a fixed custom amount).

- You link your checking or savings account.

- Once it’s set, Capital One will take care of it every month.

The benefits are obvious, you’ll never miss a payment, and you won’t have to stress about remembering dates. Plus, it helps protect your credit score since on-time payments are a huge factor in keeping it strong.

Even if you’re on AutoPay, keep an eye on your statements. Mistakes can happen, or maybe you decide you want to pay extra one month to lower your balance faster. You can still make manual payments on top of AutoPay if you want.

Troubleshooting Capital One Payment Issues

Even with all the modern conveniences, things can go wrong sometimes. Payments might fail, accounts might get disconnected, or you might even see a payment applied incorrectly. So, what should you do if something goes wrong with Capital One Make a Payment?

Here are a few common issues and solutions:

- Failed Payments: This usually happens if there aren’t enough funds in your bank account. If this occurs, Capital One will notify you, and you’ll need to resubmit the payment. Be aware that your bank may also charge an insufficient funds fee.

- Incorrect Account Information: Sometimes payments fail because the bank account number or routing number was entered incorrectly. Double-check this info before saving it in your Capital One account.

- Delayed Payments: Payments might not post right away if you made them after the cut-off time or used mail. If you think your payment is late, check the status in your online account before panicking.

- Duplicate Payments: Occasionally, people accidentally pay twice. If this happens, the extra payment usually goes toward your balance, or you might see a credit. You can also call customer service if you want a refund.

The key is not to ignore the issue. If you see something wrong with your payment, act right away. Waiting could mean late fees, extra interest, or even a hit to your credit score.

Paying Your Capital One Bill by Mail or Phone

While most of us rely on online banking these days, Capital One still allows you to pay by mail or phone. These methods can be handy if you prefer traditional ways of handling money or if you run into technical issues online.

Paying by Mail

You can send a check or money order to the address listed on your billing statement. Just make sure to include your account number so they know which account to apply it to. Remember, mailing takes time, so send your payment at least a week before the due date.

Paying by Phone

You can also call Capital One’s automated phone system or speak to a customer service agent to make a payment. You’ll need your account information and your bank details handy. Payments made by phone usually process faster than mail, but there may be a service fee in some cases.

Managing Payments Through the Capital One Mobile App

Making a payment through the app is as simple as checking your text messages. Here’s what to usually do:

- Open the Capital One app and log in with Face ID or a passcode.

- Tap on my credit card account.

- Hit “Make a Payment.”

- Choose the amount you want to pay (minimum due, full balance, or custom).

- Select your bank account.

- Confirm and submit.

Within seconds, you get a confirmation, and your balance updates pretty quickly. The app also lets you schedule payments in advance, which you find really useful when you want to pay before going on a trip or when you know you’ll be busy during the week.

Beyond payments, the app gives you tools to manage your entire account. You can track your spending, see when your bill is due, and even get alerts when you’re close to your credit limit. That means fewer surprises at the end of the month.

Setting Up External Payments from Another Bank

Sometimes, you may not want to make payments directly from Capital One. Maybe you already have a favorite bank where you manage all your bills, or maybe you prefer to keep everything in one place. That’s where external payments come in.

Most banks let you set up Bill Pay and send payments to your Capital One credit card or loan account. Here’s how to do it once through your main checking account:

- Log into your other bank’s online portal.

- Add “Capital One” as a payee.

- Enter your Capital One account number (found on your statement).

- Schedule a payment date and amount.

- After a couple of days, the payment showed up in your Capital One account. Easy enough, right?

The biggest advantage of using an external bank is that you can see all your bills in one place. Instead of hopping between apps, everything comes from one dashboard. That said, there are two downsides you’ll notice:

- Payments may take 2–3 business days to process.

- If you make a mistake entering your account info, the payment could bounce.

So while this method works, it’s suitable using the Capital One app directly because it’s faster and safer. Still, if you’re already managing multiple bills from one account, setting up external payments could be the right move for you.

What If My Kohl’s Credit Card Is Transitioning to Capital One?

If you’ve ever had a Kohl’s credit card, you might have already heard that it’s transitioning to Capital One. At first, this kind of news can be confusing. You might wonder, “Do I still pay the same way? Will my old Kohl’s account work? What happens to my rewards?”

Here’s the breakdown:

- Accounts are moving over to Capital One’s system. That means your payments will eventually go through Capital One instead of Kohl’s.

- If you had autopay or Bill Pay set up with Kohl’s, you may need to update it once your account is officially moved.

- Your new Capital One card will come with a fresh account number, so you’ll need to use that for payments.

The good news? You don’t lose your credit history in the process. Everything, your payment history, balance, and credit limit, transfers over. From a credit score standpoint, it’s as if nothing changed.

Best Practices to Stay on Top of Capital One Payments

Paying your bill is one thing, but staying on top of it month after month is another challenge.

- Set Reminders: Even if you’re using AutoPay, you can always set reminders a few days before your due date. It’s just a backup to make sure your payment goes through.

- Budget for Payments: Instead of waiting until the end of the month, you can set aside money each week for your credit card bill. That way, I’m never scrambling when the due date arrives.

- Pay More Than the Minimum: The minimum might keep you in good standing, but it won’t help with interest. You can try to pay more whenever you can to cut down on debt faster.

- Use Alerts: Capital One lets you set text or email alerts for due dates and spending. You highly recommend turning these on.

- Check Statements Regularly: It’s not just about making payments; it’s about making sure the charges are correct. If you spot a mistake early, it’s easier to dispute it.

The key is treating your payment like any other important bill, like rent or utilities. Once you shift your mindset, you stop seeing it as a chore and more as a way to protect your financial health.

FAQs

How do I pay my Capital One credit card bill?

You can pay online through the website or app, set up AutoPay, mail a check, or call customer service to pay by phone.

How does Capital One bill pay work?

It lets you schedule payments to Capital One directly, keeping everything in one place. Payments can be set for the minimum due, full balance, or a custom amount.

How do I choose a payment method for my Capital One credit card?

It depends on your needs. Options include bank transfer, debit card, AutoPay, or mailing a check. Each has pros and cons, so pick the one that works best for your schedule.

How long does it take Capital One bill pay to deliver payments?

Online and app payments usually post the same day or next business day. Payments from other banks can take 2–3 days, and mailed checks can take up to a week.

When do I have to pay my Capital One bill?

Your due date is listed on your statement. You must make at least the minimum payment by that date, but paying in full within the grace period helps avoid interest.

What if my Kohl’s credit card is transitioning to Capital One?

Your account will be moved over to Capital One, and you’ll make payments directly through them once the transition is complete. Watch for notices about updating autopay or Bill Pay settings.

Conclusion

At the end of the day, Capital One Make a Payment isn’t just about sending money, it’s about staying in control of your finances. Whether you’re paying through the app, setting up AutoPay, mailing a check, or using an external bank, the goal is the same: make sure your payments are on time and stress-free.

Whatever method you choose, the most important thing is consistency. Every on-time payment helps your credit score, saves you from unnecessary fees, and brings you one step closer to financial peace of mind.