The Fit Credit Card login process is not just about signing in; it’s about managing your financial world with one convenient tool. If you’re new to the Fit Card family, you might feel a bit overwhelmed by all the online portals, such as fitcardinfo login, yourfitcard.com, and continental finance login.

The Fit Credit Card is designed for people who want to build or rebuild their credit. Whether you’re managing your account through www.fitcardinfo.com login or checking your balance using the fit mastercard login, the process is smooth and secure. In this article, I’ll walk you through everything, from logging in to making payments, managing your card online, and even applying for a new Fit Platinum Mastercard.

What Is a Fit Credit Card and Why It Matters

The Fit Mastercard, issued by Continental Finance, is designed for people like me, those who need a reliable card to help improve their credit score while enjoying flexibility.

The Fit Platinum Mastercard® is not just about credit; it’s about opportunity. It reports to all three major credit bureaus, Experian, TransUnion, and Equifax, so every responsible payment you make counts. The card can help you rebuild your credit score over time, especially if you use it wisely.

You can use your Fit Card almost anywhere Mastercard is accepted, whether it’s shopping online, paying bills, or dining out. And if you’re someone who likes to stay on top of things digitally, the fitcard login and fitcardinfo login portals make managing your account a breeze.

About the Fit Platinum Mastercard®

Let me tell you a bit more about the Fit Platinum Mastercard®, because this is where things really start to make sense. It’s one of those credit cards that actually helps you build a foundation instead of trapping you with confusing terms or hidden charges.

The Fit Platinum Mastercard comes with an initial credit limit, usually around $400, and after six months of consistent, on-time payments, that limit can double. That’s huge if you’re working to boost your credit utilization ratio, which plays a big part in your credit score.

With fit mastercard login, fitcardinfo login, or even through yourfitcard.com, you can check my balance, track spending, and make payments anytime. The online dashboard is easy to navigate, whether you’re accessing it from your laptop or phone.

It’s also worth noting that the card is issued by Continental Finance, the same company behind the Surge Credit Card, Reflex Credit Card, Verve Credit Card, and Cerulean Credit Card. They’re known for helping consumers with less-than-perfect credit rebuild their financial lives, and that’s exactly what the Fit Card aims to do.

How to Apply for a Fit Credit Card Easily

Applying for the Fit Credit Card is simple and can be done in a matter of minutes. I personally went through the online application on yourfitcard.com, and the process was straightforward. You just fill in your basic details, name, address, income, and a few financial questions.

Here’s what you need to do:

- Go to www.fitcardinfo.com or yourfitcard.com.

- Click on “Apply Now”.

- Enter your personal information.

- Review the terms and conditions carefully.

- Submit your application.

Once approved, you’ll get your Fit Platinum Mastercard® in the mail, usually within 7–10 business days. You’ll then activate your card using the fitcard login portal.

If you’re wondering about eligibility, you don’t need perfect credit to qualify. The Fit Mastercard is geared toward people rebuilding or starting their credit journey. That said, it helps to have a steady source of income and a valid social security number.

Eligibility and Requirements for Fit Mastercard

Before you hit that “Apply” button, it’s smart to know the eligibility rules. Luckily, the Fit Platinum Mastercard® has flexible qualifications.

Here’s what you typically need:

- You must be at least 18 years old.

- You need a valid U.S. address.

- You should have a steady source of income.

- A valid Social Security Number or Tax ID.

- You cannot have a recent bankruptcy or serious delinquency on your record.

Unlike some premium cards, the Fit Mastercard doesn’t require a high credit score. This is what makes it great for anyone trying to establish or rebuild credit. The approval process usually takes only a few minutes, and you’ll receive a notification by email or mail.

Once approved, you’ll want to activate your card right away through fitcardinfo login or yourfitcard.com. Then, you can start using it anywhere Mastercard is accepted, including online shopping, gas stations, or even to pay my verve bill online if you have other Continental Finance products.

Step-by-Step Guide to Fit Credit Card Login

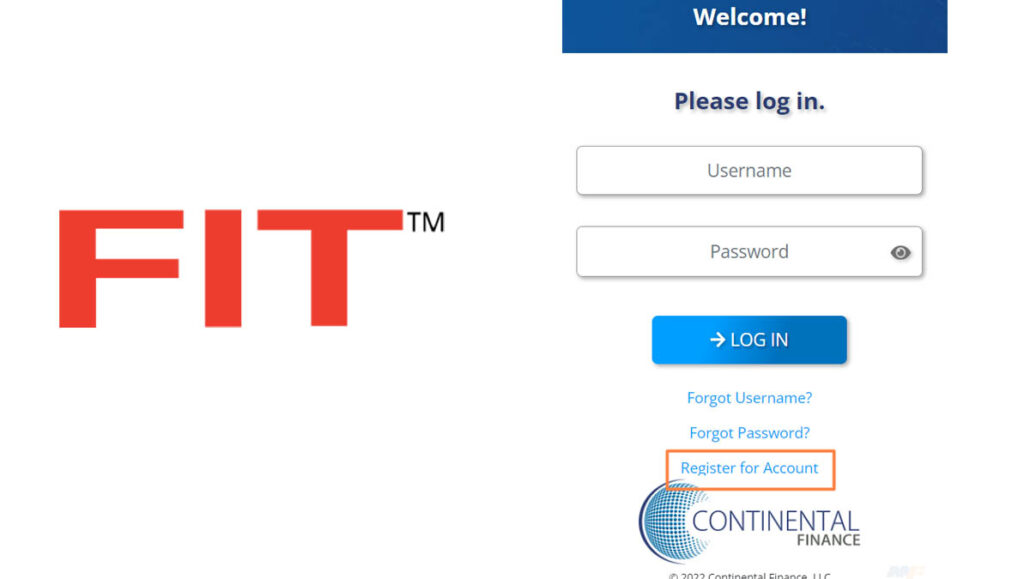

Logging into your Fit Credit Card account is where you’ll start managing your credit life effectively. The fitcard login process gives you 24/7 access to your account details, so you never have to guess your balance or due date again.

Here’s how to do it:

- Visit www.fitcardinfo.com login or yourfitcard.com.

- Click on “Login” or “Account Sign-In.”

- Enter your username and password.

- Click “Submit” to access your dashboard.

Once logged in, you can view your balance, payment history, statements, and due dates. It also lets you set up automatic payments so you never miss a due date, this is a lifesaver if you’re trying to boost your credit score.

Using www.fitcardinfo.com Login

The www.fitcardinfo.com login page is the official site for managing your Fit Mastercard account. It’s secure, user-friendly, and available 24/7. I often use it to check pending transactions and confirm payments.

Accessing YourFitCard.com Login Portal

Alternatively, yourfitcard.com login is another secure gateway for your account. It offers the same functionality as the FitCardInfo portal but with a slightly different interface. If one site is down, you can always use the other.

Alternative Login via Continental Finance Login

If you hold other Continental Finance cards like the Surge Credit Card or Reflex Card, you can use the continental finance login to manage multiple accounts in one place. This saves you from juggling between portals like surgecardinfo.com login or reflex credit card login.

How to Recover Your FitCard Login Credentials

If you’re anything like me, you’ve probably forgotten your password at least once. Don’t panic, it happens. Recovering your fitcard login credentials is quick and easy.

Here’s how:

- Visit fitcardinfo.com login or yourfitcard.com.

- Click “Forgot Username or Password.”

- Enter your registered email or card number.

- Follow the link sent to your email to reset your password.

It’s important to create a strong password and update it regularly to keep your account secure. Continental Finance also recommends not using public Wi-Fi for logging in, especially when accessing financial information.

Navigating the FitCardInfo Login Dashboard

Once you’ve successfully completed the fitcardinfo login, you’ll land on a dashboard that serves as your control center. You don’t need to be a tech genius to use itit’s straightforward and designed for real people.

From the dashboard, you can:

- Check your account balance and available credit.

- View your payment due date and minimum payment.

- See your recent transactions and pending authorizations.

- Update your personal details, like your phone number or mailing address.

- Set up paperless billing to receive e-statements directly to your email.

What I like most about the Fit Platinum Mastercard dashboard is its convenience. Whether you’re checking your balance before making a purchase or reviewing your spending habits, everything is accessible in one place.

The portal also includes a section for alerts and messages, these are helpful reminders about upcoming payments or important updates from Continental Finance. If you also have a Surge Credit Card or Reflex Card, you’ll notice that the layout is similar across their portals like surgecardinfo.com login or reflex credit card login, making it easier to manage multiple accounts.

How to Pay Bills Online Using FitCard

Paying bills used to be a headache until I started using the Fit Credit Card online payment system. With fitcard login, you can make payments in just a few clicks.

Here’s how to pay your Fit Platinum Mastercard bill online:

- Go to www.fitcardinfo.com login or yourfitcard.com login.

- Sign in with your username and password.

- Click on “Make a Payment.”

- Enter your payment amount and bank account details.

- Confirm the payment and save the confirmation for your records.

You can set up automatic payments too, which ensures your bill is paid on time every month. This is one of the smartest ways to build good credit habits.

Pay via Verve Card Pay My Bill

If you also hold a Verve Credit Card, you can use the Verve Card Pay My Bill option through the www.vervecardinfo.com log in page. It’s under the same Continental Finance family, so the interface and process are similar to the FitCard payment portal.

Pay Through Today Card Login

Some people prefer the Today Card Login method, which is another easy way to manage payments across cards like Fit Mastercard or Surge Credit Card. It’s all integrated through the same financial network, making it smooth and user-friendly.

Access via SurgeCardInfo.com Login

The Surge Credit Card login account at surgecardinfo.com login or www.surgecard.com login also works for those managing multiple cards. If you’ve got both the Fit Card and Surge Card, this cross-platform access makes handling finances easier.

Managing Your Fit Platinum Mastercard Account

Managing your Fit Platinum Mastercard is more than just logging in, it’s about staying financially organized. Personally, I use my account dashboard to monitor spending patterns and make sure I’m not overusing my available credit.

Here’s what you can do once logged in:

- Set up notifications for due dates or suspicious activity.

- Update billing addresses or payment details.

- Track monthly statements in PDF format for easy downloading.

- Request a credit limit increase after six months of good payment history.

- Enroll in auto-pay so you never miss a due date.

And if you have questions, the site has a robust FAQ section and a customer service link that connects you with Continental Finance support. They’re quite responsive, whether it’s about the Fit Card, Revel Credit Card, or Cerulean Credit Card Login.

Understanding Continental Finance and Its Role

You’ve probably noticed the name Continental Finance appearing frequently. That’s because they’re the company that issues the Fit Credit Card, along with several other credit-building products like Surge, Reflex, Verve, and Revel cards.

Continental Finance is known for catering to individuals who might have less-than-perfect credit. Their main goal is to provide a second chance at rebuilding financial trust. Each of their credit cards, whether it’s the Fit Mastercard, Surge Credit Card, or Reflex Card Login, reports to all three major credit bureaus.

That means every on-time payment you make helps improve your credit score. And if you use the online management portals correctly, like fitcardinfo login or surgecardinfo.com login, you’ll always know where you stand.

The company also emphasizes transparency, which is something I respect. You can clearly see fees, APRs, and account terms right on the website. That’s a level of honesty not every credit card issuer provides.

How to Enroll in Fit Online Account Management

Getting started with Fit online account management is one of the best decisions I made after receiving my Fit Platinum Mastercard. It not only saves time but also keeps me in full control of my finances. If you’re wondering how to get started, don’t worry, it’s easy, and I’ll guide you through it.

Here’s the step-by-step process:

- Go to www.fitcardinfo.com login or yourfitcard.com.

- Click on “Enroll” or “Register Your Account.”

- Enter your Fit Credit Card number, name, and Social Security number.

- Create your username and password.

- Verify your email and complete the enrollment.

Once you’re enrolled, you’ll have access to everything, your current balance, available credit, transaction history, and even downloadable statements. You can also set up text alerts, which remind you of upcoming payments or suspicious transactions.

Where Can I Use My Fit Credit Card?

This is one of the most common questions I get from friends who are new to the Fit Platinum Mastercard®: “Where can I actually use my Fit Credit Card?” The answer is simple, anywhere Mastercard is accepted.

That means you can use your Fit Card for:

- Online shopping on websites like Amazon, Walmart, and Target.

- In-store purchases at gas stations, restaurants, and retail shops.

- Paying bills such as utilities, phone, and internet.

- Booking travel, hotels, or rental cars.

You can use my Fit Mastercard everywhere from grocery stores to streaming services, and it’s been accepted without a problem. Since it’s part of the Mastercard network, it enjoys worldwide acceptance, perfect for both local and international use.

And if you ever forget where you can use it, the fitcardinfo.com login dashboard even provides insights on where your card has recently been used. This helps you stay on top of your spending habits and avoid any unauthorized charges.

Security Tips for Using Your FitCard Online

When it comes to financial management, security is everything. I’ve learned a few smart habits that keep my Fit Credit Card account safe whenever I use fitcard login or www.fitcardinfo.com login.

Here are some personal tips I recommend:

- Always use a secure Wi-Fi connection. Avoid logging in on public or shared networks.

- Update your password regularly. A strong password includes a mix of letters, numbers, and symbols.

- Turn on two-factor authentication if available.

- Check your account frequently. I make it a habit to log in every few days to spot any suspicious activity early.

- Log out after every session, especially when using shared computers or devices.

Continental Finance also encrypts all user data, so every transaction or login you make via fitcardinfo login is protected. Still, your best defense is vigilance, monitor your account and report anything unusual right away.

Common Issues with Fit Credit Card Login and How to Fix Them

Here are some of the most common login problems and how to resolve them:

Forgotten Password or Username

- Click on “Forgot Password” at fitcardinfo.com login.

- Follow the instructions sent to your registered email.

Website Not Loading

- Try clearing your browser cache or use another browser.

- You can also access yourfitcard.com as an alternative.

Account Locked

- After multiple failed login attempts, your account may lock for security reasons.

- Wait 15 minutes and try again or contact Continental Finance support.

Payment Errors

- Double-check your bank details and ensure sufficient funds.

- If the issue persists, contact customer service.

The Fit Mastercard customer support team has always been helpful. They’re available through phone, email, or live chat to help you resolve login or payment-related problems.

Mobile Access: Fit Login on the Go

You don’t need to be tied to a computer, whether you’re traveling, at work, or waiting for your coffee, you can sign in to fitcardinfo login or yourfitcard.com login straight from your phone’s browser.

Here’s what to do:

- Open your mobile browser and visit www.fitcardinfo.com

- Then the tap Login, enter your credentials, and in seconds, you’re looking at your balance and transactions.

- The site automatically adjusts to fit the screen, so you don’t have to pinch and zoom.

Through this mobile portal, you can pay my Fit Mastercard bill, check your due date, and even set reminders. Some users also bookmark continental finance login or fit mastercard login to make it a one-tap experience.

Customer Support for Fit Mastercard Login Issues

No matter how smooth technology gets, sometimes you just need a human touch. Thankfully, Fit Credit Card has a responsive customer support team.

Here’s how you can contact them:

- Phone Support: The number is listed on the back of your card or on www.fitcardinfo.com.

- Email Support: Use the “Contact Us” form on yourfitcard.com.

- Mailing Address: You can also send correspondence to Continental Finance’s customer service center (address found on the website).

- They can help with everything from forgotten passwords and declined payments to billing errors or disputes.

FAQs

Where can I use my Fit Credit Card?

You can use your Fit Credit Card anywhere Mastercard is accepted online, in-store, and internationally. That includes grocery stores, gas stations, restaurants, and even for paying bills or streaming services.

How do I access my Fit MasterCard account online?

Simply go to www.fitcardinfo.com login or yourfitcard.com. Enter your username and password, and you’ll be taken to your account dashboard where you can manage payments and view your transactions.

What is the Fit Credit Card?

The Fit Platinum Mastercard® is a credit-building card issued by Continental Finance. It’s designed for people with less-than-perfect credit who want to rebuild their credit history responsibly.

How do I log in to my Fit™ Platinum MasterCard® account?

You can log in by visiting fitcardinfo.com or yourfitcard.com, clicking “Login,” and entering your account credentials.

How do I enroll in Fit online account management?

Go to yourfitcard.com, click “Enroll,” and provide your card information, Social Security number, and contact details. Once completed, you’ll gain access to your online account.

How do I apply for a Fit Credit Card?

Visit www.fitcardinfo.com or yourfitcard.com, click on “Apply Now,” fill out the form, and submit it. You’ll receive a response within minutes, and if approved, your card will arrive in about a week.

Conclusion

In conclusion, the Fit Credit Card login system is more than just a way to access your account, it’s a gateway to better financial control. From www.fitcardinfo.com login to yourfitcard.com, every tool is designed to make managing your Fit Platinum Mastercard smooth, safe, and efficient.

Whether you’re paying bills, checking transactions, or rebuilding credit, this card does its job well. I’ve used many cards, but the Fit Mastercard stands out because it makes financial growth possible for everyday people like you and me.

So, if you’ve been thinking about taking charge of your credit journey, don’t wait, apply for your Fit Credit Card today and take that first confident step toward financial freedom.