CareCredit is more than just a financial tool, it’s a health and wellness partner that helps you cover medical, dental, vision, pet, and even cosmetic expenses that insurance might not touch. You see, life happens maybe your dog needs an emergency vet visit, or you need an unexpected dental procedure. In moments like these, Care Credit Payment becomes a lifesaver. It’s a special healthcare credit card issued by Synchrony Bank, and it allows you to pay for services upfront and then make monthly payments over time.

Unlike most traditional credit cards, CareCredit focuses solely on healthcare-related purchases. Whether you want to use it at a dentist’s office, an eye clinic, or even a wellness spa, it gives you flexibility and breathing room when finances are tight. What makes it even more appealing is how easy it is to manage through carecredit.com/login or mysynchrony carecredit login, where you can pay your bill, check your balance, or track transactions in real-time.

How CareCredit Works

CareCredit isn’t your everyday credit card. It’s a healthcare financing solution that helps you pay for medical, dental, vision, and even veterinary costs. When you apply and get approved, you receive a CareCredit credit card that can be used at thousands of approved providers across the U.S.

The best part is the promotional financing options. For example, you can often enjoy no interest if paid in full within 6, 12, 18, or 24 months, depending on the provider and the purchase amount. But there’s a catch, if you don’t pay off the balance by the end of the promotional period, the deferred interest gets added. So, it’s smart to plan your payments carefully.

Another key point is that CareCredit isn’t just accepted at clinics. Many people don’t realize you can also use it for wellness services like massages, dermatology, and LASIK. With a carecredit/mastercard, the possibilities expand even more since it can be used wherever Mastercard is accepted for healthcare-related purchases.

So, whether you need to pay for your child’s braces, your pet’s surgery, or your own vision correction procedure, CareCredit provides flexibility, affordability, and peace of mind, all in one.

How to Apply for CareCredit

Applying for CareCredit is surprisingly simple. You can start the process online at carecredit.com/start or carecredit.com apply. All you need is some basic information like your name, address, Social Security number, and income details. The entire process usually takes less than five minutes.

Once your application is submitted, you’ll receive an instant decision. If approved, you can start using your CareCredit card immediately through your care credit card sign in account or by adding it to your mobile wallet. If not approved, you’ll receive a letter explaining why and what you can do to improve your chances next time.

Your credit score plays a role in your approval odds since Synchrony Bank CareCredit runs a credit check. However, even if your credit isn’t perfect, you might still qualify for lower amounts. I’ve seen friends get approved for smaller credit limits, then gradually build up over time as they use the card responsibly.

Once you’re approved, it’s crucial to register your card online at carecredit.com/login. That’s your main hub for everything, bill payments, viewing balances, and managing personal information.

And if you ever get stuck during the process, you can reach out to carecredit phone number customer service. Their team is generally patient and helpful, especially if it’s your first time dealing with credit care or any financing platform.

CareCredit Login and Account Access

Now that you’ve got your CareCredit card, it’s time to get familiar with your online account. The heart of managing everything is through carecredit.com/login or mysynchrony carecredit login, depending on how you prefer to access your account.

Once you reach the login page, you’ll be asked to enter your username and password. If it’s your first time logging in, simply click “Register” and follow the steps. You’ll need your CareCredit account number, the last four digits of your Social Security number, and your ZIP code to verify your identity.

From your account dashboard, you can do just about everything, make a carecredit payment, view your recent transactions, check available credit, and even update your contact details. The site is simple and user-friendly, so you don’t need to be a tech expert to navigate it.

If you ever face trouble signing in, maybe you forgot your password or username, there’s a “Forgot Username/Password” option right on the care credit card sign in page. And if that doesn’t solve the issue, you can always call the carecredit phone number customer service for assistance.

If you prefer mobile access, you can download the CareCredit Mobile App, available on both iOS and Android. The app mirrors the web features, you can pay bills, set reminders, and check your balance anytime.

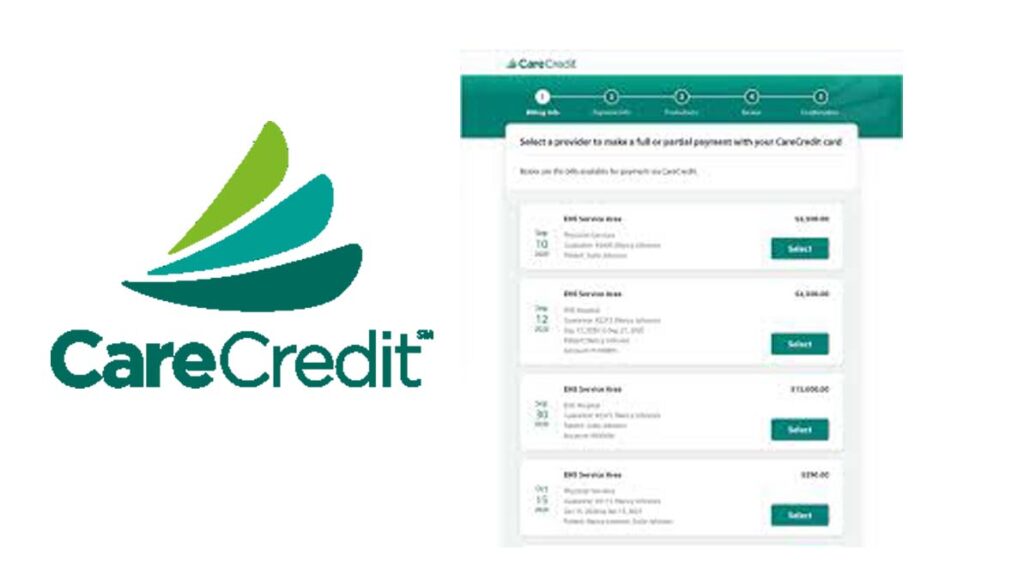

Making a CareCredit Payment

When it comes to paying your bill, CareCredit gives you several convenient options. Whether you prefer online, phone, or mail, the process is quick and flexible. Personally, I find online payments the easiest since everything is instant and trackable.

To pay online, visit carecredit.com/login and sign in to your account. Once inside, click on “Payments”, then choose the amount you want to pay, either the minimum due, your full balance, or a custom amount. You can even schedule payments in advance, so you never miss a due date.

If you’d rather not use the website, you can also call the carecredit phone number customer service at the number listed on the back of your card. This option allows you to pay carecredit credit card bills through their automated system or by speaking to a live representative.

For those who prefer traditional methods, there’s always the option to mail your payment. Just send your check or money order (with your account number on it) to the address provided on your billing statement. While it’s slower than paying online, it’s still a good backup if you’re not comfortable with digital payments.

And for people who like convenience, Synchrony CareCredit offers AutoPay. With this feature, your care credit pay bill happens automatically each month.

Remember, missing a payment can result in late fees and potential loss of promotional financing. That’s why setting reminders or using AutoPay is a smart move. With all these payment options, carecredit bill pay is as flexible as it gets, you can handle everything on your terms and schedule.

Using carecredit.com/start for New Users

If you’re brand new to CareCredit, the carecredit.com/start page is where your journey begins. It’s designed for first-time users to set up their account quickly and safely. When you visit the page, you’ll be guided through creating your online profile, linking your CareCredit Mastercard, and verifying your identity.

This is also where you can activate a new card if you’ve just received one in the mail. The system will walk you through step-by-step instructions, entering your care credit card details, confirming your email, and setting up your login credentials.

Once activated, you can immediately start using your card at participating providers. The carecredit synchrony bank system will automatically update your account, and you can view your available balance and recent transactions under your carecredit log in.

The carecredit.com/start portal also has valuable educational resources. It’s where I first learned about using credit care wisely, understanding my billing cycle, and setting up alerts for when my next payment was due.

It’s basically your one-stop shop for getting started the right way. The sooner you activate and explore your account, the smoother your experience will be.

Understanding CareCredit Synchrony Bank

Behind every CareCredit card is Synchrony Bank, one of the biggest names in consumer finance. They’re the ones who actually issue and manage the CareCredit credit card, so if you’ve ever wondered who handles your billing, that’s your answer.

Synchrony Bank plays a vital role in ensuring your payments, credit reporting, and promotional financing run smoothly. When you access synchrony care credit or care credit synchrony login, you’re essentially logging into your account through Synchrony’s secure financial system.

Another great feature is that Synchrony reports your CareCredit activity to the major credit bureaus. That means if you make timely payments, it can help improve your credit score over time. On the flip side, missed or late payments can hurt your score, so staying on top of your care credit payment is important.

They also offer robust fraud protection measures. I once had a suspicious charge on my account, and when I called the care credit phone number customer service, the Synchrony team immediately froze my card and issued a replacement. That gave me huge peace of mind.

So yes, Synchrony Bank CareCredit isn’t just a financial partner, it’s the backbone of your CareCredit experience, ensuring every transaction, payment, and statement is handled securely and efficiently.

CareCredit Mastercard: What You Need to Know

If you’ve ever heard about the CareCredit Mastercard, you might be wondering how it differs from the regular CareCredit card. Well, the CareCredit Mastercard is essentially an upgraded version of the original healthcare credit card, it offers more flexibility and a wider range of use.

With the regular CareCredit credit card, you can only use it at participating healthcare and wellness providers. But with the carecredit/mastercard, you can also use it anywhere Mastercard is accepted for qualifying health-related purchases. That means if you’re buying new prescription glasses, getting your pet’s medication, or even paying for medical supplies online, your CareCredit Mastercard has you covered.

, you still get the same great benefits, special financing options, secure transactions, and easy management through carecredit.com login or synchrony care credit.

What’s even better is that this card integrates perfectly with your existing CareCredit account. So when you log in to mysynchrony carecredit login, you’ll see all your transactions, whether they were done through a healthcare provider or a Mastercard-accepting store, right there in one place.

The CareCredit Mastercard also offers access to Synchrony’s promotional financing plans, meaning you can still enjoy deferred interest options as long as you pay the balance within the promotional period. However, keep in mind that if you don’t clear the amount before the term ends, the interest will be charged retroactively, just like the traditional CareCredit card.

Managing Your CareCredit Account

Once you’ve got your card and you’re comfortable making payments, managing your CareCredit account becomes a part of your routine.

Inside your account dashboard, you can view your statements, track past transactions, and even check your promotional balances. This is super helpful if you’ve made multiple purchases under different financing plans. Synchrony makes it easy to see exactly how much time you have left on each one before interest kicks in.

If you’re someone who tends to forget payment dates, setting up AutoPay is a game-changer. You can activate it through the carecredit synchrony pay bill section. This ensures your care credit bill pay happens automatically each month, no reminders or stress needed.

You can also sign up for text or email alerts to notify you when a payment is due or when a new statement is ready. It’s small details like this that make the CareCredit payment experience smooth and worry-free.

For people who like keeping track of finances on the go, the CareCredit mobile app is an absolute must. It mirrors the web portal, allowing you to pay care credit, review transactions, and even locate nearby care credit providers who accept your card.

And if you ever face issues, like a billing dispute, missing payment, or confusion over promotional terms, the carecredit phone number customer service team can walk you through every step.

So, managing your carecredit credit card isn’t just about making payments, it’s about staying informed, organized, and proactive. It’s a habit that pays off, literally.

Care Credit Pay Bill – Complete Payment Guide

Making your care credit pay bill process seamless is one of the main goals of Synchrony Bank. Thankfully, they’ve created several ways to handle your payments. Here’s how you can do it effortlessly.

1. Pay Online

The easiest and fastest option is to pay carecredit credit card online through carecredit.com/login. Once you log in, go to “Payments,” enter your payment details, and confirm. You can choose between a one-time payment or recurring payments via AutoPay. I recommend using a checking or savings account for faster processing.

2. Pay by Phone

If you prefer handling things over the phone, simply call the carecredit phone number customer service (found on your billing statement or the back of your card). You can either use the automated system or speak to a representative. Payments by phone are usually processed the same day.

3. Pay by Mail

Some people still like to mail payments. If that’s you, make your check or money order payable to CareCredit/Synchrony Bank, write your account number on it, and mail it to the payment address listed on your statement. Keep in mind, mailing payments can take a few business days to process.

4. Pay via the Mobile App

If you’re like me and prefer doing everything from your smartphone, the CareCredit app is perfect. You can use it to carecredit pay bill anytime, anywhere. It’s secure, quick, and incredibly user-friendly.

5. In-Store or Provider Payments

In some cases, you can even make payments directly at your healthcare provider’s office, especially if they’re integrated with care credit provider login systems. This option isn’t as common, but it’s great if you’re already visiting the clinic for a follow-up.

No matter which method you choose, always make sure your payment posts before the due date to avoid late fees.

The good thing is, care credit bill pay through Synchrony is reliable and transparent. You’ll always get a confirmation email or notification once your payment is processed.

Common Issues and How to Fix Them

No system is perfect, and sometimes things go wrong when dealing with CareCredit. Whether it’s a login glitch, a billing error, or a delayed payment, it helps to know how to handle issues quickly.

One of the most common problems is carecredit login synchrony bank errors. Maybe you forgot your password, or your browser saved the wrong credentials. If you can’t log in, don’t panic, just head to carecredit.com/login, click “Forgot Username or Password,” and follow the reset steps. You’ll get an email or text verification link. Once you verify, you’ll regain access in minutes.

Sometimes, users face technical errors while trying to pay care credit online. This can happen if your internet connection drops or the system is under maintenance. In that case, try again after a few minutes or use the CareCredit mobile app instead. If it’s urgent, you can always pay through the carecredit phone number customer service line.

Usually, online payments post the same day, but if you mail in your check, it can take 5–7 business days. If a payment is missing or delayed, contact care credit customer service right away, they can trace the payment and ensure it’s applied to your account properly.

Lost or stolen cards are also common concerns. If you misplace your carecredit credit card, call the customer service number immediately to report it. They’ll block your card to prevent unauthorized transactions and issue a new one quickly.

Lastly, billing disputes can arise if you notice unexpected charges. When that happens, gather all your receipts and transaction records, then reach out to Synchrony Bank CareCredit. Their dispute team is usually very responsive and will investigate the issue thoroughly.

So, even though hiccups happen, most CareCredit problems are fixable with a little patience and the right contact number.

Care Credit Customer Service

If you ever need assistance, CareCredit customer service is your go-to solution. Whether you have questions about your care credit application, billing, or account management, their support team can help you navigate it all.

You can reach them by calling the official carecredit phone number customer service, which you’ll find on the back of your card or billing statement. Once you call, you’ll be guided through an automated menu where you can check your balance, make a care credit card payment, or speak directly to a representative.

Besides phone support, you can also find solutions through carecredit.com/login. Their website includes a comprehensive Help Center, FAQs, and even a secure message option for account-specific inquiries. For more complicated financial or credit-related concerns, you can also contact Synchrony Bank directly since they manage the credit side of CareCredit.

What Can You Pay for with CareCredit?

One of the biggest misconceptions about CareCredit is that it’s only for major medical bills, but that couldn’t be further from the truth. You can use your carecredit credit card for a wide range of health, wellness, and even lifestyle expenses.

Here’s where it gets interesting: CareCredit covers dental, vision, cosmetic, veterinary, hearing, and chiropractic services, among others. That means you can use it for everything from braces and LASIK surgery to pet vaccinations and hearing aids. You can even use it for spa treatments, skincare procedures, and weight loss programs if they’re under participating providers.

You can easily check if a clinic or provider accepts CareCredit by visiting their care credit provider login directory. Just enter your ZIP code, and you’ll get a list of approved providers near you.

For those with a carecredit/mastercard, the range of eligible purchases expands even further. You can use it anywhere Mastercard is accepted for healthcare-related transactions.

If you’re ever unsure whether something qualifies, call care credit customer service before making the payment, they’ll clarify it for you.

What makes this card stand out is its flexibility. Whether it’s your pet’s surgery, your dental implants, or your child’s orthodontics, CareCredit ensures you can pay over time without stressing your budget.

So yes, the carecredit card sign in gives you access to much more than just medical payments, it’s your personal financial bridge to a healthier life.

Tips for Managing CareCredit Responsibly

Owning a CareCredit credit card is like having a financial safety net, but it requires responsibility. Based on my personal experience, here are a few practical tips to manage your account smartly and avoid unnecessary stress.

- Always Pay on Time: Late payments can cost you in fees and negatively affect your credit score. Setting up AutoPay through your carecredit synchrony pay bill feature ensures you never miss a due date.

- Understand Promotional Terms: Many users forget about the deferred interest clause. If you don’t pay off the full amount within the promotional period, interest will apply retroactively. Keep an eye on your expiration dates in your carecredit log in account.

- Avoid Maxing Out Your Card: Keep your credit utilization low. Spending too much close to your limit might hurt your credit score and make it harder to get future financing.

- Review Statements Regularly: Always check your carecredit.com/login dashboard for errors or unauthorized transactions. If something looks off, call care credit phone number customer service immediately.

- Use It for Planned Expenses: While it’s tempting to use CareCredit for everything, it’s smarter to reserve it for necessary or planned health-related costs.

Security and Privacy of Your CareCredit Account

Security is one of those things we often overlook, until something goes wrong. Thankfully, CareCredit and Synchrony Bank have gone the extra mile to make sure your information stays protected. From my own experience, I can tell you their system is designed with multiple layers of digital security.

Synchrony also uses encrypted servers for every transaction. So when you pay care credit online, your payment details, personal data, and account information are scrambled into secure code, making it nearly impossible for hackers to read.

You can also monitor account activity through real-time alerts. It’s also worth noting that carecredit synchrony bank adheres to strict data protection laws. They never sell your information to third parties for marketing purposes without your consent.

Still, it’s wise to practice your own safety habits. Always use strong passwords (mix of letters, numbers, and symbols), log out after using shared devices, and never share your care credit card sign in details with anyone.

And if you ever suspect unauthorized activity on your account, immediately contact care credit phone number customer service. They can lock your card, start an investigation, and issue a replacement if needed.

When it comes to privacy, Synchrony Care Credit does an excellent job at keeping things secure. After all, your medical and financial information deserves the highest level of protection, and that’s exactly what they deliver.

FAQs

How do I make CareCredit credit card payment?

You can make your CareCredit credit card payment by logging into carecredit.com/login, using the mobile app, calling the carecredit phone number customer service, or mailing your payment. The easiest option is online, it’s fast, secure, and posts the same day.

What can I do with my CareCredit credit card?

You can use your CareCredit card to pay for medical, dental, vision, veterinary, and cosmetic expenses at participating providers. If you have the CareCredit Mastercard, you can also use it anywhere Mastercard is accepted for health-related purchases.

What can a CareCredit card pay for?

The CareCredit card covers a wide range of services, dental care, LASIK surgery, pet care, hearing aids, dermatology treatments, fertility services, and more. You can check participating providers on carecredit.com or by logging into your care credit provider login account.

How do I contact CareCredit customer service?

You can reach CareCredit customer service by calling the number on the back of your card or visiting carecredit.com. Their representatives can help with payments, lost cards, login issues, and general account inquiries.

Can I use CareCredit anywhere that accepts Mastercard?

Yes, but only if you have the CareCredit Mastercard. It functions like a standard Mastercard but is designed specifically for health and wellness purchases.

Conclusion

At the end of the day, managing your carecredit payment is about more than just paying bills, it’s about having peace of mind. Whether you’re covering medical, dental, pet, or wellness expenses, CareCredit gives you the freedom to focus on your health instead of stressing about costs.

What makes it truly special is the flexibility. You can handle everything, from applying at carecredit.com/start, to managing your balance at carecredit.com/login, to speaking with care credit customer service, all in one ecosystem. Plus, with Synchrony Bank CareCredit, you know your payments and information are in good hands.

So if you’re wondering whether CareCredit is worth it, the answer is yes, if you use it wisely. Set reminders, make timely payments, and take advantage of promotional financing before interest hits. Remember, carecredit isn’t just a card; it’s a bridge that helps you manage life’s unexpected health expenses without breaking the bank.

With so many convenient payment options, whether through carecredit synchrony pay bill, phone, or the CareCredit app, you’re always in control. It’s your health, your finances, and your choice, CareCredit simply makes it easier.