When I first stumbled across the CalPERS Retirement Calculator, I’ll be honest I felt a bit intimidated. It sounded like something complicated, only for accountants or pension officers. But once I dove in, I realized it’s actually a user-friendly tool designed for everyday folks like you and me.

- Loan Qualification Calculator – Estimate Your Borrowing Power

- Loan Payment Calculator – Estimate Your Monthly Payments

- Life Insurance Calculator – Get Your Quote Today

- RV Loan Calculator – Find Your Perfect RV Financing

- Refinance Calculator – How to Calculate Monthly Mortgage Payments

- Investment Calculator – How to Calculate your Investment Growth

- Cost of Living Calculator – How do I calculate the cost…

The CalPERS Retirement Calculator is an online calculator provided by the California Public Employees’ Retirement System (CalPERS). It lets you estimate how much pension income you might receive when you retire. Whether you’re a teacher, police officer, state agency worker, or any other public employee in California, if you’re a CalPERS member, this tool is specifically meant for you.

So, why does it matter? Imagine driving to an unknown place without a GPS. That’s what planning for retirement feels like without an estimate of your income. This calculator serves as your GPS, showing the possible road ahead.

Why Should You Care About This Tool?

You probably dream of kicking back one day without worrying about paying the bills. Maybe you want to travel, spoil your grandkids, or finally focus on hobbies. But how do you know if you’ll have enough money to live comfortably?

This is where the CalPERS Retirement Calculator becomes your new best friend. It helps you figure out roughly how much you’ll receive each month after you retire, based on your years of service, salary, and retirement age.

It gives you a clear snapshot, so you can decide whether you should work a few more years, start putting extra money into savings, or even consider retiring sooner. It’s like peeking into the future, except it’s based on math, not a crystal ball.

How Does the CalPERS Retirement Calculator Work?

Inputs You’ll Need

When I used the calculator for the first time, I was surprised by how straightforward it was. You don’t need to be a math genius. All you need is some basic information, like:

- Your birth date: to calculate your retirement age.

- Your projected retirement date: when you’d like to start collecting your pension.

- Your highest average monthly salary (often over 12 or 36 months, depending on your formula).

- Years of service credit: how long you’ve worked under CalPERS-covered employment.

If you’ve ever looked at your CalPERS annual statement, most of these numbers are right there. If not, a quick call or login to your MyCalPERS account will do the trick.

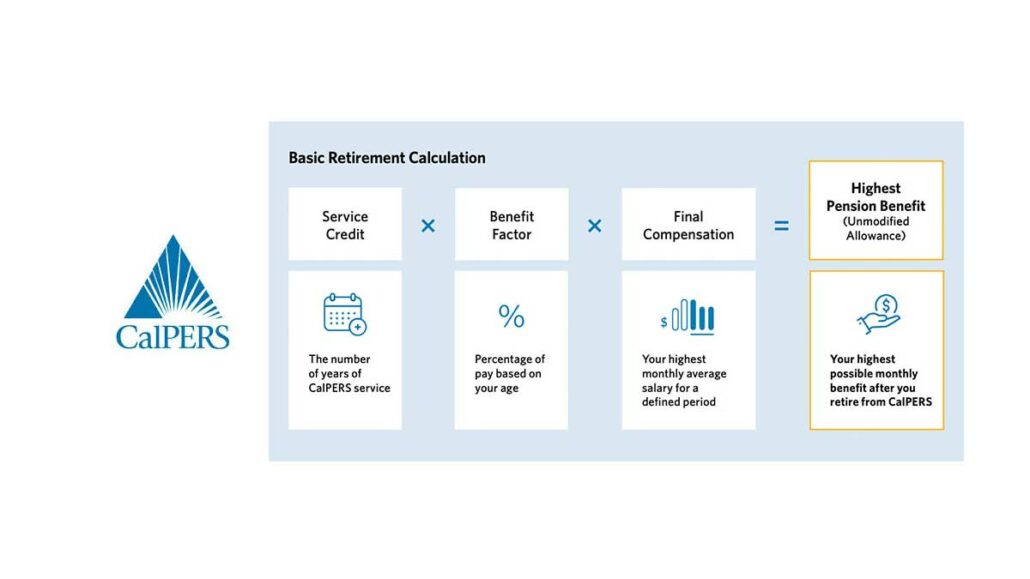

How It Calculates Your Pension

The calculator uses a formula based on three main things:

- Service Credit (Years Worked): More years, bigger pension.

- Benefit Factor (Based on Your Age at Retirement): Older you are, higher the percentage.

- Final Compensation (Your Salary): Usually highest average monthly pay over a period.

It looks something like this:

- Service Credit x Benefit Factor x Final Compensation = Unmodified Allowance

The calculator does all the heavy lifting. It instantly runs these numbers and pops out an estimate of what you might receive monthly. It even shows different scenarios like what if you wait two more years, or what if you retire sooner.

Benefits of Using the CalPERS Retirement Calculator

Making Informed Decisions

For example, I learned that if I worked just three more years, my monthly pension would increase by over $500. That’s a big difference! Maybe you’ll find out something similar. Or maybe you’ll realize you’re already in a great spot.

Knowing these figures puts you in the driver’s seat. You can decide:

- Whether to retire earlier or later.

- If you need to start saving more in a 457(b) or IRA.

- Whether to pay off your mortgage before retiring.

Reducing Retirement Anxiety

Money worries keep many of us up at night. Using the CalPERS Retirement Calculator help you breathe a sigh of relief. Seeing an estimate made your retirement feel real, not just some scary mystery.

It also helped you talk to your spouse more openly about your future plans. Once you both see the numbers on paper, you can start dreaming together instead of stressing alone.

Step-by-Step Guide: How to Use the CalPERS Retirement Calculator

Accessing the Tool

You can log into your MyCalPERS account at my.calpers.ca.gov. Under the “Retirement” section, there’s a tab called “Retirement Estimates.” That’s where the calculator lives. It’s free, secure, and tailored to your personal data so it’s much more accurate than generic calculators you might find online.

Filling Out Your Details

Once you open the calculator, it’ll guide you through a few screens. Here’s what you’ll typically input:

- Your expected retirement date. You can try different dates to see how they change your pension.

- Your projected salary. The system often auto-fills your current salary, but you can adjust it if you expect raises.

- Beneficiary options. You can see how leaving a percentage to your spouse or partner affects your monthly amount.

Understanding Your Results

After clicking through the prompts, the calculator gives you a clear estimate. It often breaks it down into:

- Unmodified Allowance: The highest monthly benefit without survivor continuance.

- Option Estimates: What you’d get if you choose to leave something for a spouse or beneficiary.

You can even download a PDF, which is super handy to discuss with your family or financial advisor.

Common Mistakes to Avoid When Using the Calculator

Overlooking Important Inputs

- Your years of service credit (which you can find in your MyCalPERS account or on your annual member statement).

- Your final compensation figures, especially if you’ve recently had a promotion or changed positions.

Also, be sure to update any projected salary increases if you expect a raise soon. It might seem minor, but these numbers have a huge impact. Remember, the calculator works with what you give it, so garbage in means garbage out.

Assuming Estimates Are Exact

Another pitfall? Believing the calculator spits out guaranteed numbers. It doesn’t. The CalPERS Retirement Calculator gives you an estimate based on current assumptions like contribution rates, laws, and your inputs.

Your actual pension could differ because of:

- Changes in state law or CalPERS regulations.

- Salary adjustments or promotions you didn’t predict.

- Cost-of-living adjustments (COLAs) that happen after you retire.

So, think of it more like a forecast. Just like a weather app can’t guarantee there’ll be sun in six months, this calculator can’t promise your exact pension. But it gives you a solid ballpark figure to plan around.

Additional Features of the CalPERS Retirement Calculator

Scenario Planning

One of the favorite features is how you can run multiple scenarios. Let’s say you’re torn between retiring at 57 or waiting until 62. Plug in both dates and watch how your monthly pension changes.

You can also adjust:

- Projected salary increases: If you expect big raises.

- Service credit purchases: If you’re buying back previous time.

- Beneficiary percentages: To see how leaving more or less affects your payout.

It’s basically like a choose-your-own-retirement adventure book, but with real money on the line.

Comparing Different Retirement Dates

Want to get even more strategic? The tool lets you create side-by-side comparisons of different retirement dates.

For example, you could compare:

| Retirement Age | Monthly Pension | Annual Total | Lifetime Total (25 years) |

| 57 | $3,200 | $38,400 | ~$960,000 |

| 62 | $4,100 | $49,200 | ~$1,230,000 |

Seeing these numbers laid out helps make the decision feel less emotional and more logical. If your family is like mine, having hard data makes conversations a lot smoother.

Tips to Maximize Your CalPERS Pension

Working Longer and Increasing Your Final Compensation

Here’s why it matters:

- More years = more service credit. Every year adds directly to your formula.

- Older age = higher benefit factor. Retiring at 60 vs. 55 can raise your benefit factor by several percentage points.

- Likely higher salary at the end. Since your final compensation is based on your highest average salary (usually over 12 or 36 months), climbing the pay scale or picking up a promotion right before retirement can give your pension a permanent boost.

Timing Your Retirement for Maximum Benefit

Timing is everything. It’s not just about how long you work, but exactly when you retire.

For example, CalPERS benefits are often calculated by birthday quarters. If you turn 60 in August, it might pay to work until September because your benefit factor could jump up that next quarter. One more month could mean thousands more over a lifetime.

Also, keep an eye on:

- Cost-of-living adjustments (COLAs). Retiring before or after a COLA change can impact your initial base.

- Health plan contracts. Some benefits roll over differently depending on retirement dates.

It might sound nitpicky, but when you’re talking about money you’ll rely on for the next 20 or 30 years, a little timing strategy goes a long way.

What If You’re Not Happy With the Estimate?

Talking to a CalPERS Counselor

If the CalPERS Retirement Calculator gives you a number that makes your stomach sink, don’t panic. And definitely don’t ignore it. This is the perfect moment to schedule a one-on-one with a CalPERS retirement counselor.

They can:

- Explain exactly how your service credit, benefit factor, and compensation are working together.

- Show if buying additional service credit (like past temporary time) is possible.

- Help you look at survivor benefit options in more detail.

Sometimes it’s just small tweaks like working one extra year or bumping your retirement date by a few months that dramatically improve your payout.

Exploring Supplemental Retirement Options

If, after running your numbers, you’re still worried, it’s time to look at other savings. Many CalPERS employees have access to 457(b) deferred compensation plans through their employer. These work a lot like 401(k)s.

Other people I know also:

- Open a Roth IRA for tax-free growth.

- Buy rental property to generate passive income.

- Take up part-time work in retirement (which many find enjoyable and social).

The calculator gives you the starting point. From there, you can figure out what you need to build on top of your pension.

How Safe is CalPERS? Understanding the Security of Your Pension

The Strength of the CalPERS Fund

I get this question a lot: “Is my CalPERS pension safe?” Short answer: generally, yes.

CalPERS is the largest public pension fund in the United States, with assets totaling over $400 billion. They’re heavily diversified across global stocks, bonds, real estate, and private equity.

Historically, even during tough markets, CalPERS has managed to pay retirees. It’s backed by both employer contributions (like from the state or your school district) and employee contributions (your paycheck deductions).

What Happens in Market Downturns?

Pensions aren’t immune to economic ups and downs. During major recessions, CalPERS has had funding shortfalls, meaning they held less in assets than long-term obligations. But California law requires public employers to make up differences over time.

In short: your pension checks don’t typically stop because of one bad year. That’s the advantage of a defined benefit plan. Unlike a 401(k), it doesn’t run out because the stock market dropped. That said, keeping informed through CalPERS newsletters and town halls is always smart.

Alternatives to Using the CalPERS Retirement Calculator

Manual Calculations

If you’re old-school or just like double-checking, you can always do the math by hand. Grab your:

- Years of service credit

- Benefit factor from the age chart (CalPERS publishes these online)

- Final compensation figure

Multiply them together:

- Service Credit x Benefit Factor x Final Compensation = Estimated Annual Benefit

Then divide by 12 to get your monthly figure. This is pretty close, though it won’t include survivor or tax adjustments.

Hiring a Financial Planner

Want a truly tailored plan? Consider meeting with a retirement-focused financial advisor. They can take your CalPERS estimate and blend it with:

- Social Security projections

- Any 457(b) or IRA savings

- Health costs and tax considerations

Frequently Asked Questions About CalPERS Retirement Calculator

Where can I find a CalPERS estimate?

You can find your personal CalPERS estimate by logging into your MyCalPERS account at my.calpers.ca.gov. From there, go to “Retirement” and then select “Retirement Estimates.” It’s the best way to get a customized look at your future pension.

How can I get a retirement estimate from CalPERS?

Besides using the online calculator, you can also request an official estimate by calling CalPERS or scheduling a retirement planning appointment. They’ll pull your exact data, including any sick leave or special credits, for an even more precise figure.

How does the retirement estimate calculator work?

The CalPERS Retirement Calculator works by taking your inputs like years of service credit, age at retirement, and final average salary and applying the standard CalPERS pension formula:

Service Credit x Benefit Factor x Final Compensation

Then it adjusts for things like beneficiary options to give you a monthly estimate. It’s all automated, so you just fill in the blanks.

How many retirees collect a year from CalPERS?

According to recent CalPERS reports, over 750,000 retirees and beneficiaries receive payments from CalPERS each year. That’s a huge community relying on this system.

How do I calculate my retirement?

To calculate your CalPERS retirement manually, multiply your years of service credit by your age-based benefit factor, then by your final compensation. But honestly, it’s way easier (and more accurate) to let the online calculator do it.

What types of retirement benefits does CalPERS offer?

CalPERS offers:

- Service Retirement: The standard pension is based on your years and salary.

- Disability Retirement: If you can no longer perform your job due to disability.

- Industrial Disability: Special benefits if your disability is job-related.

They also include options for continuing benefits to a spouse or partner after you pass.

Conclusion

Using the CalPERS Retirement Calculator can give you the clarity you need to truly plan your future. It transformed your fuzzy ideas about retirement into a solid, doable strategy. If you want peace of mind about your golden years, this tool is hands down one of the smartest steps you can take.