What is CD rates

First of all, CD fully known as a certificate of deposit is a type of bank account opening that includes members to lock funds away for over a period or month. The advantage of CD is that in return after you must have locked your funds, you get a fixed interest rate better than other types of bank account opening. This you can refer to it as CD rates. In other words, CD rates are actually a fixed interest rate you get on your certificate of deposit account.

Factors that allow your CD rates to increase all depend on how long the term or amount of time you decide to freeze your money. It is always recommended that when selecting the best CD rates, what you need to check out includes minimum deposit requirements, and also early withdrawal penalties.

According to reports, the biggest risk associated with traditional CDs involves the penalty charges that come with quick withdrawal before the date set for withdrawing. The way traditional CDs works is different from other types of CDs. This includes a fixed interest rates locked in the entire terms of the agreement. Financial institutions offer members a wide range of CDs that includes the following:

- Traditional CDs

- No-Penalty CDs

- Jumbo CDs

- Brokered CDs

- Callable CDs

- Bump-up CDs

- Step-up CDs

- Add-on CDs

- Zero-coupon CDs

- IRA CDs

However, you can learn more about the various type of CDs and select preferable CDs that suit your preference. Likewise, you need to check the interest and other factors before signing off for a certificate of deposit account.

When should you get a CD?

First of all, people that can apply for a CD account opening include financially stable people. This is because you’ll be locking away your money for a very long time. At the same time, if you require the money before the CD matures, you might be hit with a strict penalty for withdrawal. If you’re someone that does not like surprises, then a fixed rates CD serves as the best option.

Best CD Rates Of 2022

| Bank | 1-year APY | 3-year APY | 5-year APY | Minimum Deposit |

| Marcus by Goldman Sachs | 0.55% | 0.75% | 1.00% | $500 |

| Synchrony Bank | 0.55% | 0.75% | 1.00% | $0 |

| Barclays Bank | 0.55% | 0.70% | 0.80% | $0 |

| Comenity Direct | 0.65% | 1.00% | 1.10% | $1,500 |

| Citizens Access | 0.10% | 0.15% | 0.25% | $5,000 |

| American Express National Bank | 0.20% | 0.45% | 0.55% | $0 |

| Amerant Bank | 0.10% | 0.20% | 0.20% | $10,000 |

| Ally Bank | 0.55% | 0.65% | 0.80% | $0 |

| Capital One | 0.20% | 0.75% | 1.00% | $0 |

| PurePoint Financial | 0.25% | 0.25% | 0.25% | $10,000 |

| CIT Bank | 0.30% | 0.40% | 0.50% | $1,000 |

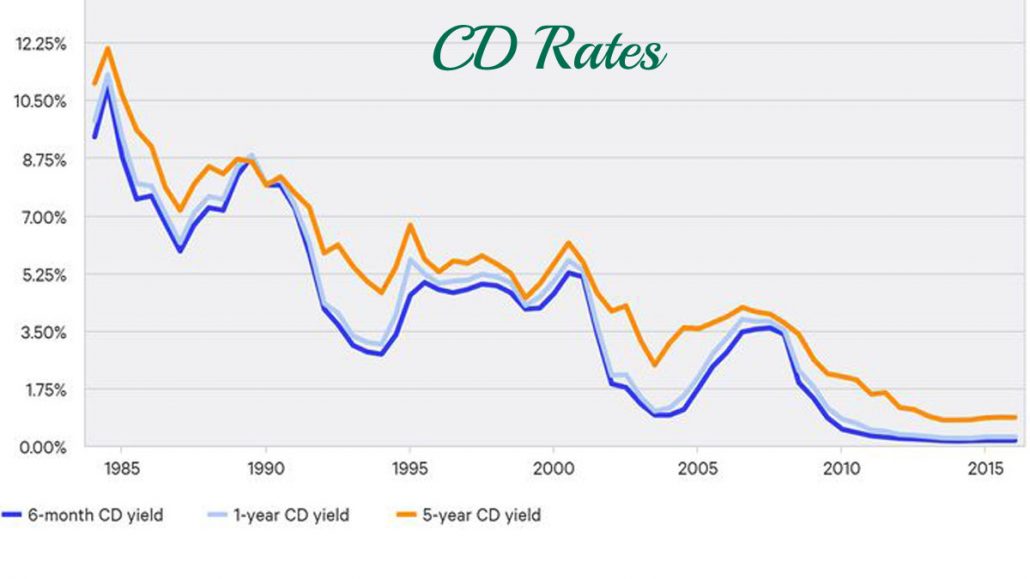

Note the following graph above is gotten to Bankrate, therefore, you can visit the website on other to learn more and to keep up with the latest interest rate.