When talking about 4Front credit union login, it means the secure process you use to access your 4Front Credit Union account online or through the app. In this first‑person‑friendly guide, I explain how you can register, log in, and understand how it all works. I’ll keep the language simple, no technical jargon and I’ll walk you through it like a friend explaining to another friend.

- Mainstreet Credit Union Login – How to Access Your Account Securely

- Charter Oak Federal Credit Union Login – Secure Access

- Credit Union for Mortgage – Get Preapproved for a Home Loan

- Credit Union For Car Loan – Apply for a Credit Union Car Loan

- Eastman Credit Union Near Me – Find Eastman Credit Union Branch & ATM Locations

- Lake Michigan Credit Union Near Me – Find LMCU Branches & ATMs Location

- Radiant Credit Union Login – How to Access My Account

- Clark County Credit Union Login – How to Log in to Online Banking

- Sikorsky Credit Union Login – How to Access Your Account Online

What is 4Front Credit Union Login?

4Front Credit Union Login is the way you get into your 4Front account on the internet. Think of it like your key to your financial world: checking balances, transferring money, viewing statements, managing cards, everything you need, all behind a login screen.

It’s not just about convenience; it’s about security, convenience, and being in control. That login lets you do things like:

- Check your checking and savings balances

- Transfer funds between accounts

- Make loan payments

- Order more checks

- Set up alerts or notifications

Why Does the Login Matter to You?

You might wonder: “Why should I care about the 4Front credit union login?” Well, I’ll tell you, it matters because it’s how you stay in charge of your money without stepping into a branch. Instead of driving across town to deposit a check, you can use your mobile phone for deposit instead..

Here’s why the login matters:

- Convenience and speed: When you log in, you can do banking in minutes, not hours. You can pay bills, transfer funds, and deposit checks all from your phone. You can, too, with just a few taps.

- Security and control: Once logged in, you can see alerts about suspicious activity, freeze a lost card, or set spending limits instantly.

- Full access to your products: Whether you have a checking account, a savings account, a loan, or a credit card, the login gives you one place to see everything and manage it.

- Better money management: Using alerts and budgeting tools that show you how to use your money. It helps you notice recurring payments you didn’t want. You can get the same clarity.

- Support and account help: Need to open a new account, ask a question, or message support? Inside the login portal, you can do messaging. You don’t need to call or visit just log in.

That’s why 4Front credit union login isn’t just a login, it’s your portal to easy, secure banking.

Registering for Online Access

Before you can log in, you need to register. Here’s how to get set up easily.

Eligibility Requirements

First off, you need to meet some basic requirements:

- Be a member of 4Front Credit Union

- Have a valid member number or account number

- Provide a social security number or tax ID for identity verification

- Have an email address and/or U.S. or local phone number for verification codes

- Be at least 18 years old or have a co‑applicant if younger

Step‑by‑Step Registration Process

Here’s how to walk through registration and how you can do it, too:

- Visit the 4Front Credit Union website: Go to the main site and look for the “Online Banking” or “Login” link sometimes labeled as “Enroll Now” or “Register.”

- Choose “New User? Register”: click the link and enter your member number, last four of SSN, and account or loan number.

- Provide your contact info: Enter a current email address and phone number. You’ll get a one‑time code to verify.

- Create a username: You pick a username something you can remember, but that’s not your email. Choose something simple but unique.

- Set your password: Create a strong password: at least 8 characters, mix upper/lower case, numbers, special symbols. You should make it easy for you to recall but hard for others to guess.

- Setup security questions: They’ll be asked to choose at least three questions and answers (like mother’s maiden name, first pet’s name). These help recover access if you forget.

- Accept terms & finish: Review and accept the terms, then click “Submit”. Within moments, I got a confirmation email and/or SMS.

Once you complete that, congratulations, you’ve created your 4Front credit union login credentials. You’ll now log in with your chosen username and password.

Logging In: Step‑by‑Step

Now that you are registered, let’s talk about how to log in. There are two main ways:

Desktop/Web Login

When on a laptop or desktop:

- Go to the official 4Front site and click “Login”.

- Enter your username and password.

- Sometimes, they ask for a security code sent via SMS or email; this is 2FA.

- After entering it, you’ll arrive in your online dashboard.

From there, you can navigate to your accounts, pay bills, transfer funds, or check statements.

If you try and fail too often, the system may lock you out, so you’d need to click “Forgot Password” or sometimes “Unlock Account” and follow recovery steps.

Mobile App Login

Logging in there is similar but easier:

- Open the app.

- Enter your credentials.

- If enabled, use biometric login (like fingerprint or Face ID) instead of typing every time.

- The app may ask for 2FA if it detects a new device or location.

Security Measures You Should Know

Keeping your account safe matters to both you and me. Here are the key security practices around 4Front credit union login.

Two‑Factor Authentication (2FA)

4Front uses two‑factor authentication to help keep your account secure.

- After entering username and password, they send you a one‑time code via SMS or email.

- You have to enter this code before getting access.

- Always keep your phone updated and secure so that the code doesn’t get intercepted.

This adds a second layer so that even if someone guesses your password, they still can’t get in without that code to your device.

Password Tips

From experience, a strong password matters a lot. Here’s what to follow:

- Use at least 8–12 characters

- Include uppercase and lowercase letters, at least one number, and one special symbol (like ! @ #)

- Avoid using personal info like birthdays or pet names

- Change your password every few months

- Never reuse the same password from other sites

You can use a password manager if you want one place to keep your secure passwords and you never have to remember them all. Just remember your master password.

Resetting Your Password or Username

Let’s face it, forgetting login credentials happens to the best of us. Resetting it is straightforward.

If you forget your password, here’s how you can reset it:

- Go to the login page on the website or app.

- Click on “Forgot Password?” it’s right under the login form.

- Enter your username and verify your identity (they may ask for last 4 digits of SSN, phone number, or account number).

- They’ll send a temporary password or reset link to your registered email or phone.

- Click the link or enter the temporary code and create a new password.

Make sure your new password is strong and secure don’t just change one letter of the old one.

If you forgot your username, here’s what to do:

- Tap on “Forgot Username?” on the login screen.

- Enter your registered email address or phone number.

- Follow the instructions they send via your chosen method.

Now, if you’re locked out because of too many failed login attempts, you’ll usually see a message that says “Account Locked.” At that point, you can either wait for a temporary unlock period or contact support to regain access immediately.

Tip from me? Try using a password manager, it’s saved me from the headache more times than I can count.

Features Available After Login

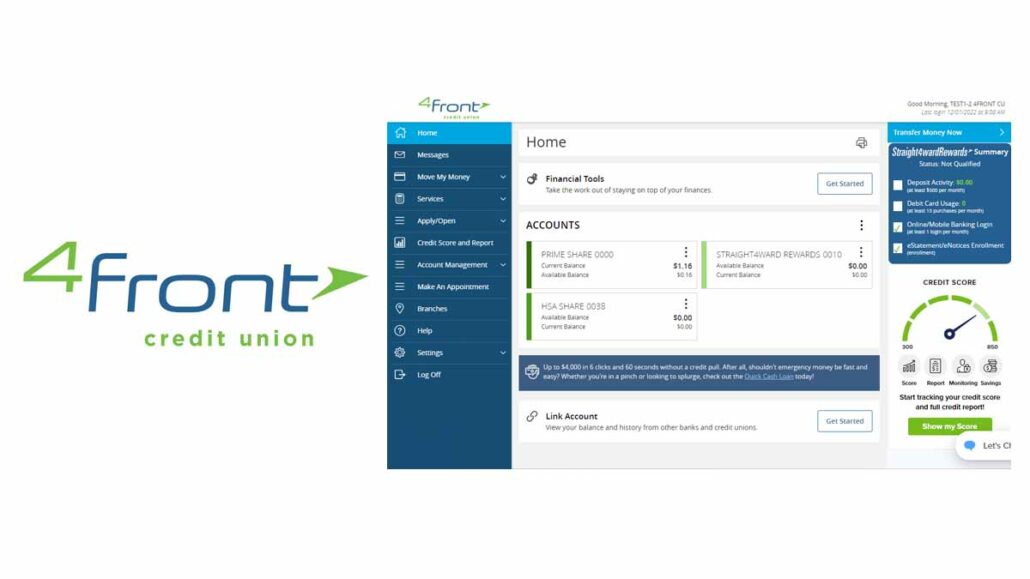

Once you’ve successfully completed your 4Front credit union login, a world of features opens up. The online banking dashboard is more than just a place to check balances, it’s your financial control center.

1. Account Overview

The first thing you see after logging in is a summary of all your accounts checking, savings, loans, and credit cards. Everything is displayed clearly, showing current balances and available funds.

2. Transfer Funds

This one’s a lifesaver. You can easily transfer money:

- Between your own accounts

- To other 4Front members

- To external accounts (with linked bank info)

The transfers are usually instant or next-day, depending on the method you choose.

3. Bill Pay

You can pay bills from within your account utilities, credit cards, rent, and subscriptions. You can have several recurring payments set up, and they just go through automatically. No late fees, no stress.

4. Mobile Check Deposit

Stopped going to the branch altogether because of this. You can just take a photo of your check using the mobile app and deposit it instantly. It usually clears within a day.

5. Statements and Documents

Need a past statement for tax time? It’s all there under e‑Statements. I love that you can go back several months and even download a PDF version if needed.

6. Card Management

Lost your debit card? No worries, you can lock or unlock it from the app. The 4Front credit union login gives you full control, and once you start using it, you won’t want to bank any other way. It’s like having the branch in your pocket.

Mobile App vs. Web Portal: What’s the Difference?

Both the 4Front web portal and mobile app offer secure access, but each has its own perks.

Web Portal (Desktop)

- Larger display: Easier to see multiple accounts at once.

- Statement downloads: I prefer using desktop to download and print statements.

- Detailed account management: When I need to update my profile info, manage alerts, or change password, desktop is ideal.

Mobile App

The mobile app is perfect for on-the-go banking. I love it because:

- Biometric login: you can log in with your face or fingerprint super fast.

- Mobile check deposit: No need to visit a branch or ATM.

- Instant transfers: you once paid back a friend from my car in under a minute.

Common Login Problems and Fixes

Here are some of the most common problems and how you can fix them:

1. Wrong Password or Username

Most login issues are just typos. Double-check:

- Caps Lock is off

- No accidental spaces at the end

- You’re not mistaking O (letter) for 0 (number)

If you can’t remember your credentials, just follow the “Forgot Username” or “Forgot Password” link.

2. Account Locked

If you enter the wrong info too many times, your account might be locked for security. You’ll either:

- Get an auto-unlock after a waiting period

- Need to call customer support for manual unlock

3. 2FA Not Working

Sometimes you don’t receive the one-time passcode right away. In that case:

- Make sure your phone has a signal

- Check your spam/junk folder if it’s an email

- Try “Resend Code”

4. Browser or App Issues

If your browser isn’t working:

- Clear cache and cookies

- Use an updated browser like Chrome or Firefox

- Try incognito/private mode

For the app:

- Make sure it’s updated

- Try uninstalling and reinstalling

If all else fails, contact customer support they’ve always been helpful.

Contacting 4Front Credit Union for Login Help

When the 4Front credit union login isn’t cooperating or you have security concerns, reaching out to support is the best move.

Here’s how to get help:

- Call Customer Service: You can reach them at their phone number during business hours. They’ll help you reset passwords, unlock accounts, or troubleshoot technical issues.

- Visit a Branch: If you’re near a local branch, the staff are friendly and helpful.

- Use Secure Messaging: After you log in, there’s a secure messaging system where you can send questions or concerns.

- Email and Live Chat (if available): Sometimes the site has a chat feature, which is great for quick questions. But for login issues, phone support is usually faster.

Have your account number ready and verify your identity when asked.

How Safe is Your Information on 4Front Credit Union?

Is this really safe? What if someone hacks into my account?” I’ve learned how secure the platform really is.

1. Advanced Encryption

4Front uses industry-standard 256-bit SSL encryption, which means your data is protected while being transmitted. It’s the same type of encryption that big tech companies use, and never experienced any breach.

2. Secure Login Features

Besides passwords and usernames, they also use multi-factor authentication. Every time you log in from a new device, they send you a one-time code via email or text. Even if someone guessed your password, they wouldn’t be able to get in without your phone or email access.

They also let you enable alerts for every login or suspicious activity, which gives you peace of mind.

3. Biometric Login

The mobile app lets you log in with your fingerprint or face ID, depending on your phone. I love this because it’s both secure and fast.

4. Fraud Monitoring

You get an alert when someone tried to make a suspicious charge. 4Front caught it before it processed, locked your card, and helps issue a new one. They’re always monitoring your accounts behind the scenes.

5. Tips I Use to Stay Safe

- Never click login links in emails always go directly to the official site.

- Use a password manager to generate strong, unique passwords.

- Avoid using public Wi-Fi when accessing your bank account.

- Log out after every session, especially on shared devices.

Why Should You Choose 4Front Credit Union?

1. Member-Owned Structure

Unlike big banks that answer to shareholders, 4Front is a credit union. That means it’s member-owned, and any profits go back to us, the members, through better rates and lower fees. 4Front offered me a better APR on an auto loan than any big-name bank.

2. Local Focus, Personal Touch

They’re based in Michigan and support the local community. Every time you walk into a branch or call, the staff are genuinely helpful. It’s not just some corporate call center experience.

3. Competitive Products and Services

- Free checking accounts

- High-yield savings options

- Loans with low fees

- Credit cards with rewards

The 4Front credit union login ties all these services together. It gives you a single dashboard to manage everything, making it easier to take advantage of their offers.

4. Financial Education and Tools

They don’t just want to take your money, they help you grow it. They offer budgeting tools, savings calculators, and free financial literacy resources.

5. Digital-First Banking That Works

They’ve invested heavily in technology, and it shows. The mobile app is smooth, secure, and constantly updated.

If you’re asking yourself, “Why should I join 4Front?” my answer is simple: you’ll get excellent service, better rates, and a sense of being valued, not just numbered.

4Front Credit Union Services You Can Access After Login

Once you’ve passed the 4Front credit union login, there’s a whole suite of digital services waiting for you. Use these tools every week; they make managing your money faster and simpler.

1. Checking Accounts (What is 4Front checking?)

Their checking account, also known as 4Front Free Checking, comes with:

- No monthly fees

- Free eStatements

- Free debit card

- Online & mobile access

- Over 30,000 surcharge-free ATMs

Used this for daily expenses, automatic bill pay, and direct deposits. The best part? No surprises or hidden fees.

2. Savings Accounts

Yes, 4Front offers savings accounts, too!

- Competitive interest rates

- No monthly fees

- Automated transfers from checking

- Option to open multiple savings “goals” accounts

You can even set savings goals in the app, and it’ll help you track your progress.

3. Loans & Mortgages

After logging in, you can apply for loans or check the status of the ones you already have. They offer:

- Auto loans

- Personal loans

- Home equity lines

- Mortgages

The application process is smooth. You can apply for a car loan through your account, sign everything electronically, and have funds approved within hours.

4. Credit Cards

Got a Visa Rewards Card? You can manage it entirely online checking transactions, paying the balance, setting limits, and even freezing the card if needed.

5. Financial Tools and Calculators

After login, there are tools to help with:

- Budgeting

- Retirement planning

- Savings growth estimates

- Debt payoff planning

Everything is designed to make you feel empowered, not overwhelmed.

Tips for First-Time 4Front Credit Union Login Users

If you’re logging into 4Front for the very first time, let me give you a few tips.

1. Don’t Skip the Setup Emails

After registering, 4Front sends confirmation emails. They might include login instructions, temporary credentials, or next steps.

2. Enable Two-Factor Authentication Immediately

Even if it’s not required at first, go into your settings and turn on 2FA. It adds a big layer of protection. You’ll need your phone or email to get a code every time you log in on a new device.

3. Use the App as Your Main Portal

Honestly, the mobile app is super convenient. Download it from the Apple App Store or Google Play Store, and log in using your new credentials.

4. Bookmark the Official Website

There are phishing scams out there. Always bookmark the official site, so you don’t accidentally click on fake links.

5. Set Up Alerts Right Away

Inside your dashboard, go to alerts and notifications. to set up alerts for:

- Every login

- Large transactions

- Balance below $100

It keeps me aware of what’s going on without having to constantly log in.

FAQs

How do I make a payment to 4Front Credit Union?

There are a few easy ways you can make a payment:

- Log in to your account and use the Bill Pay feature

- Use the mobile app to transfer money or pay a loan

- Set up automatic payments from your checking or savings

- Visit a branch or call support to make a manual payment

You can set up recurring payments, so you never miss one.

Why should you choose 4Front Credit Union?

Chose them because they’re member-owned, which means they work for us, not for profit. They offer low fees, great customer service, local community involvement, and easy-to-use digital tools. It’s banking that feels personal and honest.

Does 4Front Credit Union have a savings account?

Yes, absolutely! They offer savings accounts with competitive interest rates. Open one to build an emergency fund, and you can create separate savings goals for different needs. It’s easy to manage online, too.

Why should I join 4Front?

If you want a credit union that’s secure, modern, and focused on YOU, not just your money, 4Front is a solid choice. They have everything from free checking and high-yield savings to loans, credit cards, and a user-friendly login system that works.

How do I control my 4Front debit & credit card?

Once you log in, you can:

- Lock or unlock your card instantly

- Report it lost or stolen

- Set spending alerts or limits

- Monitor real-time transactions

- Activate or deactivate your card

What is 4Front checking?

4Front Checking is a free checking account with no monthly fees, unlimited digital access, and a debit card. It’s perfect for everyday banking. You get access to online bill pay, mobile check deposit, and real-time account monitoring through the app or website.

Is the 4Front credit union login safe to use on public Wi-Fi?

I don’t recommend using public Wi-Fi for any banking, even with 4Front. While their encryption is strong, it’s best to use mobile data or a trusted private network when logging into your account.

Can I open a new account through the login portal?

Yes! Once you’ve logged in, you can apply for:

- New checking or savings accounts

- Personal or auto loans

- Credit cards

- Mortgage pre-approvals

Everything is digital. You can open a savings account right from your dashboard in under five minutes.

What should I do if I don’t receive my 2FA code?

If you don’t receive your two-factor code, try these steps:

- Make sure your phone signal is strong

- Check your spam/junk folder for email codes

- Use the Resend Code option

- If that doesn’t work, call support

Can I use fingerprint login with the 4Front app?

Yes! Once you install the app and log in, you can go to Settings > Security and enable Touch ID or Face ID, depending on your phone. I use this every day, and it’s super fast and secure.

Conclusion

Managing your money doesn’t have to be stressful or complicated. With the 4Front credit union login, you get easy access to everything we need to stay in control of our finances from checking balances and paying bills to locking a card or applying for a loan.

Whether you’re a first-time user or someone trying to make the most of the online features, 4Front makes digital banking simple, secure, and stress-free. You don’t have to worry about long lines at the branch or waiting on hold for support. Everything is right there when you log in from your mobile phone or your desktop.

So if you haven’t signed up yet, now’s a great time to do it. Once you register and get comfortable using the online and mobile platforms, you’ll probably wonder how you ever managed your finances without it. The 4Front credit union login is more than just a username and password, it’s your personal doorway to smarter banking.