If you values convenience, security, and having control over your policies at your fingertips, then knowing how to use Brighthouse Financial Login and use the Brighthouse platform can make a big difference.

Brighthouse Financial is one of the leading providers of annuities and life insurance in the United States, and they’ve built an online servicing system that allows customers to easily access their policy details, make updates, and even connect with customer support without leaving home. Imagine being able to review your retirement plans while sipping coffee at home or checking the status of your life insurance policy right from your phone, it’s that simple once you know how the login process works.

Logging into your account gives you access to all the important features: policy summaries, payment history, updating beneficiaries, downloading statements, and more. If you’ve ever had to deal with waiting on hold for hours just to ask a small question about your financial plan, then you’ll appreciate how much smoother life gets once you’re using the Brighthouse Financial login portal.

How Much is Homeowners Insurance on a $150000 House

How Much Would a $1000 Payday Loan Cost

Mortgage Lenders have the Lowest Rates

Get a Loan- Find a Loan Lender

Housing Assistance Payments

Mortgage 30 Year Fixed Rate – Find the Best Rates & Info

Mortgage 0 Down – Buy a Home with No Down Payment

Loan Discharge – Understand Your Options & Eligibility

Loan Xpress Pay – Fast Online Personal Loans

Loan 3000 – Get a $3000 Loan Instantly

Loan to Pay Off Credit Cards – Consolidate Debt & Save Money

Mortgage 150k House – How Much House Can I Afford

Understanding Brighthouse Financial

Before we dive deeper into the login details, it’s important to understand who Brighthouse Financial is and how it connects to the larger financial landscape.

Who is Brighthouse Financial?

Brighthouse Financial is a major provider of annuities and life insurance products in the U.S. The company’s mission is clear: to help people achieve financial security and peace of mind, especially when planning for retirement. What sets Brighthouse apart is its focus on simplicity and transparency, something we don’t always see in the financial industry.

Is MetLife Now Brighthouse Financial?

One of the most common questions people ask is whether MetLife and Brighthouse are the same company. The answer is a little nuanced. Brighthouse Financial was actually spun off from MetLife in 2017. While they share a history, today Brighthouse operates as a completely independent company.

That means if you previously had a policy with MetLife, there’s a good chance it was transferred to Brighthouse. This is why many people end up searching for the Brighthouse Financial login instead of a MetLife login when they need to access their account.

Does Brighthouse Still Exist Today?

Yes, absolutely. Some people get confused because of the transition from MetLife, but Brighthouse Financial is still very much around and serving millions of customers nationwide. The company continues to expand its services and strengthen its online tools, making it easier than ever to stay on top of your policies.

Why Brighthouse Financial Login is Important

The Brighthouse Financial login is your key to unlocking all the important features of your account.

Easy Access to Policy Information

Gone are the days of digging through paperwork or waiting for monthly statements in the mail. With your login, you can instantly check your policy details, see current balances, and monitor the performance of your investments. It’s like having your entire financial file neatly organized in one digital space.

Managing Annuities and Life Insurance Online

If you have an annuity with Brighthouse, the login lets you check interest earnings, make adjustments, and track how your retirement funds are growing. For life insurance, you can confirm your coverage, manage beneficiaries, and keep your policy up to date. Instead of calling customer service for every little thing, you’ll have the power to handle it on your own.

Secure Digital Servicing Benefits

Brighthouse has built strong protection features to keep your financial data safe. Multi-factor authentication, encryption, and monitoring systems work behind the scenes to ensure that your sensitive information stays private.

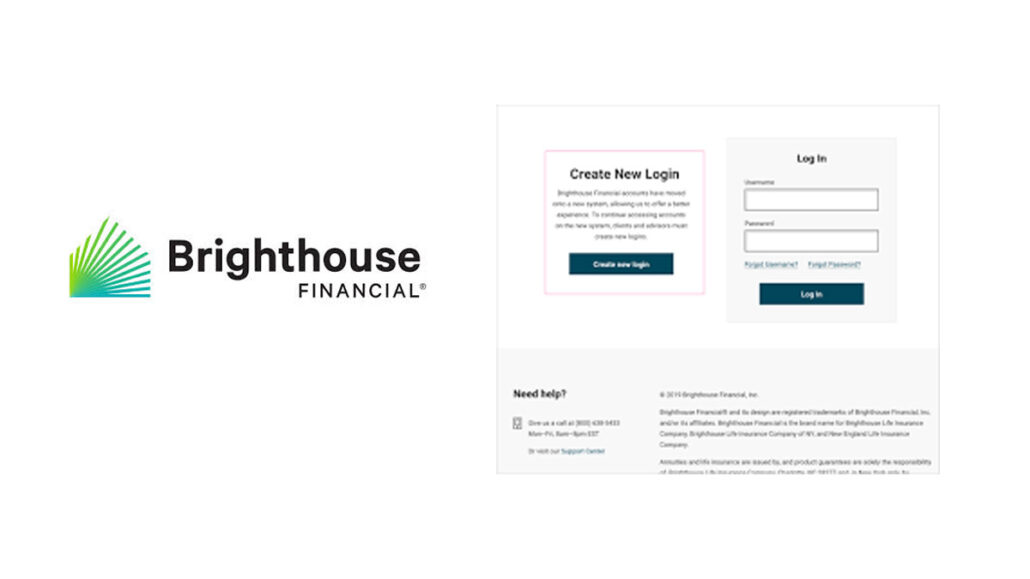

How to Access Brighthouse Financial Login Portal

Now, let’s get into the part you’ve probably been waiting for, the actual steps to log in. The process is pretty straightforward, but if you’re new, I’ll break it down so you don’t get lost.

Step-by-Step Login Process

- Open your web browser and go to the official Brighthouse Financial login page.

- Enter your username and password in the fields provided.

- Click “Log In” to access your account.

That’s it, you’re in!

Forgotten Username or Password Recovery

We’ve all been there, staring at the screen because we forgot a password. Luckily, Brighthouse makes it easy to recover. On the login page, you’ll see links that say “Forgot Username” or “Forgot Password.” Just click the right one, follow the steps, and you’ll regain access. They usually send a verification code to your email or phone for security.

First-Time Registration Guide

If it’s your first time using the online servicing portal, you’ll need to create an account. Here’s how:

- Go to the Brighthouse Financial login page.

- Click on “Register Now.”

- Enter your policy number, Social Security number, or other identification details.

- Create a username and password.

- Verify your identity through email or phone.

Once that’s done, you’ll have your own online account ready to go.

Exploring Brighthouse Financial Online Servicing

Once you’re logged in, the platform opens up a wide range of tools that make managing your finances a lot easier.

How Do I Start Using Brighthouse Financial Online Servicing?

Starting is as simple as registering your account and signing in. Once you’re inside, you’ll see a dashboard with different sections for your policies, payments, and account settings. It’s intuitive and designed to guide you step by step, so you don’t have to guess where to click.

Tools Available After Login

Some of the features you’ll have access to include:

- Viewing policy details and balances

- Downloading statements and tax documents

- Updating beneficiaries and contact information

- Setting up or modifying payment schedules

- Accessing customer support directly through the portal

Security Features Protecting Your Account

The portal isn’t just convenient, it’s also secure. Brighthouse uses encryption, firewalls, and monitoring systems to protect sensitive data. They also encourage users like you and me to set strong passwords and keep login details private.

Contacting Brighthouse Financial

How Do I Contact Brighthouse Financial?

Brighthouse provides multiple ways to get in touch, depending on what you need. The easiest is through the customer portal, but you can also use phone, email, or mail.

- Phone: You can call their customer service team directly. They usually list different numbers for annuities, life insurance, and general inquiries.

- Email: If you prefer writing things down, Brighthouse also has email support for policyholders.

- Mail: For official documents or requests, you can always send them through their mailing address.

Customer Service Hours and Phone Numbers

Most of Brighthouse’s support lines operate Monday through Friday during normal business hours. They often provide dedicated lines for different products, so you’re connected to the right team immediately.

For example:

- Annuities support line

- Life insurance support line

- General customer inquiries line

Support Through Email and Mailing Address

If calling isn’t your style, you can reach them by email through their website’s secure messaging system. They also maintain a mailing address for official correspondence like policy changes or claims. I always recommend using the secure portal whenever possible since it’s faster and safer than traditional mail.

Brighthouse Financial Mobile Access

We live in a mobile-first world, and Brighthouse knows it. That’s why they’ve made sure you can manage your account on the go, not just on a desktop computer.

Does Brighthouse Have an App?

Yes, Brighthouse offers a mobile app that makes the login experience even smoother. I love that I can pull out my phone, log in, and check my policy in seconds, whether I’m at the coffee shop, traveling, or just relaxing at home.

The app offers most of the same features as the desktop portal, including:

- Viewing policy details

- Downloading documents

- Making payments

- Updating contact information

- Reaching customer support

Mobile Login Process

Logging into the app works just like the desktop version. You use your username and password, and for extra protection, you can enable biometric security like fingerprint or face recognition. That way, you don’t have to remember your login details every time.

Advantages of Managing Policies On-the-Go

The biggest advantage is convenience. Plus, the app is designed to be user-friendly. Everything is simplified for mobile use, so you’re not dealing with tiny text or endless scrolling.

FAQs

How do I contact Brighthouse Financial?

You can contact them by phone, email, or mail. They also have a secure portal for online support.

Does Brighthouse Financial offer life insurance?

Yes, they provide term and universal life insurance policies designed to protect your loved ones.

How do I start using Brighthouse Financial online servicing?

Simply register for an account on their login page, verify your identity, and you’ll have access to your policies.

Who is Brighthouse Financial?

Brighthouse is a leading provider of annuities and life insurance in the U.S., spun off from MetLife in 2017.

Where can I find a list of Brighthouse Financial ratings?

You can find them on rating agency websites like AM Best, Moody’s, and Standard & Poor’s.

What’s new at Brighthouse Financial?

They’ve been improving their digital tools, streamlining products, and enhancing customer support.

Is MetLife now Brighthouse Financial?

No, Brighthouse became independent from MetLife in 2017, but many MetLife policies were transferred.

How do I access my Brighthouse policy?

Log in through the Brighthouse Financial portal or mobile app to view and manage your policy.

Does Brighthouse still exist?

Yes, Brighthouse continues to operate as one of the largest U.S. annuity and life insurance providers.

Does Brighthouse have an app?

Yes, their mobile app allows you to manage your account on the go.

Conclusion

The Brighthouse Financial login isn’t just about signing into an account, it’s about taking control of your financial future. With one simple login, you can manage your life insurance, track annuities, download documents, and contact support without ever leaving your home.

Brighthouse has proven that they’re not only financially strong but also customer-focused, offering tools that make life easier. Whether you’re planning for retirement, protecting your family, or simply staying on top of payments, the login portal is your best friend.